This stock more than doubled in a year and is still undervalued. Should it be a corner stone of your portfolio for the coming 5 years?

Our continued search for the best stocks of the coming 5 years, brings us to Australia and an industry that is surfing a long-term trend Mr Mimetic discovered by reading one of Vaclav Slim's books.

Disclaimer: to get up to date about our intentions, the holdings in the Mr Mimetix Fox Fund, our investment process, and criteria (all based on research by Alta Fox Capital on the best stocks between 2015 and 2020), please take a look at our preamble.

From Wonder to Burden

When visiting Rome for the first time, last autumn, Mr Mimetic was truly amazed while walking around the Forum Romanum. You can still wander around under the same pillars where Caesar or Marcus Antonius walked. You can stand on the same wall where Augustus once stood. How amazing is that?

Part of the wonder is this: how can it be those walls still stand? What chain of uninterrupted continuous luck had to happen for a building, aqueduct, or bridge to still stand after thousands of years? And the crazy thing is: how are these 2000-year-old infrastructures still functioning?

Turns out, the luck is to be found in the chemical composition of the Roman cement.

When reading Vaclav Smil's “How the World Really Works” Mr Mimetic learned that …

“Roman cement was a mixture of gypsum, quicklime, and volcanic sand, and it proved to be an excellent and durable material for large structures, including expansive vaults. The Pantheon, intact after nearly two millennia (it was completed in 126 CE) still spans a greater distance than any other structure made of non-reinforced concrete” - Vaclav Smil in “How the World Really Works”

Mr Mimetic also learned, however, that modern concrete is not so lucky. The chemical composition of nowadays concrete makes it NOT withstand the test of time.

“These enormous masses of modern concrete will not last as long as the Pantheon’s coffered dome. Ordinary construction concrete is not a highly durable material and it is subject to many environmental assaults. Exposed surfaces are attacked by moisture, freezing, bacterial and algal growth (especially in the tropics), acid deposition, and vibration. Buried concrete structures suffer from crack-inducing pressures, and from damage caused by reactive compounds seeping from above. Concrete’s high alkalinity (freshly poured material has a pH of about 12.5) is an effective guard against the corrosion of the reinforcing steel, but cracks and exfoliation expose the metal to corrosive disintegration. Chlorides attack concrete submerged in seawater and concrete on winter roads where salt is used for de-icing.” - Vaclav Smil in “How the World Really Works”

In short: our modern-day cities, our bridges, our roads, our pipelines are slowly but surely rotting away.

Between 1990 and 2020, the mass-scale concretization of the modern world has emplaced nearly 700 billion tons of hard but slowly crumbling material. (…) Many will deteriorate badly after just two or three decades while others will do well for 60–100 years. This means that during the 21st century we will face unprecedented burdens of concrete deterioration, renewal, and removal. - Vaclav Smil in “How the World Really Works”

Someone somehow someday will have to clean those deteriorating massive amounts of concrete.

And that someone, is the next company Mr. Mimetic wants to take a look at.

Care to join?

Our checklist

To remind you, these are the criteria Mr Mimetic will be looking at:

market cap below 2 billion$

cheap

growth > 15%

barriers to enter

competitive advantage

ebitda growth > revenue growth (preferably)

insider ownership (preferably)

financially healthy

acquisitions to boost growth

Those criteria were compiled from a study by Alta Fox Capital researching the listed companies with the highest shareholder return between 2015 and 2020.

Crossing some items on that checklist real quickly:

Market Cap is 208 million AUS$. Small enough. ✅

“Top management collectively owns 33% of company shares outstanding, and the 60 senior managers under them collectively own another 6% of the company for a total of 39% held by employees.” - from a report by Sohra Peak Capital Partners. Insider ownership checks out. ✅

Growth in revenue checks out just fine. ✅

Cheap enough, since below 3x trailing Sales, 20x trailing EBITDA and 30x trailing PE. ✅

Financial healthy? Well, they ended HY 2023 with

a 60 million cash balance

non-current liabilities of 13,775

current assets of 109,998 vs current liabilities of 112,973

total equity of 36,306 vs total assets of 163,054

a Current and Quick Ratio of 0,97

This seems borderline, at best.

Yet, since they are paying out a dividend with a payout ratio above 50% of net income, long-term debt is low and ex-cash the total liabilities vs operating income is under 4… this might be the cost of doing/growing their business?

Mr Mimetic concurs with the benefit of the doubt. ✅❓

Unfortunately, margins are lumpy. There is no clear flywheel where more revenue amounts to higher margins.

While Revenue grew at 27,94% 5Y CAGR per share, EPS did only at 14,31% and EBITDA at 15,55%. ❌

Mr Mimetic will have to look into that, but is not willing to throw in the towel just yet, since according to the Sohra Peak Capital this is the TLDR on the company:

an Australian-listed micro-cap company with little coverage and little-known outside of Australia that has grown revenues since its 2010 founding at a 32% CAGR almost entirely organically, reaps 30%+ ROIC, and was recently guided by management to deliver FY23 (ending June 30) revenue growth YoY of +35-48% and EBITDA growth YoY of +66-81%

Who they are and what they do.

The three founders worked together at an engineering company, in the maintenance division. Poor management by their CEO made them decide in 2010 they could do much better on their own. So they found a sponsor for some seed money (still a 11% owner now) and were able to attract talent among their former colleagues from the poorly run division, to start their own asset remediation firm.

So what they do is: they renovate deteriorating buildings and infrastructure. Mostly rotting concrete and rusting steel. First, they analyze existing buildings and infrastructure, and when the cost of maintenance, repair, renovation, or upgrade is smaller than the cost of a total rebuild… they can manage that job for you.

And usually, it is. Extending the life of an existing asset is highly cost-effective.

Moreover, it pays to analyze and monitor your assets and infrastructure to stay ahead of costly repairs. (In the same way that preventive healthcare is a lot cheaper than curing a disease; or educating children is a lot cheaper than, you know, putting them in prison.)

They specialize in concrete and steel but are also capable of odd jobs like toxic paint or asbestos removal.

One of their biggest clients is the Ministry of Defence, but also the Mining industry, and repairing or maintaining building façades is bringing in large chunks of revenue.

Now, what sets them apart from other remediation firms, is their in-house expertise in asset assessment. One of their former colleagues with a Ph.D. in corrosion and concrete durability founded his own firm, but decided to sell to the three founders in 2017.

This assessment division “acts as a strong lead generator of clients by providing best-in-class asset assessment services to potential clients and boasts an 80% conversion rate” (Sohra Peak Capital report).

The ability to be a one-stop-shop service is highly competitive advantageous.

Moreover, the maintenance and repair industry is not only an expertise game, but also a reputation game. 80% of their revenue is recurring.

Their industry experience and ability to attract talent among their former colleagues from their previous job gave them an advantage that will be hard to copy for any other small newcomer.

Another competitive advantage is their decentralized, local footprint. The 60 senior managers are involved with running the 20 local shops, in an entrepreneurial way: they have to win contracts and are awarded as co-owners.

So, you would find that:

barriers to enter ✅

competitive advantage ✅

checks out.

Now, the reason why they are so cheap might be the low visibility of their niche in the overall engineering and construction market; the lumpy margins; the working capital requirements, and fear of inflation.

Although the spending in maintenance and repair is not cyclical, it is however a labor-intensive service.

To sum it up: a growing, founder-led niche company, in a hard-to-penetrate industry, with some competitive advantages, surfing a global trend, that could use a slightly healthier balance sheet.

Two more things

Are they using acquisitions to boost growth?

The tuck-in of the assessment expert firm led to great growth: for every $1 of consulting work for a client, the company earns $25 in project revenue. So, that was a great move.

In late 2022 they acquired a pipe company, as a way to open up the Oil&Gas market to them, which they deemed difficult to enter organically.

So, opportunistically they are willing to do acquisitions. So far, they have a stellar record in that department.

What about future growth?

In their home market, they are only at 1% of the Total Addressable Market in all sectors. Long term they can surf the wave of a global trend.

In affluent countries with low population growth, the main need is to fix decaying infrastructures. The latest report card for the US awards nothing but poor to very poor grades to all sectors where concrete dominates, with dams, roads, and aviation getting Ds and the overall average grade just D+. - Vaclav Smil in “How the World Really Works”

And indeed, management has stated that it believes growth opportunities across the board should continue “for years to come.”

Off course, there is some risk in terms of financials, large client exposure (the Ministry of Defense is 40% of gross profit), risk of project failure, and labor costs, but Mr Mimetic is confident those are manageable as the company is venturing in new industries to diversify their margins and revenue streams.

Mr Mimetic can see a future between the mid-and long-term where they are addressing 10% of the TAM. A future where they are a 2 billion AUS$ company, instead of a 200 million AUS$ company.

The Mr Mimetic Fox Fund

So, who are we talking about, exactly? What is the name of the company?

Is Duratec a slam dunk in our checklist of criteria?

No, they are not. Financials and Margin Growth carry a question mark.

Can Duratec become one of the top-performing stocks in the next 5 years?

Yes, Mr Mimetic believes they can.

Should Duratec be included in our Mr Mimetic Fox Fund?

Yes, it should.

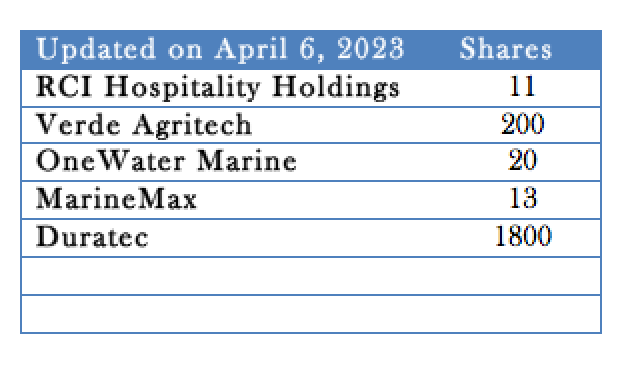

Which makes the composition of the fund thus far:

Some links:

Greetings,

Mr Mimetic