Will we add to these 4 holdings?

Q4 results for Afya, Clinica Baviera, Envela and Verde Agritech

As per the rules of the Mr Mimetic Fox Fund, Mr Mimetic has to decide whether to add to a holding in the fund after the yearly results.

(By the way: there are no sells; however awful the results and however deteriorating the share price - as a pinch to get things right from the start)

Four of our companies have posted yearly results: Afya, Clinica Baviera, Envela, and Verde Agritech.

Let’s see how they did.

WHAT ABOUT AFYA?

+17,23% since 18.07.2023

After reviewing all the education stocks we could find…

… Mr Mimetic concluded that -within the universe of the Mr Mimetic Fox Fund (sub 2 billion US$ market cap)- Afya stands out as the best education company worldwide.

Afya is a niche medical education company.

Results for the year 2023 are in and they were great:

Cash flow from operating activities increased by 24.1% YoY, with a cash conversion rate of 97.1%

On the back of revenue growth of 23% and improving margins.

The metric that matters most is “students”:

So, apart from maybe price, there is no reason not to add to our position of Afya in the fund.

Even so, let’s post-portem our initial buy:

What Mr Mimetic Likes

What Mr Mimetic Learned

What Mr Mimetic Doesn’t Like

Post-Mortem on the Initial Position

To summarize

When will Mr Mimetic be wrong?

What Mr Mimetic likes about Afya:

Afya is in the medical space. Meaning: it’s an education that involves people. In contrast to mathematics or contract law, you need time in a hospital, with real people to earn your degree. This makes networks and relations important.

The employment rate of students is 98%.

The economics of the business: revenue is turned into heaps of cash.

The growth. Students flock to Afya, while Brazil wants to improve its health network: there is a big need for doctors and such in the smaller cities all over Brazil.

The Compounding Rate of Afya:

This means Afya can reinvest their hard-earned cash at high enough returns. Also known as “the makings of a multi-bagger”.

The owners. The founding family is still on the board, backed by majority owner Bertelsmann Group (also a family holding; Mr Mimetic has had several jobs for some of the companies of the Bertelsmann group).

the track record for acquisitions so far

they are category leaders in a splintered market, with numbers 2 and 3 half the size of Afya.

the investor presentations have a nice look&feel

the space is tightly regulated - this creates barriers to entry

They are increasingly shifting from a pure education play to a preferred “assistant of your career” play. In time, they can become the Well Health of Brazil:

What Mr Mimetic learned about Afya:

They offer free consultations to people who need it (one study Mr Mimetic once read showed a correlation between stock market performance and additional volunteer work a company does - it comes down to corporate culture)

There is a case in front of the Supreme Court concerning the amount of “Medical Seats”: the Ministry wants 35.000 seats, the appeal is for 57.000 seats.

Apart from that outcome, in the next 5 years another 10.000 seats will open.

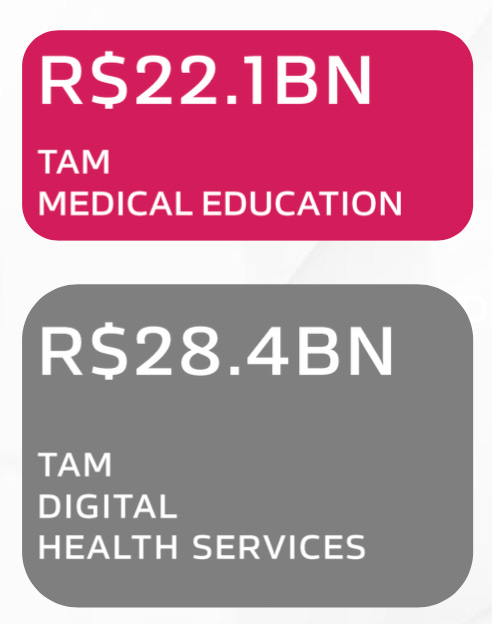

With the initial buy, Mr Mimetic didn’t really do a so-called “distance analysis”: how far can Afya reach? 3x, 5x, 10x? And how fast is that path? This is the Total Addressable Market in both categories they are in:

So, to grow 10x from R$ 2 billion (now) in a R$ 50 billion market, they would have to grow to 40% market share in both. Not impossible, but unlikely. International expansion is on the table, though. This means that 10x is also on the table - but on a longer time scale.

Some nice details about Brazil:

“There are over 5 applicants for every available medical school seat in Brazil”

According to the last call that is now even 6.

“Doctors are some of the highest paid professionals in Brazil, earning 44% more than engineers and over 200% more than lawyers, on average.”

“Argentina is the most popular destination for Brazilian students studying abroad. It is popular because up until a few months ago, it was free. Argentina’s new president Milei has ended free education for foreigners, so 18,000 Brazilians students (across all disciplines not just med students) in Argentina could potentially be returning to Brazil.”

They will use the zero-budgeting accounting method starting in 2024. (This is an accounting method developed by Texas Instruments, but popularized by 3G Capital, take-over owners of Anheuser-Busch InBev, Heinz, etc.)

What Mr Mimetic doesn’t like about Afya:

the use of adjusted financial numbers in communication

the fact that the CEO and CFO have little skin in the game

while revenues quadrupled between 2019 and 2023, EPS only doubled

political risk in Brazil

Post-mortem:

Fundamentally, it was a great buy.

Somehow, stock market performance will catch up with the fundamentals. No worries, there.

While Mr Mimetic neglected the digital service part of the business in favor of the educational side, now Mr Mimetic believes the real growth can be in that space.

It might even make sense in the future to take over physical practices and manage medical careers from the campus to retirement.

However, since we need to reach 25% per annum to become a truly great collection of stocks (the best 1% of stocks will probably do over 300% in 5 years)…Afya is risking to grow just below that yardstick.

This only shows how high our threshold for admission to the Mr Mimetic Fox Fund really is

International expansion will be helpful. And a little margin expansion will be necessary…

To Summarize:

Results were great.

The Market Cap of Afya is creeping close to 2 billion US$ - the upper threshold for the Mr Mimetic Fox Fund.

Now is probably the last time Mr Mimetic can add to a position of Afya (save a general market sell-off or some sort of drama), before simply letting it run.

When will Mr Mimetic be wrong about Afya:

When the legal stuff, which Mr Mimetic now sees as a positive, turns against Afya.

When margins no longer expand and revenue growth doesn’t translate in 25%-ish cash-from-operations-growth.

When international expansion is much harder than anticipated

When digital services don’t become dominant over time (now 80% of graduating students use some of the digital services when they start their practice, like the diagnostic aid tool Whitebook)

When people no longer get sick

To keep up with the medical space, we turn our eye from Brazil to Spain and Europe:

WHAT ABOUT CLINICA BAVIERA?

+32,9% since 13.09.2023

Clinica Baviera is a network of ophthalmology centers, where vision disorders can be treated surgically or otherwise.

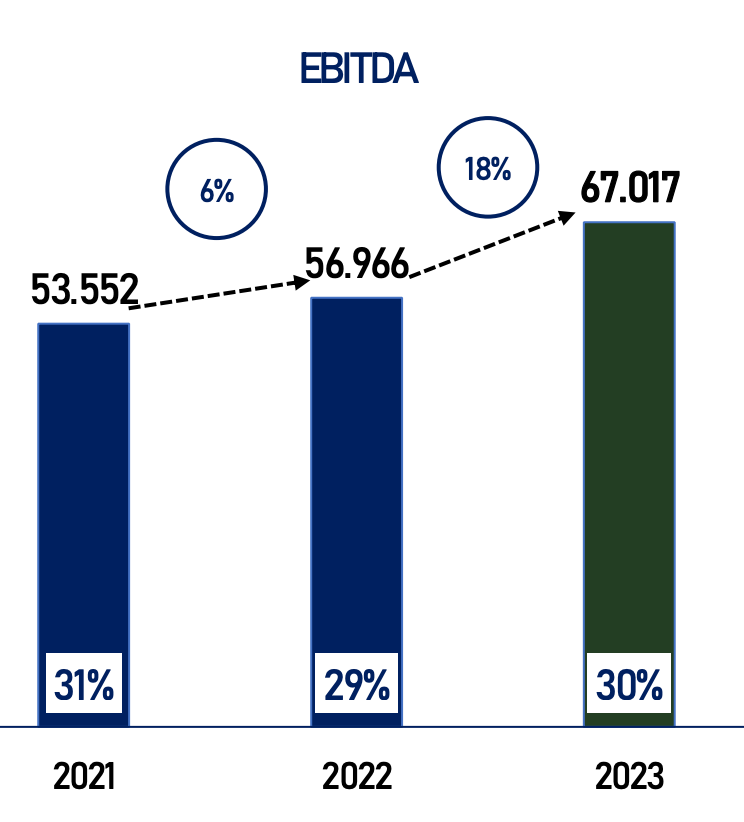

Revenue grew 14%, while EBITDA grew 18%

10 new clinics were opened, reaching 107 locations in Spain, Germany and Italy. They are looking to accelerate that in 2024.

For recent openings (last 3 years), the average return on invested capital (ROI) exceeds 30%.

