The Mad Men Series, part 3: a Constellation-model in the Advertising Space?

Or: a shameless piggyback

The Mad Men Series is a series about inefficiencies in the advertising industry and the few companies that deliver effective Cash Return for Ad Spend.

With all the brilliant investing writers out there, Mr Mimetic is a fool. First, to attempt an investing blog himself. (Who are we kidding?) Two, to desperately trying to find companies all by himself, by turning rocks. Once starting from macro-questions, like:

Who will clean up all the rotten concrete?

Or

Does Advertising even work?

Then again, starting from numbers:

What are some of the fast-growing companies out there?

But why re-invent the investing wheel over and over again, when we can just hang out, chill, lay back, and let other (and better) people do the heavy lifting for us?

Why not look at the myriad of stock-write-ups out there, to see what fits our 10 hurdles?

Wouldn’t that be the smartest thing to do?

Yeah, true. But what would be the value ad by that? The whole point being that you can find valuable, original content here, that is nowhere else to be found. A scouting POV, from an original starting point, with a new take on the market out there. Not the fintwit populair fare, but undiscovered, potentional, future big names.

“To boldly go, where no man has gone before.” - Captain James T. Kirk

Yet, for this only once, let’s make an exception to the rule. Since the company we are about to consider for the Mr Mimetic Fox Fund, has been written up by others:

Hurdle Rate in 2021

Feathertop Capital in 2022 (a 35-page report)

Contrarian Cash Flows in 2024

Not on SeekingAlpha and not on Value Investor Club, or anything.

HURDLE RATE is 67% up on its position.

Not bad, but since revenue kinda doubled since 2021…

…the stock price is somewhat lagging.

For answers to that we can look towards the multiple expansion:

“I paid a price of 7.5x EV/EBITDA or roughly 12x post-tax earnings” - Hurdle Rate

FEATHERTOP CAPITAL bought in at around 3,4 EV/EBIT and is up 98% on their position.

The drop in price was due to COVID, perfectly timed with a botched acquisition.

EV/EBITDA is now around 8,3 and EV/EBIT around 12.

Still cheap.

Multiple expansion hasn’t really hit it off, yet. So, there is still room for a so-called Davis Double: where revenue/income grows and the multiple expansion follows suit.

But maybe, there are good reasons for that rather low multiple? (More about that later.)

First, let’s see what this company is doing? Let’s call them COMPANY Z for the convenience of the story.

The Business

Mr Mimetic made the case before that the only real proven way to advertise is through affiliate marketing: somebody produces content that is linked to your product, and you only pay the content creator who is able to convert viewers or readers into customers.

No sale, no pay.

All other forms of advertising are not clear-cut proven. Not really. How funny that statement might sound, it still might be true.

COMPANY Z is in that exact affiliate marketing space, but with a twist.

They are matchmakers. They match demand with supply. And they claim that their special sauce is exactly that: finding people who need something and matching them with people who offer something.

More often than not, they work in a space where both ends of the equation are both offering AND in need. For example:

“I’ve got skills and time to offer, but I need money”

VERSUS

“I can offer you money, but I need people who can do this one thing really well”.

Matching those two, is what COMPANY Z does.

It can be jobs, real estate, travel, used cars, babysitters, nurses, marriage agencies,…

The matching happens through advertising campaigns and “search engine optimization”.

That is quite a hard thing to do.

Except when you have superior data. So, COMPANY Z not only does the matchmaking but also owns the platform where the matchmaking happens.

They are an advertising company that had the insight that it’s better to own the platform where the transaction happens, instead of simply producing leads to the platform.

Those platforms are mostly niche.

Things like: “used Japanese cars for an overseas owner” ; “nail salon jobs” ; “real estate for hire” ; “construction workers” ; “drivers” etc…

In short, Company Z owns a few dozen platforms where they bring businesses that need people in contact with people who want something specific.

“There are areas where people with skills are not enough, and we look deeply into such areas.” - CEO of the company, at the latest Conference Call (their translation)

And they make sure to only look into niches where both sides of the potential transaction are equally motivated.

But instead of simply doing the advertising for others, they own the platforms and advertise those platforms.

This reminds Mr Mimetic about another holding of the Mr Mimetic Fox Fund: a software company that is in the business of making clinics run more efficient, decided it is better to buy the clinics outright and then make those way more efficient with their software -and management system.

Think of it like this: instead of being a niche ad company that produces advertising campaigns for hotels, you decided to own booking.com.

Now, the key ingredient is still advertising. Efficient advertising. What campaign works for what kind of match?

There is no recurring traffic. The transactions are one-offs: once someone finds a job, they might not return to your platform for a few years, or never.

This is no platform business like Amazon or Meta, where people flock to a few times a week.

No, you need to be able to convert new eyeballs to your platform. Over and over again. How do you do that? Through advertising.

So, you better be good at it.

And this is exactly what COMPANY Z claims to be: superior in advertising. They are very focused on what messages work for what kind of situation and profile.

Here you can see how traffic surged after the acquisition of a platform for hair salon and beauty salon jobs:

It’s their best-performing platform….

“We were able to increase revenue six-fold and operating income 39-fold, or approximately 40-fold, which we are proud of” - latest earnings call presentation

And the prototype of how to handle things. They were able to repeat these numbers with other platforms.

It’s a roll-up, baby.

Now, how is this a potential Constellation Software type of play?

COMPANY Z has this modus operandi: they buy platforms that are inefficiently run, and with their matchmaking algorithm they can boost the traffic and the economics of the platform.

This is how they describe themselves:

“We have the ability to provide users with the appropriate information to encourage them to take action” - investor presentation

They aim to convert those platforms to the nr 1 or nr 2 player in their niche.

And although organic growth can be limited within each niche; they can expand vertically and horizontally in more niches, or more territories.

“I believe that we have a plan to grow in any direction, whether vertically, horizontally or diagonally”. - june 2024

They also claim that since they own a collection of platforms (28 so far), they can run experiments, have a vast database, and can learn from their entire universe, to make each platform better at converting eyeballs “into action”.

Somehow, this leads to better Gross - and Operating Margins than Constellation Software:

They get paid in two possible ways:

fees on successful matches -”no sale, no pay”

for access to potential matches - “no lead, no pay”

Which one suits best, is dependent on the type of transaction that is taking place.

When it’s a simple exchange of goods (travel), no sale-no pay is a great way to do business.

When the transaction is more complicated (like job searching), the no lead-no pay is a better way to do business.

Now, what drives their results is not the advertising though. It is not “demand” or “civilians wanting something”.

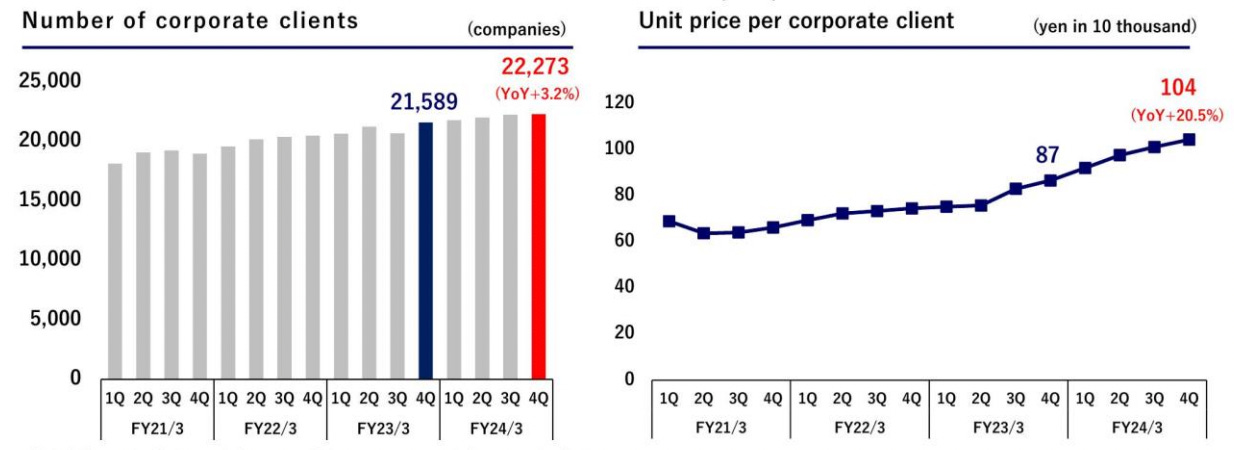

KPI’s

What drives their result is “sales”. And a better way to look at “sales” in this situation is “supply”, in the form of “corporate clients”.

While the “civilian” users, who are groomed through advertising, are mostly one-offs, the “corporate clients” are more sticky.

Those are the real customers of COMPANY Z.

The plan is to…

“increase the number of corporate clients to 50.000 (FY3/2026) “ - The Medium-Term Managment Plan

Still a way to go from where they are now….

The only way to get there is through a massive acquisition spree.

Now, in any other situation - the weight of those objectives might pull on you as a manager and pressure you to go out there and roll-up platform after platform after platform to hit those targets.

That’s why owner-operators come in so handy.

The CEO bought the company in 2009 through a management buyout (when he was 25 !!), is a +40% owner, and is very disciplined when it comes to acquisitions. He will not overpay, since “total shareholder return” is high up on his agenda. In the latest earnings call presentation (may 2024) we could hear this:

“Our financial policy is to use the cash not used in a given period for share buybacks in the following period. (….) As for shareholder returns, we plan to repurchase JPY2.8 billion of our own shares, the largest amount ever, and will also pay a commemorative dividend.

Any share bought stays in Treasury, as a possible currency for future acquisitions.

Not sure if anybody ever did the math on that, but this seems like a great policy. Mr Mimetic never really got that “cancellation of shares” practice. Why just not keep them in treasury?

Luckily, the CEO is aware that the yields he can achieve through acquisitions are way better than through buybacks:

“We are confident that M&A is the most effective way to use money in our company.”

Canceling shares would indeed be capital destruction.

The buybacks are correlated with the fact that the last fiscal year has been slow on the acquisition front.

Here, you can see "TAM," which stands for "total addressable market," and one of our goals is to expand the size of the overall market.

The record in M&A is outstanding. There is a 70% success rate. Part of that has to do with the disciplined and the “value investing” approach when it comes to Acquisitions.

They look for places where they can maximize the LTV/CAC spread: the lifetime value produced per (corporate) customer vs the Customer Acquisition Cost - which is Advertising in practice.

Especially, they look for places where digitization hasn’t taken root yet or is still in its infancy - and where there is a structural gap between demand and supply.

Moreover, the churn rate (for corporations) seems to be as small as 2%.

And, obviously, they are quite focused on the conversion rate: what type of information leads to conversion?

Now, by all means, this CEO seems to be something special. The philosophy behind the company and the execution seem top-notch. But why oh why is there still an opportunity, when that is all true?

Growth is on par with Constellation Software (except during COVID):

Clouds on the horizon

Why the multiple or valuation is so low, has to do with the space they are perceived to be (mostly) in: job search.

The CEO is aware of that:

“In terms of demographics, you may think that the pie will shrink in the HR field in the very long term because of Japan's declining population. “

To counter that they diversify, grow their TAM, and look for industries where demand is rising, ahead of supply. One example is Nursing, another one is Logistics (your friendly local parcel courier).

And obviously, Sam Altman claimed that AI Will Replace 95% of Creative Marketing Work:

It will mean that 95% of what marketers use agencies, strategists, and creative professionals for today will easily, nearly instantly and at almost no cost be handled by the AI — and the AI will likely be able to test the creative against real or synthetic customer focus groups for predicting results and optimizing. Again, all free, instant, and nearly perfect. Images, videos, campaign ideas? No problem." - in: “Our AI Journey”

The CEO tends to agree:

I believe that companies that can take advantage of this AI will grow very rapidly, and companies that cannot master it will gradually stop their growth.

The CEO says they are already working with AI, in terms of big data (not as a content-generating tool), and they have been doing so for many years already.

We have been working on machine learning that includes things outside of the context of current generative AI, even before the period of this generative AI. (…) The conversion rate before and after the use of AI is changing considerably in our company.

Indeed, they rank certain information points and correlate those with different profiles, to decide what information to push in the advertising side of the business.

The overall market sentiment is, however, that they are vulnerable vis à vis big-time players, who can throw massive piles of money at AI, to compete them into the ground.

Mr Mimetic thinks those concerns are overblown since their niches are too small for big players to go after. Who will throw AI at the “Japanese Used Cars, sold in Africa” market? Nobody.

Except for Company Z, that is. Most likely they will be able to use big-player AI suites for their particular use cases.

Another reason for the lack of appreciation by Mr Market is the “overpromise underdeliver” phenomenon.

The CEO made a 5-year plan (ending in 2026), that aimed at 30% CAGR. (Last year they were at 27%, so close). Then with COVID, and a dry spell on the M&A front, they are far behind the initial projections. More capital was allocated towards internal investments into efficiency and organic growth opportunities, but those don’t yield the same results as those juicy Acquisition numbers. They might in the future, though, since the CEO claims those investments need some time to produce results.

The CEO admitted the whole mid-term plan was maybe confusing shareholders and debated whether it is actually a good idea to communicate such plans externally.

The consensus is also that marketing & advertising costs will only go up in the foreseeable future. (Mr Mimetic thinks the opposite might occur since AI might be able to create campaigns at a fraction of the current costs)

Next concern might be the drought in M&A space. Prices are too high, and opportunities too little. There is a cyclicality to the roll-up universe.

As there is to the overall market Compay Z is in. With an uncertain future in terms of economy and global politics, the job markets might be in for a few tough years.

Mr Mimetic take on this is, that there are advantages of being in a cyclical industry as long as you are the low-cost producer. You will most likely come out on top, and be able to grab market share of lesser companies - who have a harder time than you. Let them suffer, and scoop them up.

As you can tell, Mr Mimetic likes the story so far. Some of the patterns here echo with highly successful companies.

But can the story pass our numbers test?

The 10-hurdle race

A while back, some people at Alta Fox Capital, looked into the best-performing stocks over a 5-year period and distilled a few metrics that those companies had in common.

That report was the starting point for Mr Mimetic trying to find the best-performing stocks of the NEXT 5 years, using those metrics.

While on this journey, Mr Mimetic noticed the good people of Alta Fox Capital didn’t include a Return-on-Investment metric, so we added one of those. And Mr Mimetic found it useful to include a so-called Distance Analysis - to gauge whether a 10x growth is in the foreseeable future.

All in all, this leads to a 10-item obstacle race that is the hurdle any company must be able to step over, to become a proud member of the Mr Mimetic Fox Fund.

SIZE

Under 2 billion US$ market cap? Market cap is 382,25 US$ ✅

GROWTH

A minimum of 15% revenue CAGR? ✅

OWNERSHIP

Substantive enough to be life-changing? Management owns together 48% of outstanding shares ✅

HEALTH

Financially healthy enough to survive and be flexible when times are rough? ✅

ACQUISITIONS

Possibility to grow through acquisitions? Doing so in a value-adding manner? ✅

Payback period is short…

Returns on Acquisitions are really great:

What’s not to like?

DISTANCE ANALYSIS

The first knee-jerk reaction is that Japan and the niches they are in, are too small to grow towards 10x or 100x.

But then again: why would their “system” not be repeatable?

They own 28 companies now. Only 3 are material at the moment, in terms of revenue.

Cash and Cash flow is abundant.

Constellation Software has over 500 companies under the umbrella. Some of those companies are really small, with 50 employees and 10 million in revenue. They are, however, dominant niche players, with a quasi-monopoly.

One KPI of Company Z is “corporate” clients. They want to grow that number to 50.000, while they are now not even half that far. The point is: 50.000 is achievable in Japan.

According to Perplexity.ai:

“Constellation software has over 125,000 customers in over 100 countries”

What if Company Z ventures into foreign waters?

What about Korea? What about Taiwan? What about Vietnam? What about Brazil? What about Mexico? What about India? What about Nigeria?

What if they can acquire the underperforming platforms in those territories and turn them into the dominant force?

What about Canada, Germany, France, Britain, the US?

Bolt-on acquisitions haven’t happened as of yet, but the CEO is open to them.

The internal organization will have to change a bit, though.

The CEO is now fully committed to working on the operational side of things within each company. It’s where he spends most of his time on in each Q4: to fine-tune the business plan with each “business director” (There are 18 of them).

Annually there are between 2 and 4 acquisitions.

Decentralization does seem to have a nasty taste in Japanese culture:

“I would like to expand that more and more as I mentioned (when talking about) TAM. There are often negative comments about conglomerates and the like, but I believe that we can create synergies and premiums. This is not for a short term.”

Look, the CEO is still very young. He was 25 when he bought the company, 30 when they went public and is now about 40.

The last 10 years bore witness to an outstanding trajectory:

“(Company Z) achieved impressive revenue growth averaging 32% annually, increasing from JPY 1.17B in 2013 to JPY 18.7B in 2023” - Contrarion Cashflows

This company will 10x. Again.

The pace in which this happens, however, might be “steady as she goes”.

Which is fine. Rather prudent than rampant.

Just beware: the next 10x will probably not happen in a 5-year time frame.

So ✅ or ❌ ? Neutral ±, with a positive sent.

BARRIERS TO ENTRY & COMPETITIVE ADVANTAGE

Japan has its distinctive corporate culture and language. Which makes it harder for foreign entrants to get an easy foothold.

However, there is no natural moat around the industry or markets Company Z performs in. The industry as a whole may be even under duress:

“Unfortunately there is a big question mark over the longevity of Web 2.0 and traditional advertising / SEO.” - Feathertop Capital

Not all platforms Company Z is operating are even the number 1 in their market. They might become the number one in due time, but they are not there yet. The proof of that pudding is not yet in the eating.

“We have seen some pretty intense competition in certain niches” - Feathertop Capital

The only thing that Mr Mimetic is convinced of, is that what Company Z does, is quite a hard thing to pull of.

Being able to keep a low Customer Acquisition Cost, through effective Advertising is not easy. This might be proprietary.

It is definitely not something their Acquisition Targets can easily do themselves, which leads those companies few options but to sell to Company Z.

However, it is not impossible, for a dedicated competitor.

“We are trying to continuously create competitive advantages... when selecting a market, we consider the size of that market and our ability to compete”

- CEO in 2022

One thing that is an opportunity for Company Z, to make it harder for any competitor to compete, is to exercise the “Scaled Economies Shared” strategy: turn additional earnings and revenue growth into price reductions for clients.

This would give them a sturdy moat, that is very hard to compete with, given the constellation of platforms they are building.

However…

“We know very little about the pricing structure employed” - Feathertop Capital

So we don’t even know if this is the case. They don’t provide that info, which leads Mr Mimetic to believe they don’t employ the strategy.

Which is a shame.

So, all in all: ✅ when it comes to Competitive Advantage, but ❌ when it comes to Barriers to Entry.

This industry is not risk-free.

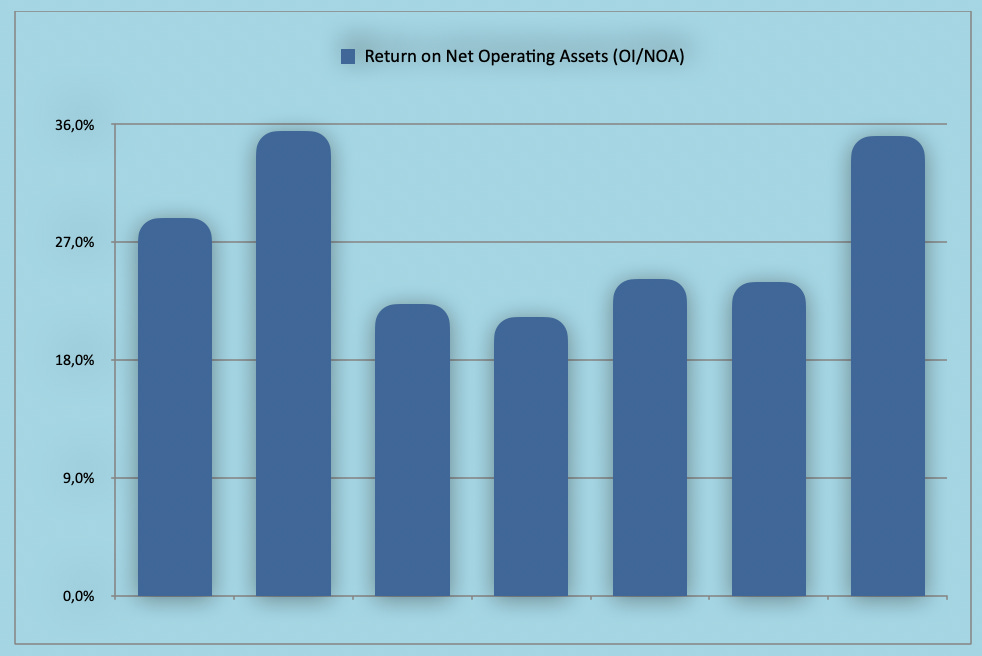

EXPANDING MARGINS

“(Company Z) has the strongest operating margins (being in the 40s) in the comp-set vs its direct competitors” - Feathertop Capital

Return on Capital Employed suggests we are looking at a great business:

ROCE is helped by the high amount of cash on the balance sheet, something we call the Japanese Disease:

If the cash was deployed at the same rate it has been so far, ROCE would still be pretty high.

Mr Mimetic is growing the personal bias that any company with a ROCE under 40% is uninvestable.

Margins are, however, not expanding.

There is no flywheel effect. ❌

Some of Mr Mimetic own favorite metrics, don’t hit the ball out of the park, either:

How come?

Not enough of the earnings are re-invested in the business.

Returns on the capital that is indeed invested are wonderful. Yet very little of what is earned finds its way toward the acquisition funnel.

The real question to answer here is whether that is temporary (part of the cyclicality of M&A space) or structurally:

are there not enough great acquisition targets?

are there not enough ways to re-invest in the business to grow organically?

is the CEO too risk-averse?

or:

Is the CEO very disciplined and is this just a temporary depression of results, as you might expect from a great owner-operator who has the very long term in mind?

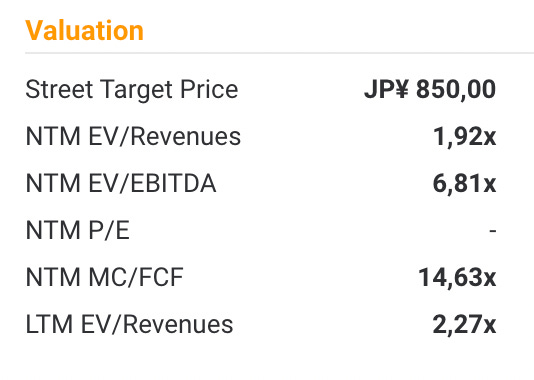

CHEAP

Current EV/EBITDA is 8,83 but according to Tikr the Next-12-months is very cheap:

My own metric for valuation is the Mr Mimetic Score:

(EV/EBITDA)/Compounding Rate

This gives us 0,99 (while Mr Mimetic expects < 0,50).

When you would use Free Cash Flow as a metric, or Owner Earnings (instead of EBITDA) this would fall in 0,3 territory.

Free Cash Flow is growing faster than revenues, due to the lack of investment opportunities. (Cash for investing is a deductible in calculating Free Cash Flow)

So, cheap? Cheap enough, yeah. ✅

The Key Questions to Anwer

When will the Acquisition Wheel start spinning again?

Will it ever spin in turbo?

Is that achievable in the near future?

Can the past 10 years be repeated in the coming decade?

Mr Mimetic feels like there is not enough information to answer those questions.

But, what do we know?

Mr Mimetic thinks the risks for permanent capital destruction are very low, the chances of very disciplined capital allocation are very high, and the chance of substantially higher valuation once future (bigger) acquisitions start to contribute to revenue is also quite high.

The CEO seems confident enough:

“We are on track to achieve the second medium-term plan.” - CEO in may 2024

Which means:

10 billion Yen in EBITDA can easily translate into a market cap of 100 billion.

The current Market cap is 61 billion.

It’s not that important whether this is achieved in 2026 or 2027.

Mr Mimetic thinks 3x in 5 years is necessary to become a part of the 1% best-performing stock in any given 5 years.

A market cap of 180 billion in 2029 would require an EBITDA between 15 and 20 billion, and revenue between 50 and 70 billion Yen.

This requires a CAGR of 14% to 19% in terms of revenue, starting from current FY revenue.

Since the goal is currently 30% CAGR, there is ample room for error.

This leaves us with only one open question: what is the real name of Company Z?

Here are some of the platforms:

The star CEO is called Joe Hirao or Magic Joe…

…who, incidentally, made some interesting personal investments in used car platforms in India…

To find out if Zigexn is now part of the Mr Mimetic Fox Fund, you can subscribe to stay up to date on the Funds holdings and our performance (only $30/year)

If you like what you’ve read, please feel free to share it with your investing aficionados

As always, thank you for reading.

Kind regards,

Mr Mimetic.

SOME SOURCES

Investor Relations at Zigexn.

Sam Altman comments on the advertising industry.

And 3 great write-ups:

Hurdle Rate:

Feathertop Capital: