This Digital Health Company takes care of caregivers. Will it take care of your returns?

Building on the shoulders of proven success.

As of the time of writing, one of our Turkish holdings is up over 400%.*

That’s quite the experience.

It’s mind-blowing to see a stock go up 10%, day after day after day.

The holding we are talking about is a software-farm for hospitals, delivering a suite of apps and software to smoothen the workings of a hospital, from patient-intake, to billing, planning, parking etc…

More than 60 applications catered for specific problems. Their mission is to create “digital hospitals”.

Our Turkish holding signs contracts with individual hospitals, but more often than not it is with large groups or larger entities that are directors of a number of hospitals (like municipal or regional governments or institutions).

Some of the software they write themselves, and for some applications they are a Value Added Seller, meaning they sell software from somebody else and make bespoke adjustments for each client (or for hospitals as an industry), plus providing training, implementation, and whatnot.

You can find the exact name of that holding on the Mr Mimetic Fox Fund page:

The cool thing about their market is that there is a language barrier so global companies don’t even bother and the digital penetration of their markets is amongst the lowest in the world (Middle East, Eurasia, Africa).

Why are they up 400%?

Great fundamentals, a buyback program + 6 new contracts since November.

COMPOLLEAGUE

Yeah, that’s a new word.

It’s like a colleague that is also your competition.

When you are a professional in a sports team, you know what Mr Mimetic is talking about. Or in a legal firm, or anywhere where there’s internal competition for higher ranks.

In the mother tongue of Mr Mimetic this neologism is used quite often, but admittedly: it doesn’t translate that well.

However, you get the idea: Mr Mimetic went around the world looking for companies with the same business model as our Turkish winner.

Why wouldn’t we?

Thanks to Hourglass Investing, Mr Mimetic’s gaze was directed towards…

As a reminder, Mr Mimetic has a 10-item hurdle companies have to be able to jump over, to make it into the fund. Some of those hurdles are mathematical, but the most important filters revolve around competition, the business model, the addressable market, the nature of the industry, and basically, the special sauce that makes the company a potential future elite company.

(The overall idea is to collect a pool of stocks that are part of the best 1% of performers over a 5-year period.)

So, what does this “compolleague” Digital Hospital Company look like?

LET’S START WITH THE UGLY

Share count. The evolution of the outstanding share count is horrendous:

And the most recent number is even bigger:

“In terms of our share capitalization, as of November 13, 2023, WELL had 258,385,460 fully diluted securities issued and outstanding.” - The CFO, during the Q3 call.

Who in their right mind, thinks this is the best idea to fund growth? Well, it might be because they are already leveraged with traditional debt up to their necks.

Up to their tits.

At least, there’s sufficient insider/founder/management holding; so they are basically in the same bath as other shareholders.

The share price took a hit following its recent earnings report after the company announced a C$34 million bought deal offering of common shares at a price of C$3.70, below the market price when the offering was announced. This move dilutes existing shareholders, which is the reason why it is generally viewed negatively.

However, the CEO believes that the company will be able to deploy this capital in a highly accretive manner.

Well, let’s have a look at the “per share” numbers, then?

Dilution damps the recent growth numbers.

In any usual case, this would be no-go territory for Mr Mimetic. Issuing shares below market price is basically stealing from shareholders. It doesn’t bode well for the integrity and capital allocation smarts of the ones at the helm.

Just for now, Mr Mimetic gives the CEO/Founder the benefit of the doubt. The “per share” numbers don’t contradict their prediction that it will be beneficial in the future.

And the other reason is that the company is in a sort of land-grab-situation: digitalization of the healthcare sector is actually quite poor in small and medium-sized locations.

And that is exactly the market where this company comes in. It does feel like a crucial moment in time to go in and take advantage of the gap between capabilities and the situation on the ground. Now is the moment to go all in.

Before anybody else does.

More about that later…

SOME NUMBERS

Some of the characteristics we are looking for in companies are easy to check.

Things like

Market cap is under our 2 billion US$ treshhold.

Growth is spectacular: over 100% CAGR since 2018, 71% CAGR since 2021.

Margins tell a great story:

But it is early days. They are only recently profitable.

Current Ratio is 1.18 and Quick Ratio is 0.95.

This means that short-term liabilities are more or less covered by liquid assets. They should be able to pay the heating bill.

Net Debt/EBITDA is almost 4.

This is high.

At least, the CEO is aware of the risks:

“Just given our higher debt service costs as a result of inflation and higher interest rates, we're very careful. As you can see, we paid down our leverage ratio. So we understand the environment that we're in. We're going to continue to be very careful, but we're going to be opportunistic.” - the CEO during the latest call

At the current levels, they can pay off their debt in about 4 years.