These are the questions begging for an answer:

What Mr Mimetic Likes

What Mr Mimetic Learned

What Mr Mimetic Doesn’t Like

Post-Mortem on the Initial Position

To summarize

When will Mr Mimetic be wrong?

What Mr Mimetic likes about Clinica Baviera:

One of the competitive advantages Clinica Baviera has is its academy and research center: young ophthalmologists know they have access to the best training and science updates through the network of Clinica Baviera. An expensive and time-consuming thing to do on a stand-alone basis.

Also, for patients: they know Clinica Baviera has access to the most cutting-edge technology + a specialized surgeon will have performed some rare procedure countless times because of the network effect. Thus Clinica Baviera becomes the go-to ophthalmologist for high-quality outcomes.

The founders, two brothers, are still at the helm of operations as CEO and Medical Officer (Although they sold the majority of the shares to a Chinese counterpart.)

Structural advantages: an aging population increasing age-related ophthalmological conditions. Myopia (near-sightedness or short-sightedness) is on the rise.

Market Share is only 5% of European Clinics.

Return-on-Capital Employed is constantly above 50%. This is truly great. Return-on-Net-Operating Assets is also sound:

The company doesn’t need a lot of incremental (additional) capital to grow its revenue.

There is pricing power in ophthalmology. People will pay what they have to pay.

Net Debt is negative (There is more Cash than Debt)

Growth is accelerating again.

The Compounding Rate looks good (not outstanding):

What Mr Mimetic learned about Clinica Baviera:

The market is less splintered than anticipated: 300 clinics are owned by Sanoptis (part of the listed investment holding Groupe Bruxelles Lambert), EuroEyes is a German competitor that is listed on the Hong Kong Exchange, with the same model as Clinica Baviera, and 28 clinics.

The Sloan Ratio is repeatedly around -25%, which is in red-light territory. Are assets written off too aggressively? (Cash from Operations is quite bigger than Net Income since Net Income is depressed by Amortization and Depreciation) Does this mean that EPS in the future might surprise us on the upside?

Results are depressed by high Capex. This means margins (and revenues?) will be better in the future, after the Capex-spend-cycle.

What Mr Mimetic doesn’t like about Clinica Baviera:

The founding brothers sold a big shunk of their shares to a Chinese ophthalmologist. Knowing what they know, why would they do that? It is the biggest negative point about Clinica Baviera.

Mr Mimetic distrusts Chinese law, in terms of corporate law, financials, the stock market etc. Obviously, Mr Chen Bang seems like a stand-up guy with great merits. No questions popped up in terms of integrity and such.

Investor Communication is sparse.

Revenue growth is beneath our minimum threshold of 15% per annum. As is Compounding Rate (Mr Mimetic likes +25%)

About half of net income is paid out in dividends. Mr Mimetic rather sees those funds invested in growth. The Re-investment of earnings in growth is way too small.

Post-mortem:

Mr Mimetic saw Clinica Baviera as a long-term opportunity, with structural tailwinds.

However, a distance analysis now reveals that conquering all of the market in Europe will be much harder than anticipated. Can they grow their clinic count 10% per year, at minimus? Can they reach 500 clinics? Yes. Can they reach 1000 clinics? Probably only by taking over an already-established group like Sanoptis.

Growth isn’t up to speed. Or Clinica Baviera is too conservative, or there are not enough opportunities to invest the cash that is generated.

Mr Mimetic liked the network effect and the de facto regional monopoly, forgiving lower growth right now for possible larger organic growth in the future.

The accounts show that cash as a percentage of assets is on the rise: are they anticipating a higher interest rate environment, in which they can accelerate acquisitions? (Real Estate should become cheaper in a higher interest rate world, cash more valuable and loans more expensive).

All in all, it seems Mr Mimetic was too enthusiastic about the growth prospects and too optimistic about the splintered state of the market.

But somehow, Clinica Baviera strikes a cord: should Mr Mimetic be more patient and look at the evolution through the cycle of 5 years?

With the Cash from Operations Multiple at 8 versus Market Cap, there is enough room for margin expansion as well.

When will Mr Mimetic be wrong about Clinica Baviera?

when growth in earnings doesn’t accelerate above 20% à 25% in a few years

when pricing power turns out to be non-existent due to competition

when adding new locations in other countries in Europe turns out to be impossible or way harder than in Spain

when they choose to become a mere dividend play instead of a growth company

when they get acquired (instead of acquiring a somewhat large group themselves)

when a fairy with a magic stick appears to heal all eye diseases

From suffering eyes to eye candy is a small step:

WHAT ABOUT ENVELA?

+21,57% since 29.10.2023

Here is a chart that should rejoice Envela shareholders:

Envela is a reseller of used jewelry (including watches) and a producer of scraped precious metals. (The gold in your cellphone, etc)

What Mr Mimetic likes about Envela?

The Owner-Operation, John Loftus. He took a dying company and turned it around. Big time. He seems to know his clients very well. He talks about what is hard in the business, why there are obstacles, and where they should improve. And he has all his skin in the game.

The economics per location.

The splintered market. There is a land grab opportunity to fill the void left by retiring mom-and-pop locations.

It’s still a people’s business: people want to go to a physical location to buy jewelry, watches, etc.

The expertise needed to run an Envela shop is quite rare. You need to be some kind of antique dealer to adequately access the value of what people want to sell to you.

We are in the early innings of a growth story. The path towards 10x growth is very clear.

The fact that 2024 will see a doubling of the store count. 2023 was a year of prospecting, training staff, and investing in new locations.

Capital allocation - the balance between buybacks, debt reduction, investing in growth, inventory,…

The Compounding Rate, Return on Capital Employed, and Return on Net Operating Assets are well above 25%.

They do better than the overall market.

Envela used to be a position held by 180 Degree Capital (TURN). CEO of 180 Degree, Kevin Rendino, is one of the greatest capital allocators Mr Mimetic has seen up close. Mr Mimetic likes to call the likes of Rendino, Buffett, Elkann (Exor), Gayner (Markel) “Investment Jockeys”. (Disclosure: 180 Degree Capital is in the top 3 of Mr Mimetic’s personal holdings).

What Mr Mimetic learned about Envela?

The acquisition of the jewelry designer is more strategic than Mr Mimetic gave credit for. Since they are (also) in the scrap business, they can now use those precious metals and supply the jewelry business with cheap gold - they don’t have to sell it on the market when prices are low or (from the jewelry side) buy in the market when prices are high. It is an effective hedge for both of the businesses, that should improve margins.

Companies slowed down in replacing old tech (like computers) with new tech, so there is less supply available to scrape.

By studying another company in this space, Mr Mimetic learned there is a waiting list for luxury watches in the order of 3 years. (When you want to buy one, you have to wait for 3 years before you can actually get one). In other words: the demand for high-end watches is high.

There was a decline in demand for gold in the second half of 2023.

In 2019 saw the start of the “biggest bull run in watch history”. Prices have come down since:

“Prices on the secondary market peaked in May 2022 and have been declining ever since, with the fourth quarter of 2023 having marked the seventh down quarter in a row” - Robb Report

The decline in prices was substantial:

“According to Morgan Stanley, in 2023, prices on Rolex, Patek, and AP declined by 8 percent, 16 percent, and 18 percent, respectively” - Robb Report

But the pre-owned luxury and watches market is poised for growth

“The global pre-owned luxury watches market was valued at USD 24.38 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 9.2% from 2024 to 2030” - Grandview Research

Some people think interest rates will have a material effect on the price and volume of pre-owned watches and jewelry market.

What Mr Mimetic doesn’t like about Envela:

The full-year results. Revenue was down, gross margins stable, expenses way up, EPS halved. On the surface real bad results.

They are struggling to grow the scrape business - inventories are low.

Competition is growing. Some big players like Rolex and Tiffany’s are following the Envela playbook and making pre-owned a big part of their strategy. Access to enough inventory will be crucial.

Post-mortem:

That growth wasn’t on the table, was already apparent over the course of the year.

Mr Mimetic added Envela to the Mr Mimetic Fox Fund because the share price seemed low in light of the growth plans.

Mr Mimetic still feels like Envela is a great company to partner with, on a mid-term to long-term time frame.

When will Mr Mimetic be wrong about Envela:

When Envela will have trouble building inventory in light of added competition by the legacy brands.

When jewelry and watches fall out of fashion.

When the new store locations are ill-chosen and become loss-making endeavors.

When Envela cannot grow from 7 stores to 70 stores or 140 stores, or even 300 stores in the future.

When time itself comes to a standstill.

From precious things sourced from the earth, towards the preciousness of the soil itself:

WHAT ABOUT VERDE AGRITECH?

-82,08% since 30.01.2023

Verde owns a potassium silicate open pit mine in Brazil. They have a proprietary process so that their potassium silicate can be used as a multi-nutrient fertilizer, with stuff added to it that boosts soil health, biodiversity, carbon capturing, etc.

This is what happened to the price of potassium:

And the share price:

What Mr Mimetic likes about Verde Agritech?

Management has skin in the game and takes the long-term view. There is a clear vision, combined with a scientific reflex.

Potassium Silicate has a natural local monopoly. The freight cost is the highest factor in the cost for the thing, so it makes sense for farmers to buy local.

The nearby market around their pit is big enough to grow over 10 times from where they are now. Easily.

The proven reserves are really high - for 50 years to come. One of the biggest sources in the world.

They created a platform that they can expand on to help farmers get a better harvest and better soil. They can attach nutrients and other stuff to the potassium, which enriches the soil and improves harvests.

The margins are ridiculously high. It’s like software.

They are building and planning to have a capacity to produce 12.6 million tons a year.

Brazil is the second largest customer of potassium in the world.

One of the other producers in Brazil is closing down shop.

When they saw sales weren’t doing what they were supposed to do, they changed the incentive structure and brought in a sales manager.

What Mr Mimetic doesn’t like about Verde Agritech:

The results:

Despite their natural advantage over competitors in the region where they are located, they weren’t able to materially sell to the farmers nearby.

They sold less volume. (The premise was that they would outgrow price declines by larger sales volume) Mr Mimetic is under the impression that Management thought their product would sell itself since it is so much better than the rest that is out there - but they got outpriced and underestimated the conservative nature of the farmer who rather does the same every year than experiment with something new.

The debt is manageable in normal circumstances, but not when prices and volume stay this low.

What Mr Mimetic learned about Verde Agritech:

Sales are done by representatives who are incentivized through commissions and bonuses. That incentive structure wasn’t perfectly aligned.

They didn’t have a Sales Manager before! How so?

Brazilian farmers gambled on ever-rising crop prices and didn’t hedge their harvest (like they usually do), so when crop prices declined a lot of them got squeezed on the gap between high prices for the seeds (which forced them to take on loans) and low prices for the crop.

Interest rates in Brazil are way higher than in the West: “the basic interest rate is 10.75%”. Damn.

They did a study and apparently, they have a product that captures carbon in a quite spectacular fashion. So now they are looking at how they can help farmers claim carbon credits when they use their products. This might be a game-changer and a clear USP for them: getting paid by fertilizing your crops? Yes, please.

Post-mortem:

Mr Mimetic couldn’t have been more wrong about this than he was.

Mr Mimetic was swept by the inflation environment and became convinced that commodity price levels were there to stay for a while. That was wrong and negligent.

Mr Mimetic was also convinced -seeing their capacity, quality of the product, and supposedly local natural monopoly- they would outsell any possible drop in price per tonne.

All in all, Mr Mimetic was convinced that the technological achievements at the company were a sign of the quality of management, but on the sales side of the business, the CEO apparently has a blind spot. Something Mr Mimetic failed to see himself.

All richness starts and ends with sales.

Since Verde Agritech was added to the Fund, Mr Mimetic has adjusted the ratio in terms of EV/EBITDA that the Mr Mimetic Fox Fund is willing to pay. The price at the time when Verde Agritech was added to the Fund would not meet the current standards.

Despite the decline in share price, the valuation has still not entered reasonable territory, because of the loss in revenue (and EBITDA, EBIT, After Tax Operating Income, Net Income, Cash Flow).

All in all, Mr Mimetic was short-sighted and made a few assumptions that weren’t factual.

Despite the fact that Verde Agritec has a clear path towards 10x…until sales volume is restored, Verde becomes cash flow positive again, the debt situation is de-risked, and results catch up with the price, there is no way that Mr Mimetic can add to the position.

(Full disclosure: Mr Mimetic did however buy a really small amount of Verde Agritech for a private portfolio he manages for friends, recently - but the mandate there is: “high risk/high reward”)

When will Mr Mimetic be wrong about Verde Agritech:

when sales pick up in a dramatic fashion

when they run at full capacity

when debt is restructured or paid off and is no problem at all

when the carbon capture thing makes them the new hype

when crop and commodity prices reach the sky

when the long-term potential of Verde Agritech is already accomplished in the next year

when the fundamentals approve, but the share price becomes too expensive and the Mr Mimetic Fox Fund is not able to add to the position ever again.

SO, HOW ABOUT IT?

Which company will get the distinct honor of an added position in the Mr Mimetic Fox Fund?

Afya? Clinica Baviera? Envela?

You can find it out here:

Hope you had fun reading.

Might these ramblings be useful for your investing journey….

Kind regards,

Mr Mimetic

If you liked what you read, consider sharing this post with your investing aficionados.

SOME SOURCES

Zero Based Budgetting and 3G Capital

Dream Big: the biography of 3G Capital.

ophthalmology clinics in Europe

Sanoptis, owned by GBL

The Price of Gold in the last 100 years

Clinica Baviera investor relations