Battle of the Education Stocks

194 listed education companies, but which ones are worth a closer look?

In the quest to create a collection of stocks that are part of the best 1% performing stocks over a 5-year period, Mr Mimetic turns his attention towards the pure play education sector.

(No publishers, but companies that teach people stuff.)

Why education?

Education will look quite different in the decades ahead than how it looks now.

What we will learn (and how) will most definitely change, not the fact that we need to keep learning.

“The global EdTech market was estimated at $163 billion in 2019 and is expected to reach $404 billion by 2025, reflecting a 16.3% CAGR growth” - Frost & Sullivan Equity Research

The structural trend towards lifelong learning and the value of education as an asset for your career will most likely continue.

People who invest in their own intellectual life or skill set will have a higher probability of succeeding in life. The others?

They might be entertained...

The current education model is a product of the 19th century Industrial Revolution: instead of people working from their homes, and the merchants traveling around from farm to farm to pick up textiles and wool and such - it turned out that concentrating that labor in one place was quite the game-changer. First through workhouses, later in real factories.

So, this model was copied in the field of education. Instead of teachers traveling to families to teach their offspring, the kids would now travel to the teacher - in one concentrated place: school, the factory of education.

The results were stunning:

While there is (or was) a trend towards specialization in education, more and more research suggests that we should train generalists, who will then take care of their own specialization all by themselves.

Epistemology, sports, history, art… might have a future after all - and might well be the prerequisite for top-quality specialists later in life.

A common threat among future subject matters might be: problem-solving skills. Instead of rule-based mathematics, creative and problem-based mathematics. Instead of chronological history anecdotes full of royal marriages and battles, mystery-filled detective quests and data-based historical insights.

(For example: not wars, politics, and kings are the real engine of the world’s history, but inventions are - be it technological, philosophical, or cultural. Something you can only figure out by asking: what is the most important historical event ever? And then apply methodical and data-driven criteria to that question.)

All this is just to say that the future of education will look quite different from how it looks today.

What the factory-model of education still is today -an overpriced, elitist, lecture-based, professorial, location-bound 19th century exclusion mechanism- is ripe for disruption.

Less than a quarter of the officials surveyed said a majority of their faculty (which they defined as 70 percent) has experience in designing online courses.

- “Changing Landscape of Online Education” report via InsideHigherEd.com

Honing your problem-solving skills and getting you ready for superb specialization can happen in a lot of ways.

The education entity that can crack that code, might become the next Microsoft or Apple.

So, let’s have a look. Which company has a shot to be the best education stock of the next 5 years? Who has the vision, the business model, and the executive team to pull that off?

Going through 194 education stocks

A little digging brought us a list of 194 publically quoted education entities.

All companies with a market cap over 2 billion US$ were immediately deleted from that list, as per the rules of the Mr Mimetic Fox Fund. This leaves out well-known (and great) companies like Duolingo and Coursera.

(This also leaves out Graham Holdings, the parent company of Kaplan - a stock that Mr Mimetic holds in his personal portfolio)

Since Mr Mimetic once had a bad spell with an investment in a country with no legal regard for the small/foreign shareholder…China, Hong Kong, and Russia are off the table: too much juridic uncertainty.

When additionally considering delisted stocks and non-filing companies (without recent publicized financials) the list shrinks to 90 stocks.

Should Mr Mimetic simply read all 90 latest annual reports or are there criteria to narrow that list further down?

Maybe Mr Mimetic should do some preliminary work before diving in, to separate the wheat from the chaff? How about screening the 90 remaining stocks for these 8 criteria:

EV/EBITDA < 15

Net debt/market cap < 33%

CAGR REV 2018-2022 > 15%

Average Return-on-Capital > 9,9%

Current Ratio > 1

Quick Ratio > 1

total debt/ebitda < 4

5 year stock market return > 300%

Mr Mimetic assigned a score of 1 to each of those lines, when the conditions were met. So, any potential stock has a maximum score of 8. (As it turns out, when data were unavailable the benefit of the doubt was applied and a score of 1 was given)

The Score

The median score of all 90 stocks was this:

This makes you wonder if the education industry is even all that great? Pathetic revenue growth, abysmal Return-on-Capital, and disastrous stock market returns, leading to a well-deserved low valuation.

AFYA, the Brazilian specialist medical education stock that is already part of the Mr Mimetic Fox Fund -unsurprisingly- scored a maximum of 8 out of 8.

The stocks with the highest score were:

Since Mr Mimetic is no venture capitalist, revenue growth is a great place to start narrowing this list further down.

Mr Mimetic wants to find companies that are able to sell their products to paying end-users. But are also able to grow those revenues, preferably methodically, for years to come: be it through the sheer superiority of their product or serial acquisitions.

Once you have sales, you should have income. Income means cash. Never ever has anyone heard of a company crippled by debt that became the industry leader of the decade.

So, debt (or growing debt) is a red flag.

Since the stock market is a weighing machine in the long run, a good share price performance in the last 5 years is usually a good sign.

The landscape now looks like this:

With Chegg and American Public Education kinda out of the picture (because of low Insider Ownership), Afya already part of the Mr Mimetic Fox Fund and SuRaLa posting limited and declining numbers, we are down to…17 companies.

All those are worth a closer look, wouldn’t you think?

Of the original 9-step hurdle rate for inclusion in the Mr Mimetic Fox Fund, all these companies meet the 5 first requirements :

Small: below 2 $billion in market cap

Growth: a minimum of 15% CAGR in EBITDA

Health: a healthy balance sheet - no problems drawing future credit

Insider Ownership: owner-operators do it better

Cheap: below 3x trailing Sales, 20x trailing EBITDA, 30x trailing PE

These 4 ingredients are yet to be determined:

Acquisitive: acquisitions are a great tool to boost growth

Barriers to entry: competing in an industry that has a natural moat

Competitive Advantage: have something unique that is not easily copied

Expanding Margins: a sign of a flywheel - more net dollars per extra dollar sold

The 10th (new) ingredient is Addressable Market or Distance Analysis.

This is the real work. (as opposed to the numbers-game and mathematics)

Yet, before looking into the competitive situation, TAM, and business strategy of each company, Mr Mimetic might just do this last preliminary math trick that seems to be a great predictor for future growth…

COMPOUNDING RATE

What is the Compounding Rate, again?

Mr Mimetic explained it here in full:

And technically you can describe it as:

Compounding Rate = Re-investment Rate x Return on Incremental Capital Invested

But in the real world it is simply: how much extra money is available to invest in growth & how are the returns on that extra capital you invested?

This is important because it means that you don’t need everything you have earned to maintain the business and/or that there are investment opportunities to grow.

When we look at those 17 education stocks (plus Afya as a reference), we get:

That’s quite disappointing.

From 194 stocks to this elite group of 17 and, apart from Afya, only 1, maybe 2 or 3 stocks show decent numbers:

Learning Technologies Group

Kiyo Learning (maybe)

Stadio Holdings (maybe)

Let’s have a look then:

LEARNING TECHNOLOGIES GROUP

So, the compounding numbers are great.

Learning Technologies was even part of the Alta Fox Report “The Makings of a Multibagger” (!) that looked at the best-performing stocks between 2015 and 2020. That report was the very inspiration for the Mr Mimetic Fox Fund.

Since the end of Covid, however, the stock has gone downhill:

They don’t operate schools but are specialists in workplace digital learning.

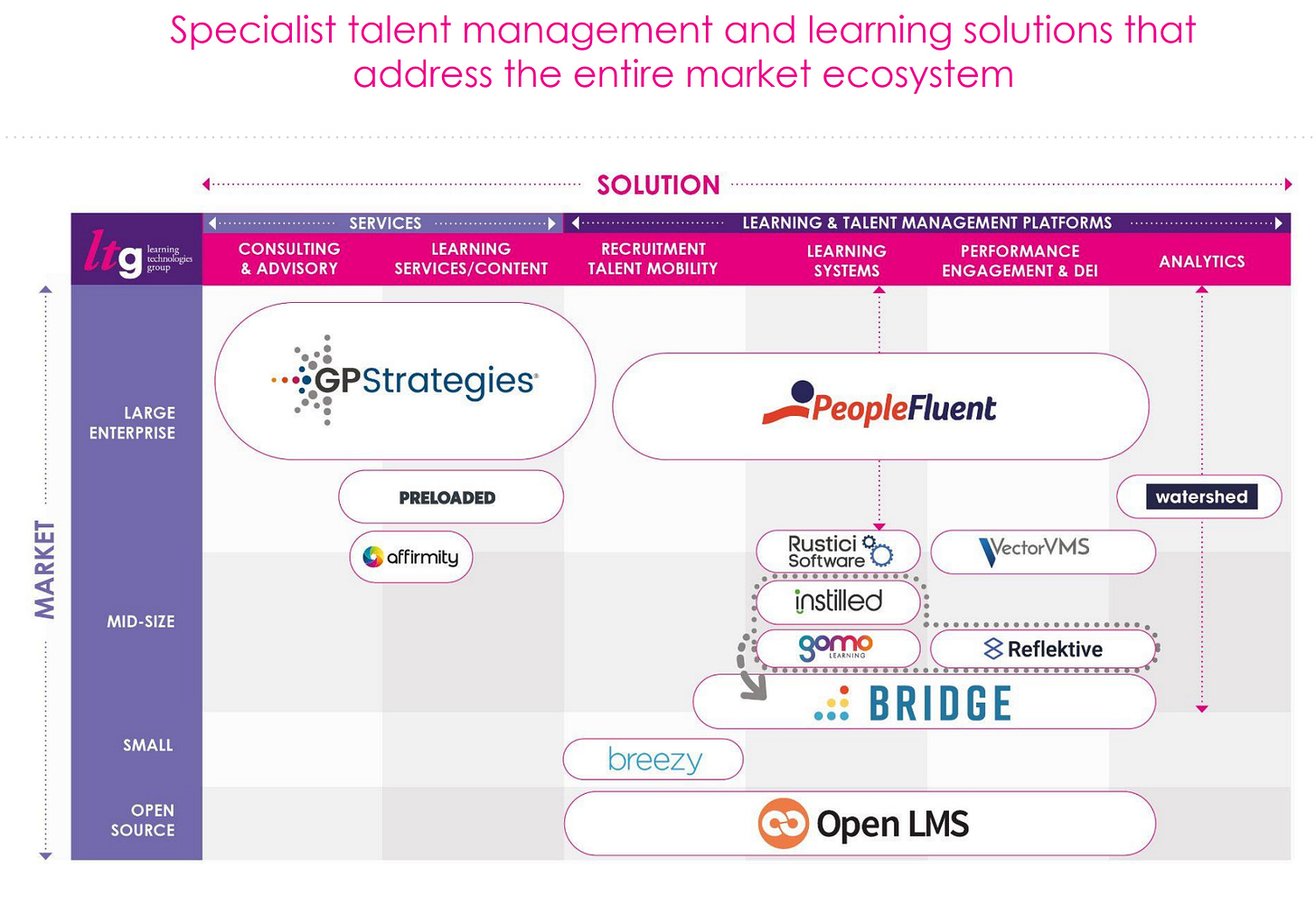

In doing so, they don’t necessarily provide the learning content to companies, but the picks and shovels for companies to be able to train, develop, assess, motivate, retain, and evaluate their people. The whole shebang:

Growth has stalled in 2023. There were problems with the integration of big acquisition GP Strategies in 2021. Since then acquisitions also have dried up.

Organic growth is negligent for the time being, but margins improved year-over-year.

However, there is no sign of a flywheel where increased revenue automates into expanding margins:

Synergies that were hoped for, didn’t materialize.

Free Cash flow has improved over the last years, but mind you: investments in the future are expensed in the Free Cash Flow statement. Looking at it that way FCF growth is not a great indicator: lower FCF can counter-intuitively even be a sign of future revenue growth.

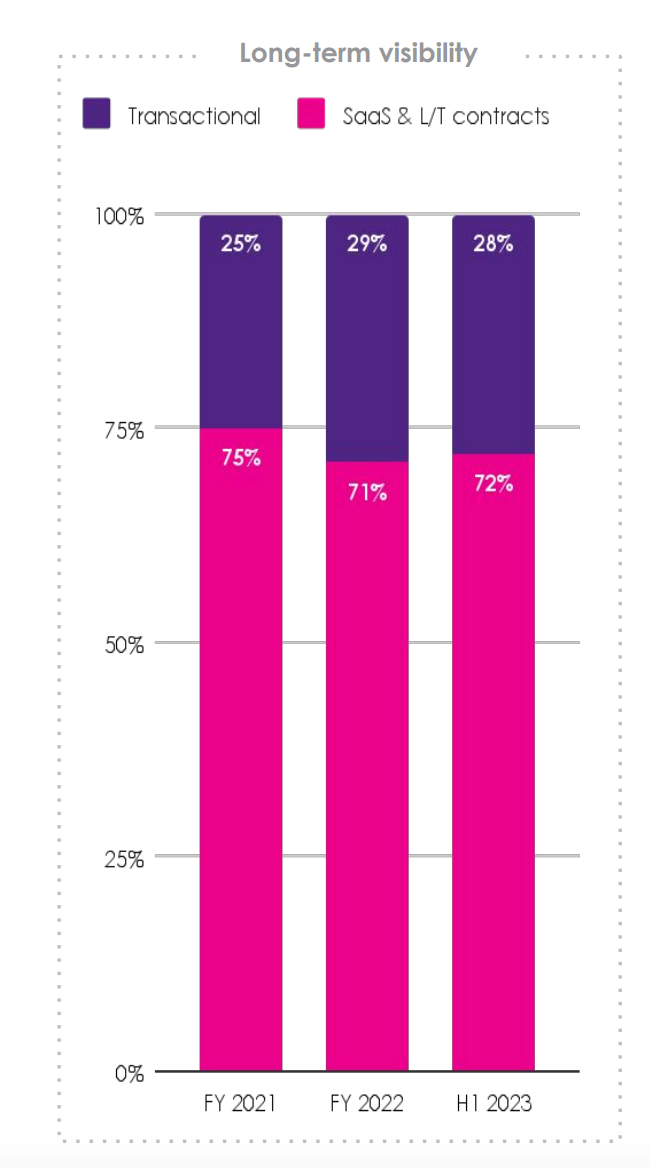

Most of the revenue is recurring, through their SaaS-platforms:

The addressable market is large enough for them to grow 10 times in the future. They bring in 600 million GBP a year in revenue, while there’s a 100 to 300 billion market out there.

Learning Technologies Group (LTG) is a specialist in workplace digital learning or ‘e-Learning’, a market that is forecast to be worth $325bn by 2025. -

https://regencyresearch.co.uk/

(Their goal for 2025 was 850 million GBP in revenue, but that seems unachievable now).

Even if they would take only 10% of that market, they would do quite well for shareholders.

Structurally, they are at the right crossroads of trends:

…which is a shrinking available workforce, and a very fast pace of change (…), both of which drives the need to cause their talent to want to stay with them, but also to be developed and trained into new capabilities. - CEO Jonathan Satchell in the latest conference call.

The problem is that it is quite a competitive space:

“So it's tough out there, there's no question. And it will continue, we believe to be tough for a while.” - CEO Jonathan Satchell in the latest conference call.

If Mr Mimetic has to summarize his stance on Learning Technologies Group, it would be something like this:

The positive:

great owner-operators

great industry in the mids of a macro tailwind

quite cheap

enough room to grow 10 times and more

highly fragmented market

The negative:

competitive space

no sticky customers

no mission-critical product

low barriers to enter

As a matter of fact, we can just repeat what Alta Fox had to say 4 years ago:

Which leads to an uncertain future:

Damn. The company with the best numbers (apart from Afya) isn’t a great fit for the Mr Mimetic Fox Fund.

Maybe the next one?

STADIO HOLDINGS

Stadio Holdings was already part of the Afya write-up:

Mr Mimetic had this to say about Stadio in July 2023:

Mr Mimetic likes Company B for its vision, but doesn’t like the dividend; when there is an opportunity for re-investment 100% of profits should be re-invested in growth.

Although that might seem harsh and short-sighted, those capital allocation decisions do reflect in the growth numbers: Stadio has problems reaching 15% year-over-year growth numbers. (Which is necessary to have a shot at becoming part of the best 1% performing stocks over a 5-year period).

They will without doubt reach their target of 100.000 students…

…but will it be fast enough?

Also: part of the business has no competitive advantage due to the general nature of the training subject. Obviously, physical schools have a sort of natural local monopoly, but this is not a hard moat. More-over, Stadio is focused on mostly online-learning: again, no hard moat.

So, once again - Mr Mimetic has to pause and wave his goodbyes to Stadio Holdings.

KIYO LEARNING

Kiyo is the (much) smaller Japanese competition of the British/global “Learning Technologies Group”. They offer learning solutions for companies and a platform for individual learning.

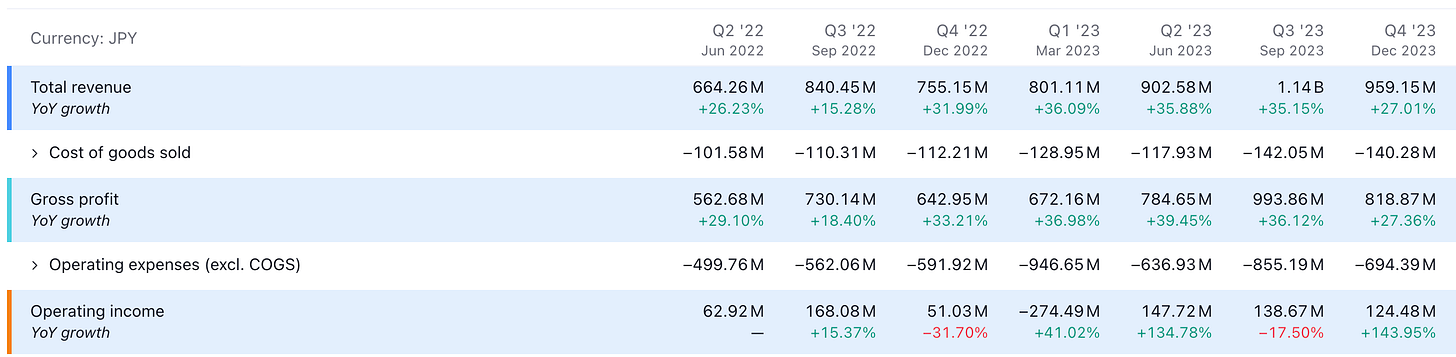

Growth numbers are great, and part of a plan spanning through 2026:

As its big brother, Kiyo suffered a dramatic price decline:

And even a 30% decline since the publication of its latest results in February:

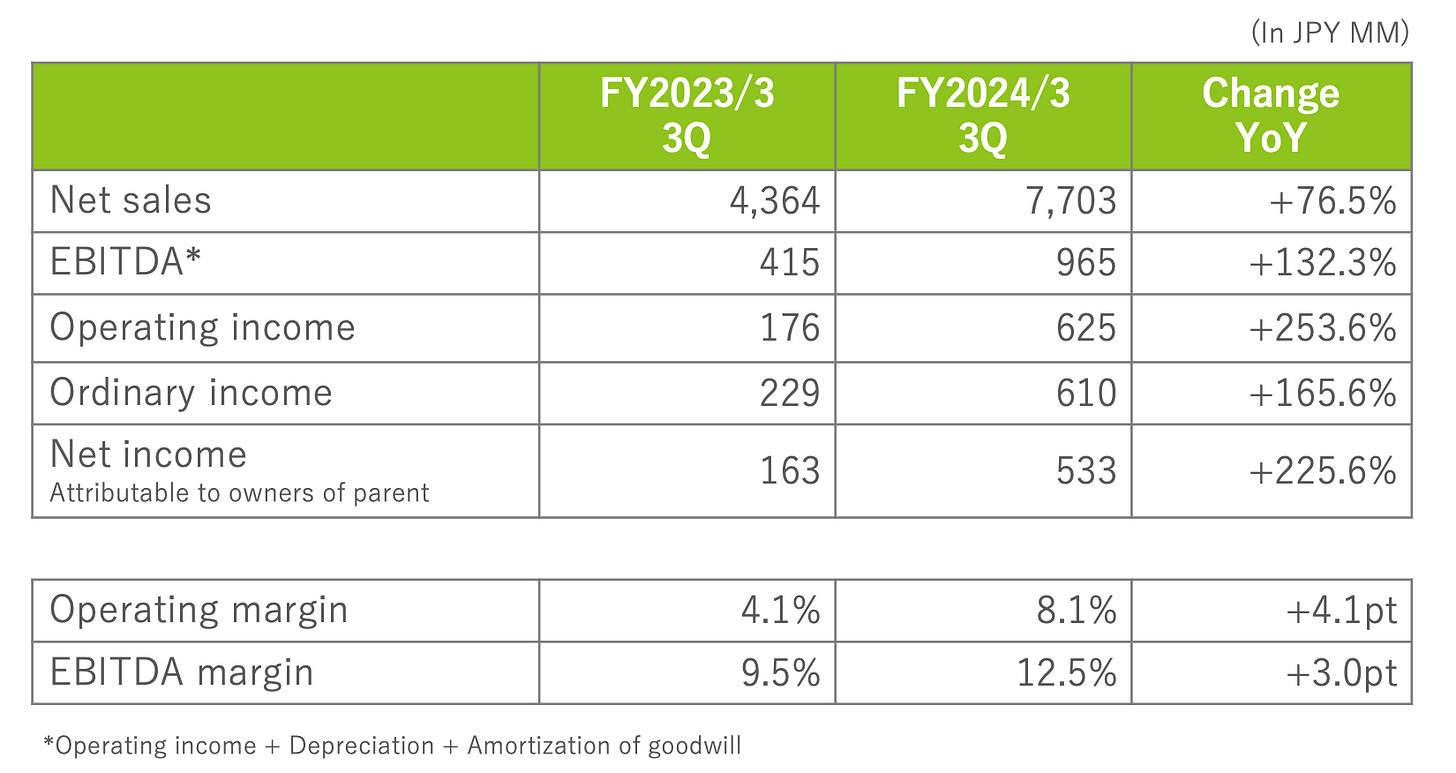

Results weren’t even all that bad:

You might think this is due to the difference between forecasted numbers by management and the actual results:

But when Mr Mimetic lets AI translate this page, it turns out the actual results are better than forecasted…

Right now, it’s quite cheap - especially since half its market cap is in cash:

In terms of language, the barriers to entry are higher than for “Learning Technologies Group”, but apart from that the risks stay the same.

Low barriers to entry and no real moat. In all probability, Kiyo Learning will keep on posting great growth numbers (among others fuelled by advertising), but this cannot blind us to the harsh truth: they are vulnerable to competition.

Mr Mimetic cannot and should not count on the sustainability of that growth.

So, none of those 194 education stocks is eligible for the Mr Mimetic Fox Fund?

Well, AFYA (up 31% since July 2023) is part of the Mr Mimetic Fox Fund.

And you know, going through some of the reading materials of those 18 companies, Mr Mimetic became quite a fan of RareJob and ProEduca Altus. Both have a nice business strategy.

Helas, at first glance, the numbers just don’t support an addition to the fund.

Unless…

When we look at the freshly published, quarterly numbers of RareJob (not included in the calculation here above) we can see that we better take a closer look.

They posted a great quarter:

Guidance for the FY is great as well:

This is due to the “childcare support” acquisition. The legacy business is hardly growing:

What job is RareJob doing?

A fine job.

The great thing about RareJob is, that it is one of the few EdTech companies that has a real moat.

Their core business is an English-language training service, where they employ native speakers to be one-on-one tutors for students.

Indeed, research shows this is a more effective way to learn a foreign language.

The nifty trick of RareJob is that they use people from the Philipines, who have English as their mother tongue, as tutors. Obviously, this is a lot cheaper than employing certified Japanese English teachers.

Moreover, there was one little sentence in a press release by RareJob that reminded Mr Mimetic of something Nick Sleep (of Nomad Partners fame) wrote about in his annual letters, which suggests RareJob might be onto something special: Robustness.

The Robustness Ratio is a way to measure the strength of a moat in a quantifiable way, based on two criteria:

how much potential profit is the company investing in a better (or cheaper) experience for the customer?

how much potential profit is the company investing in their people?

The poster child for Robustness is Costco: they keep prices low for their customers and they pay their staff substantially more than standard practice in retail.

What Mr Mimetic read was this:

“User numbers are steadily increasing, with the aim of improving customer unit prices.” - the Q3 2024 press release

This is about all you need to know about a company’s culture: when improved sales and profitability are invested in lower prices for the customer, you have yourself a member of a rare group. And that group is called:

“Scale Efficiencies Shared”: when the gains won by scale are shared with customers and employees.

Costco is part of that group. Amazon is. Microsoft as well: they don’t lower prices, but they add a lot of extra apps and services without hiking the price. Same difference.

At a certain point, you are willing to put so much money towards your customer that:

the value of the service exceeds the price - it’s a no-brainer to hire you

it becomes impossible for any incumbent to compete with you

Not only is RareJob willing to lower the prices of their offerings, they also pay their Tutors in the Philipines substantially more than what they can earn locally doing other jobs.

Cheap for RareJob, but great value for their Tutors, becomes great value for the customers. Robust.

Another example:

Smart Method® Course is the 16-week English coaching program with “guaranteed results”

Why should you not subscribe to that?

While Scale Efficiencies Shared is a well-known business model, very few companies deploy those strategies. They are not innovative enough or are not willing to give up today’s profits for future revenues.

IS IT A BUY, THEN?

Now-now, is RareJob cheap enough? And financially healthy?

Under 8 times EV/Ebitda with those growth numbers? We should be fine.

Net Debt is negative, meaning: they have more cash than debt obligations.

Also, when it comes to future growth: not only have they room to grow in Japan, but they also have room to grow all over Azia and Latin America. Basically in every part of the world where people need to communicate with the world in English, but have no organic tradition of English fluency.

RareJob is tiny at the moment: a market cap of only 56 million US$. We can easily envision a future where they are a 100 million company, or a 250 million company or 10 times as big as today.

Growth will do that. And multiple expansion.

Now, that growth will come unevenly, mostly through acquisitions and launching new business lines. In bursts, rather than in a smooth upward path.

But apart from that, yes….

Kind regards,

Mr Mimetic

If you liked what you read, consider sharing this post with your investing aficionados.

SOME SOURCES

Research on an Israeli education company, with some useful market observations.

Online learning has only just begun, according to InsideHigherEd.

Scale Efficiencies Shared explained.

The Nomad Partners letters. Some of the best out there. Worth your time.

The RareJob Investor Relations Page.

Also, you might consider taking a little peek at the Mr Mimetic Fox Fund page. Quite a dramatic change in performance has occurred since our last update at the end of January…