In terms of Mr Mimetic Fox Fund hurdles, we are halfway:

Size ✅

Growth ✅

Ownership ✅

Expanding Margins ✅

Financial Health ❓❓❓

Since revenue is projected to grow towards 900 million or even a billion by the end of 2024 and EBITDA should reach 150 million (sans new acquisitions), we are actually talking about a manageable situation here.

Things are moving fast on the ground, and that might outpace the balance sheet lag.

When your share price is up 620% in 5 years you must be doing something right:

Still not a fan of that massive dilution, though.

THE BUSINESS MODEL

Acquisitions are mentioned 33 times in the most recent call. They do tuck-in acquisitions, they do acquisitions to expand their geography, and they do acquisitions to expand their product mix.

In practice this is what they do:

Medical practitioners need to manage the Electronic Medical Record of their patients. This requires software, security protocols, etc. This service is offered through a SaaS-product, reaching 33.000 professionals in Canada. This makes them the number 2 player after Telus Health (a division of the 34 billion CAD$ market cap Telus Corp.)

The SaaS offering is bigger than just EMR, with apps comparable to the offerings by our Turkish holding: from billing, to planning, to buying meds online or referring possible specialists when needed. Doctors can choose the whole package or à la carte.

A big difference between this company and the Turkish one, is the focus on small clinics instead of hospitals.

They illustrate their product like this:

Now this is only 9% of their revenue.

Next thing they do is:

They own 98 locations outright, where they run 168 clinics.

Since digitization is at such a low level in some places, they can come in and scoop up small or medium medical clinics, make them efficient with their e-health management system, do some investing, and thus boost revenue and margins by a fold.

One of the cool strategies to boost revenue is their referral network: whenever a big hospital or practice has people on the waiting list, they can automatically refer those to their clinics that have excess capacity. Patients are happy because they are helped more quickly, and clinics are happy because capacity is optimized.

This is just one of the neat tricks they can do to boost performance at the physical locations they acquire.

“We believe the Canadian market continues to be an enormous untapped potential (…) and very much remains a land grab opportunity. We are the largest player, and we've just achieved just shy of 1% market share of this large multibillion-dollar opportunity.” - the CEO in the latest call

Why does this land-grab opportunity exist?

“There’s a very big generational shift going on.” - researcher Marcy Cohen

Young physicians are used to working in teams, and value their life-work balance and family-life more than the old generation, “who are used to fee-for-service and who are used to the long hours”.

As the biggest operator they only own 1% of the market, which is thus massively splintered. With this generation shift, and older physicians or practitioners retiring, they can keep on acquiring locations for prices that are really cheap based on future revenue and margins.

Mind you: one of the new hurdles for addition to the Mr Mimetic Fox Fund is “distance analysis”. Is there an easy-to-see path toward 10x growth? How large is the market, how large is their existing market share, and is there a clear strategy toward market share expansion?

In this case we can say “yes” to all of the above.

This might (or might not) justify the debt and share dilution strategy.

Anyway, they are quite happy about their competitive position in Canada:

All in all this second vertical is 30% of revenue.

OTHER GEOGRAPHIES & AI

The other 60% of revenue is made in the United States:

They have 2 online-focused businesses: one for primary care…

…and one for women’s health issues.

And then there is “a leading provider of anesthesia services”

All in all: they seem quite agnostic about what kinda acquisitions they do - as long as they see an opportunity for them to boost earnings with their software and their “clinic transformation process”:

‘“We have a proven track record of improving growth and profitability of our acquired assets.” -CEO in the latest call

The great thing about all this is the data they acquire. They have been developing an AI system that trains on those (anonymous) data to further boost early diagnostics, workflow and patient outcomes. In other words: cost reduction.

The AI start-up can be found in the stock market, as a separate listed entity:

a pure-play healthcare AI and data science technology company focused on preventative care

They own approximately 17% of that company but can grow their ownership above 50% when certain milestones are reached.

Or, as Murray Stahl would say:

Optionality.

COMPETITIVE SPACE

The special insight, obviously, is that you have a software company that helps you manage a clinic better and improve margins and that they saw there’s a better buck to be made by acquiring the clinic outright, instead of simply trying to sell the software.

That is proof of stake, right there.

“an interesting business model and very much a small-cap name with lots of potential growth opportunity ahead. However, I’ve been burned by telehealth names before (looking at you Teladoc).” - Hourglass Investing

Telehealth is a very competitive space with rather low barriers to entry.

One of the online components of this company is, however, reviewed as the best of the common niche women’s health telehealth companies

(Even better than HERS, which Mr Mimetic owns in his private portfolio)

The other online platform receives bad reviews:

“Even when my daughter was in tears, Dr. SHUKLA left her camera off. The telehealth visit left her upset and embarrassed. The phone call was under 20 min and we were charged over $250 (before insurance cap). I do NOT recommend Dr Shukla.” - Judith, January 16, 2024

All in all, despite some regulative hurdle rates, this line of business seems to be way too competitive and lacks a special “culture” at the moment, that makes it stand apart or builds an impenetrable moat.

There are no signs those 2 online companies would be the winners in the space.

Luckily, they are only a small part of the overall company. About the 2 online businesses:

“We feel quite confident that both will be either approaching or exceeding $100 million in revenue and essentially within a year to 2 years, we think both will solidly be $100 million businesses for us and continuing to exhibit double-digit growth interactions.” - the CEO in the latest call

This would make them less than 10% of revenue.

The real driver of the USA operations is a copy of the Canadian strategy, where small or specialized practices are acquired, optimized, digitized, and then turned into cash-flow printing machines.

Also nice to know:

BRINGING IT ALL TOGETHER

Their focus on small clinics and improving them through digitization with their own software might give them a real flywheel effect.

With a current 1% market share in a splintered market, they have a long path to growth. Telus Health is focusing on the more boutique clinics, so they seem to stay outside each other’s slipstream.

They don’t seem to fall into the trap of Mimesis, where they want what the other wants until both are standing bleeding, ready to fall.

Even if another player was coming in and started acquiring small clinics left and right, they would have to have the same modernization process in place as this company -which is possible. Even then, the nature of these niche serial acquirers is that usually, not many players have the combination of expertise, execution, and capital.

Basically, they are playing by the same playbook as, for example, Dentalcorp, a Canadian serial acquirer for dental practices.

What Hourglass Investing writes about Dentalcorp, goes for this company:

The difference is: that this company is a software company at its heart + the debt-situation chez Dentalcorp is way up there.

Mr Mimetic can even see a future where this company starts to play in the space of Dentalcorp: acquire small dental practices, modernize them with software and workflow systems, invest a little bit, and…it’s off to the races.

They already own some Chiropractor locations and Physical Rehabilitation centers - so why not?

To sum it up, Mr Mimetic thinks the following labels are in order:

Acquisitions ✅

Distance Analysis ✅

Barriers to entry ❌

Competitive advantage ✅

SOME QUALITY MEASURES

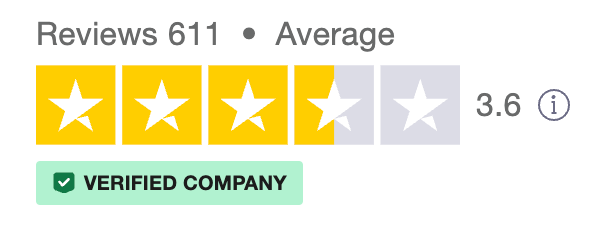

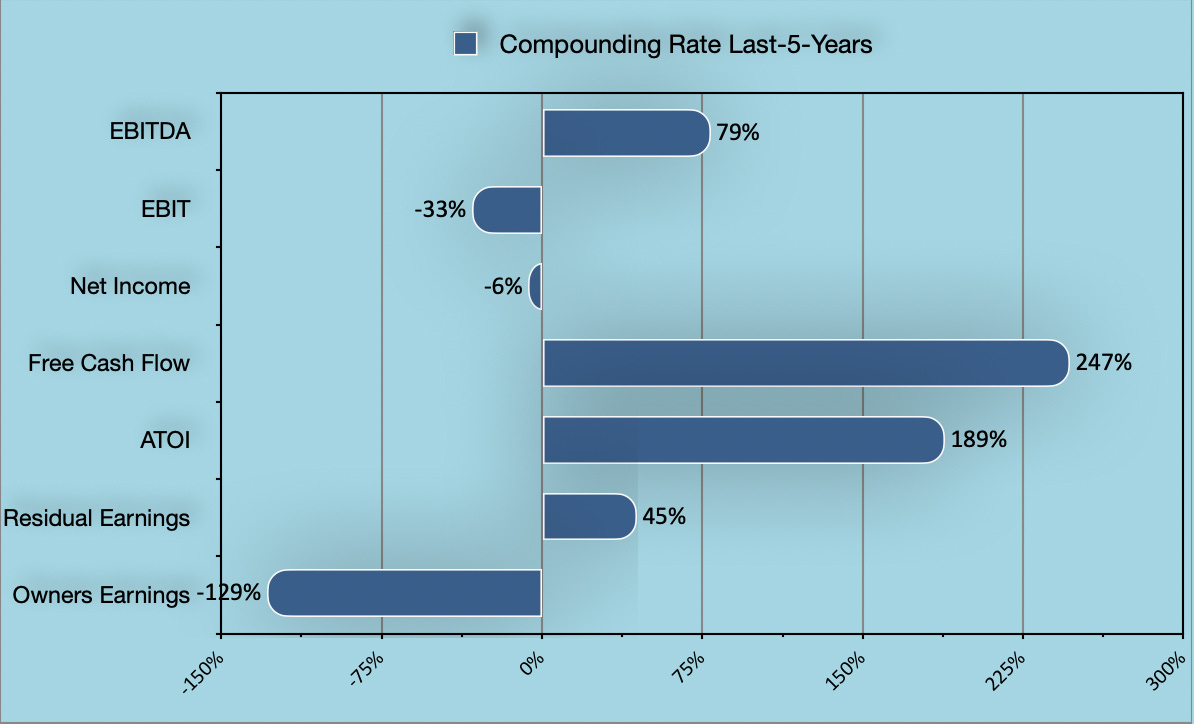

Since they only recently started to earn some accounting profit, it is not very useful to calculate their Compounding Rate.**

When Mr Mimetic puts the numbers in his personal little model, it is rather nonsensical.

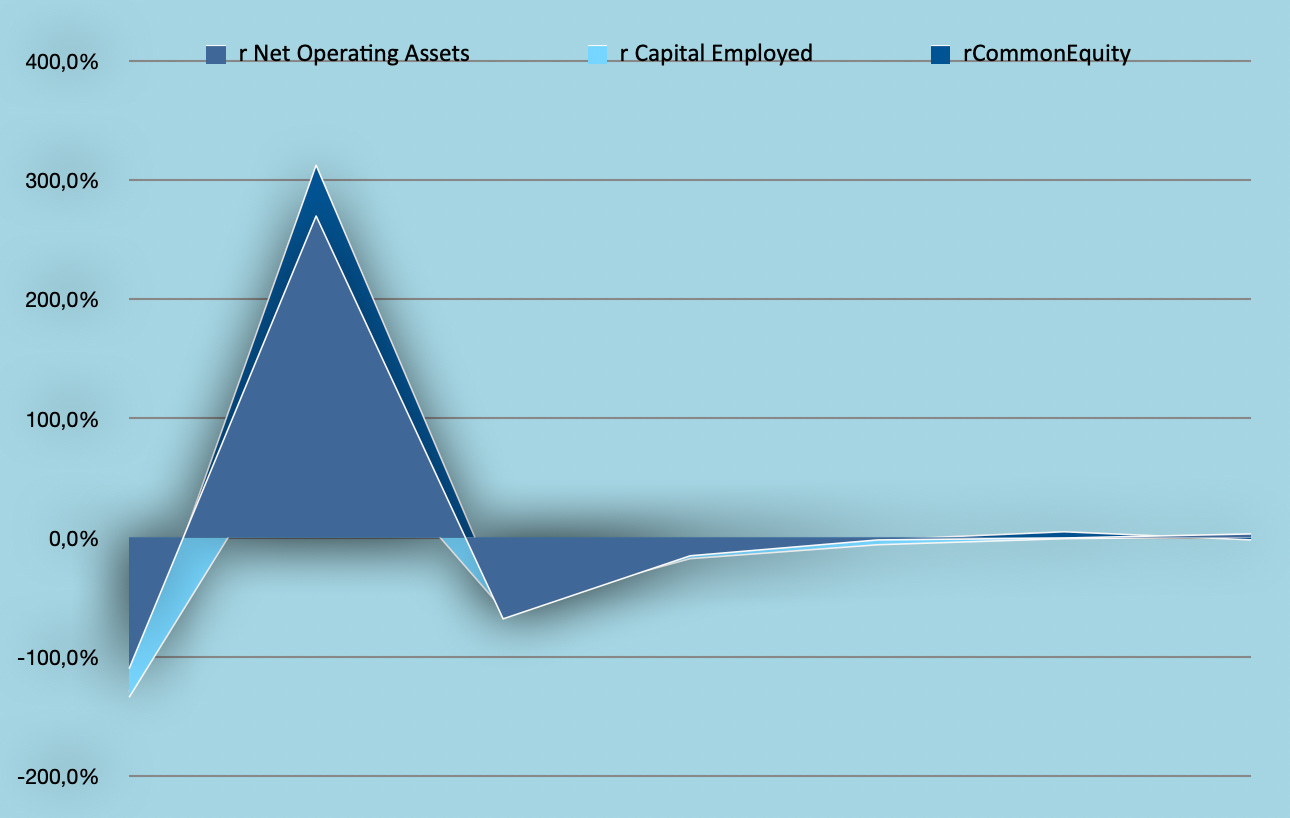

Mr Mimetic also likes to look at “Return on Net Operating Assets”*** as a proxy for quality, but there’s nothing to here see, really:

Both are usually a good indication of what is playing under the hood of a company’s operations and if they can create value for shareholders.

At the moment, the cost of running the business is way too high. Revenues are great, gross profits are great, but Expenses eat that up:

One must suspect this cost are part of the “clinic transformation process”: profits made by acquisitions only show up on the bottom line after a year or so.

Half of those expenses are salaries, about a quarter is marketing for the 2 online telehealth companies, and some fees for the practitioners/former owners (Mr Mimetic guesses).

Another reason is “Stock Based Compensation”:

So, yeah, management dilutes minority shareholders but makes sure they don’t get diluted themselves by granting themselves a nice stock package.

Again, this reeks. It doesn’t sit well with Mr Mimetic.

It feels like being with a hot partner who doesn’t love you back, but stays with you for the sex.

So, to answer the question of whether they create value or just “buy” revenue through stock dilution and debt, Mr Mimetic needs to delve a little bit deeper, into the details of the Annual Reports.

What are the real economics of this vehicle?

In 2022 8 acquisitions were done for 40,399 million.

“If the acquisitions had occurred on January 1, 2022, consolidated pro-forma revenue and net income for the year ended December 31, 2022 would have been $598,990 and $21,213 respectively.” - Financial Note 23 in the 2022 Annual Report

Did they really only pay 40 million for 600 million in yearly revenue and 20 million in yearly income?

Since 2018 this is what they paid in acquisitions:

They are guiding up to 1 billion in revenues this or next year, without any extra acquisitions, based on the fact that they are still integrating a bunch of clinics that are newly added:

Looking forward to next year, I'm really excited to introduce our revenue guidance of achieving more than $900 million in 2024 in revenues. However, we wanted to provide you with some early indications of our confidence level in 2024. In the past, I've mentioned our goal to achieving $1 billion in annual revenue within 2 years. - the CEO

With around 15% in EBITDA margin, this comes to 150 million in EBITDA. Overall, it seems like they paid less than 4x EBITDA for their acquisitions.

Not too shabby.

This leaves only one last filter left on our 10-item checklist:

IS IT CHEAP ENOUGH?

Current EV/EBITDA is 15.44

According to TIKR the Next-12-Months EV/EBITDA is 11.44.

Price-to-book is 1.3

Cash from Operations is about 80 million currently versus a market cap of 960 million.

This is within range.

Mr Mimetic likes to use his own version of the PEG-ratio to consider if the company is cheap when future growth is realised.

We call it the Mr Mimetic Fox Score (all tongue-in-cheek) and it goes something like this:

This equates to 0.20 (based on a 48% EBITDA compounding rate), which is really cheap.

Even when we are conservative and don’t consider a 48% Compounding Rate to be sustainable, this price point should still be a great entry point when the future resembles recent history somewhat.

Two questions are still in search of an answer:

what is the name of the company

will the company be added to the Mr Mimetic Fox Fund?

THE FINISH LINE

Drum roll… the name of the company is`?

This is founder-CEO Hamed Shahbazi who has the rather great vision to transform a software company into a brick-and-mortar serial acquirer:

The big question is: how heavy does Mr Mimetic weigh the dilution of minority shareholders? Will Well Healt be added to the fund?

It seems to be a duel between Integrity vs the promise of El Dorado.

To find out if Well Health Technologies made it into the fund, you can visit the Fund Page:

Thank you for reading.

As always, we hope it was helpful to assist you in your stock market journey.

Kind regards,

Mr Mimetic

If you liked what you read, consider sharing this post with your investing aficionados.

SOME NOTES

*Our position was even up 700% at one moment. Ridiculously so.

**Compounding Rate is = Re-Investment Rate x Return on Incremental Capital

***Return on Net Operating Assets = After Tax Operating Income / Net Operating Assets.

SOME SOURCES

Article about Primary Health Care in Canada

Hourglass about Dentalcorp: