Screening for Our Next Winner. (part II)

The new strategy to scout for Mr Mimetic Fox Fund candidates continues. Can we find a business with great characteristics AND a great path ahead?

Please, read the preamble to check out our investing philosophy.

Mr Mimetic continues to look at companies with a great statistical snapshot, or with a good recent track record, on paper.

The screening criteria are:

Market Cap under 2 billion US$, TTM revenue growth, TTM EBITDA growth, TTM ROIC growth, and EV/EBITDA multiple under 15. (TTM = Trailing Twelve Months).

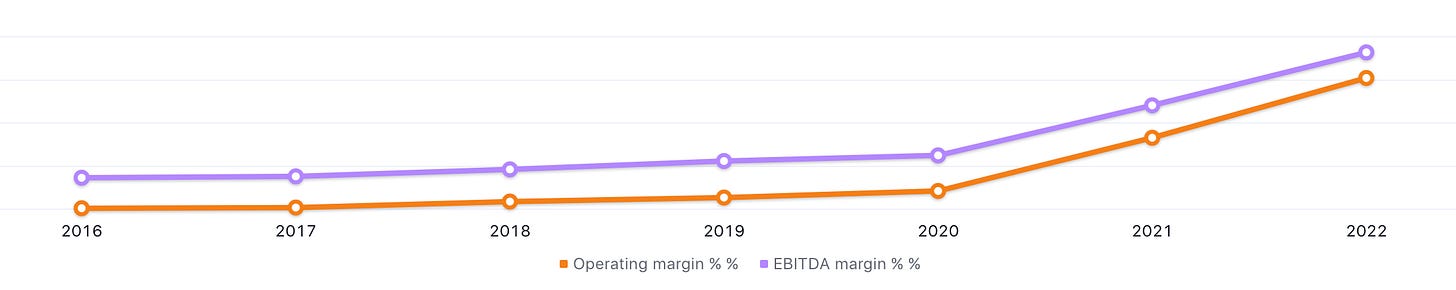

A first selection is made based on the revenue growth in the last 5 years (double or nothing) and expanding EBITDA margins (Does EBITDA grow faster than Revenue?)

What Mr Mimetic is hoping to find out is:

Are those numbers a testament to how their industry, business strategy or company culture is truly special? Can Mr Mimetic identify how they could become part of the 1% best-performing stocks of the next 5 years?

In other words: is their statistical history providing us with a glimpse of their future?

Again, Mr Mimetic will give the following info per company:

a description of their activity

5year price history

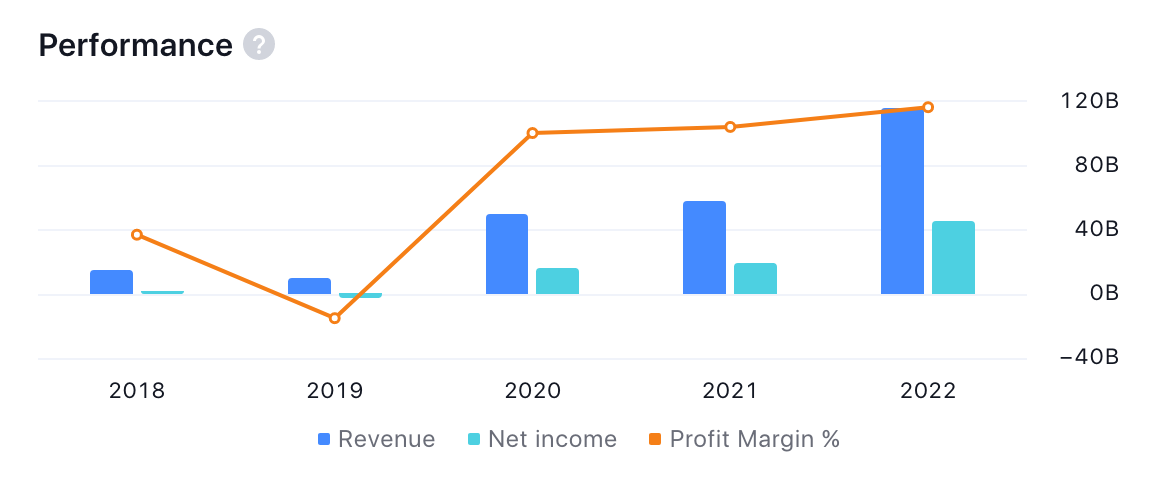

5year CAGR in revenue and EBITDA, and a look at Free Cash Flow (CAGR = Compound Annual Growth Rate)

5year trend in margins and current Operating Margin

Net Income performance (merely as a confirmation check; Net Income doesn’t seem to be the best of metrics)

ROIC and ROE trend

Insider ownership

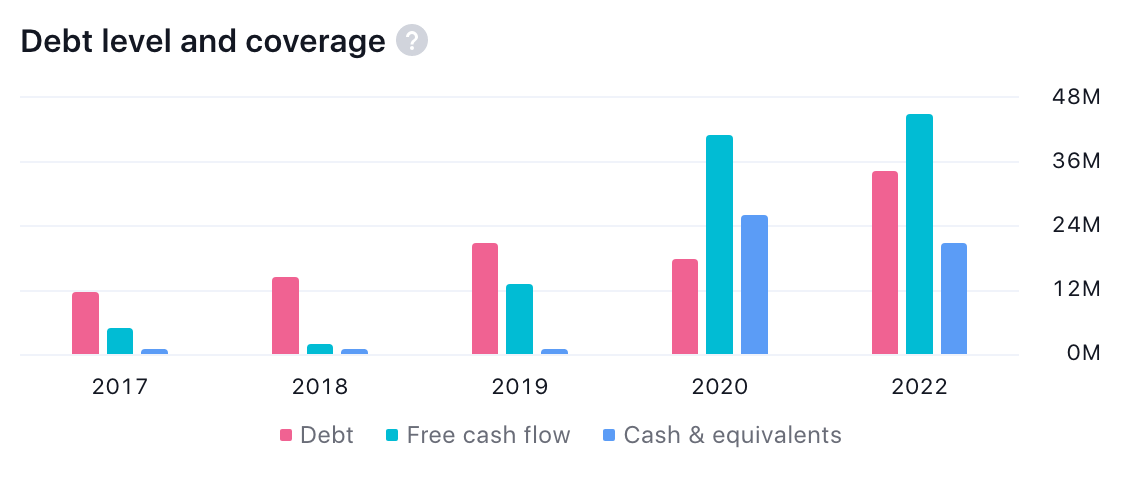

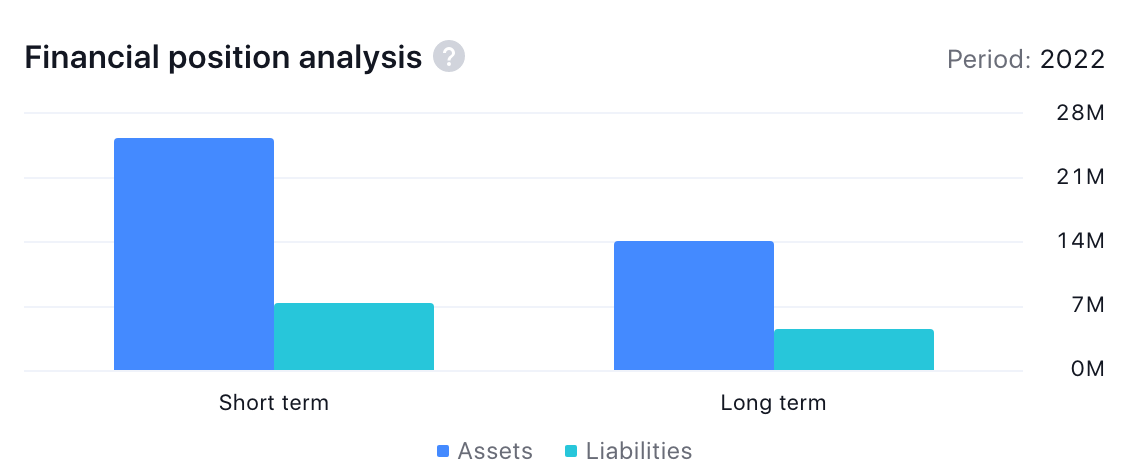

Financial health (debt vs cash + FCF ; solvency)

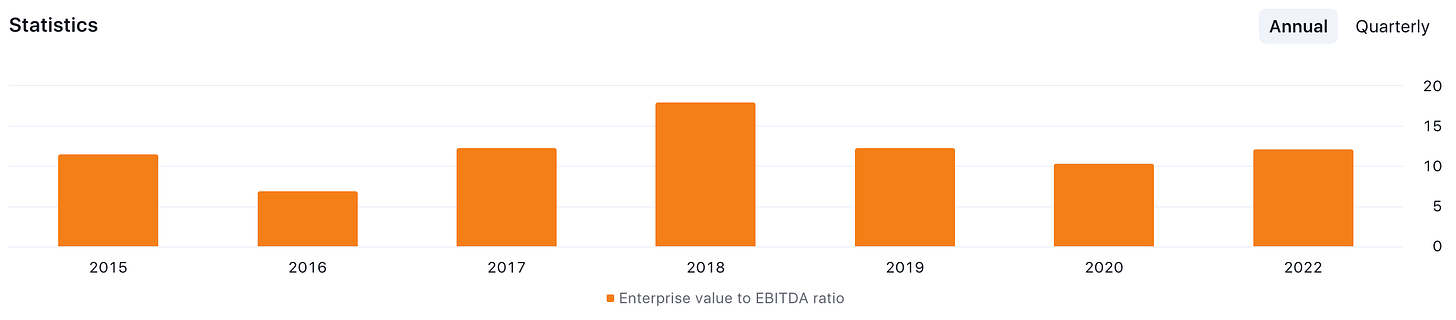

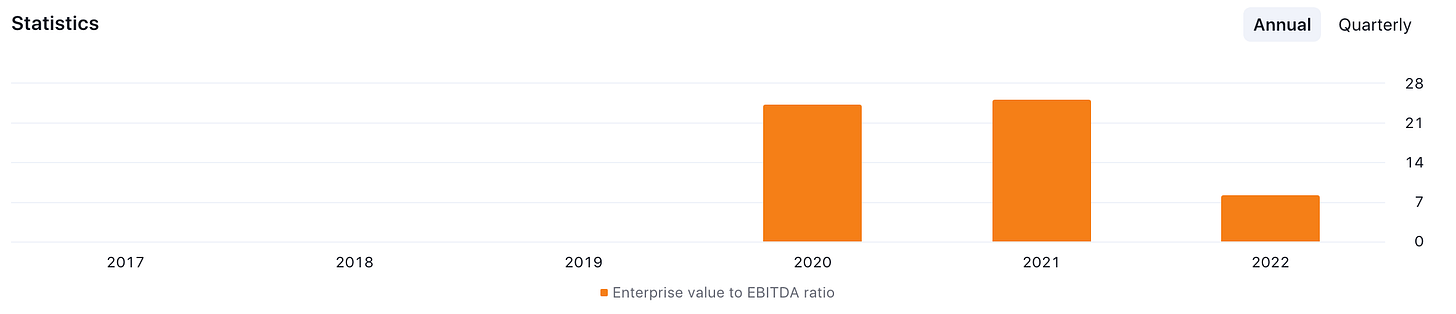

EV/EBITDA multiple

a preliminary conclusion focused on the moat and competitive advantage

So, here we go.

A RANDOM GLOBAL SELECTION OF 7 MORE POTENTIALLY INTERESTING STOCKS:

12. NEXT VISION STABILIZED SYSTEMS

Next Vision Stabilized Systems Ltd. develops, manufactures, and markets stabilized day and night gimballed cameras for ground and aerial vehicles such as micro and mini drones. The company was founded by Chen Mordekhay Golan and Boris Kipnis on April 1, 2009 and is headquartered in Raanana, Israel.

A stock that was able to climb 257% in the last 12 months is bound to be expensive. Since reviewing how the best stocks of the class of 2015-2020 fared after that date, Mr Mimetic is well aware of the EV/EBITDA multiple.

So, right from the bat: Next Vision is too expensive for the Mr Mimetic Fox Fund.

How did it skip through the screening criteria?

A great business can carry an EV/EBITDA of 15, but anything beyond that requires an impenetrable moat or clear path to growth (in total addressable market or in market share).

And Next Vision is not only expensive… Having lived through the rise of GoPro and other AV equipment companies, Mr Mimetic is fickle to consider anything AV-tech related as having a strong moat.

The next big thing is already around the corner. Mr Mimetic doesn’t see how Next Vision will sustainably, with reasonable predictability, continue to do fabulously well. They might, but Mr Mimetic doesn’t see what might predict it.

13. RAND WORLDWIDE

Rand Worldwide, Inc. engages in Autodesk solutions and value-added services (Value Added Seller) to customers in the manufacturing, infrastructure, building, and media and entertainment industries; professional training and consulting services to companies with complex design projects. The company was founded in 1981 and is headquartered in Owing Mills, MD.

At first sight, there is a lot NOT to like about Rand Worldwide. They are no longer reporting to the SEC, and all they seem to do is sell software from another company: Autodesk.

(Autodesk is a 41 billion US$ company that sells software to design complex stuff like bridges and buildings)

How is re-selling software a sustainable, defensible business? Can Autodesk not just decide to sell their own suites themselves? Or train their end users in-house?

Well, no. Value Added Selling is actually a surprising business:

First, Rand knows the very specific needs of their customer intimately, on a level that is totally unreachable for Autodesk themselves.

Second, Rand can customize Autodesk for specific projects, in a way that is too hard for the end-users to do themselves.

This makes Rand mission critical for both Autodesk and the End User. They are close-knit partners on both ends of the stick.

Yes, they are gushing with free cash flow. Yes, they don’t care how they look in the eyes of the stock market. And, yes, they are quite confident about the competition.

Their biggest rival, is actually not a rival at all, since they do what Rand does, but in a separate part of the world, in a different language: Mensch Und Maschine - the Autodesk Value Added Seller in the German-speaking Territories in Europe.

Regular readers will recognize Mensch Und Maschine as a name we encountered before: it was one of the few companies that were among the best-performing stocks 2015-2020 AND continued to do even better after 2020. See here.

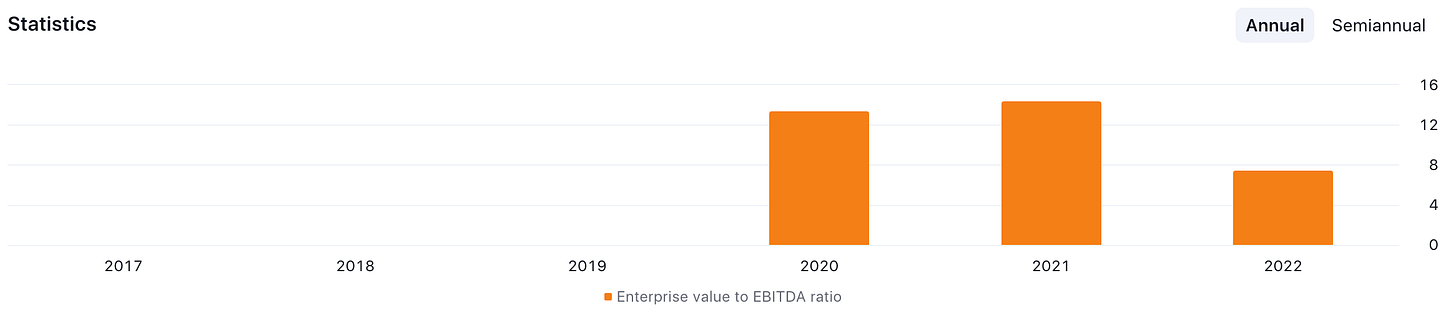

Whether or not Rand will make it into the Mr Mimetic Fox Fund, and how they compare to Mensch Und Maschine will be the subject of a separate blog post. With an EV/EBITDA of 7,75 they sure look cheap enough.

Stay tuned, for that one.

14. NEXTIN

NEXTIN, Inc. is a holding company that provides inspection solutions for semiconductor and display industries. Its products include an aegis wafer inspection system, an iris wafer inspection system, and 3rd dimension image comparison technology solutions. The company was founded on July 1, 2010 and is headquartered in Hwaseong-si, South Korea.

As previously encountered, Korean Companies are not big on displaying English information for international investors.

They seem to be a spin-off from or a joint-venture with AP Systems?

The most recent numbers look flat, compared to last year’s quarters - but all in all Mr Mimetic is simply unable to assess the competitive landscape when it comes to wafer inspection. How strong are their patents? What is their culture?

There is the matter of sub-optimal legal rights for individual investors in Korea, which makes mr Mimetic uncomfortable, to start with.

In general, Mr Mimetic has a really hard time evaluating the future of any hardware or machine manufacturer, when there is no niche, or a monopoly or oligopolistic play. Can Samsung not just sweep in, in due time?

Only for local or industry specialists, this one.

15. SOLUTION DYNAMICS

Solution Dynamics Ltd. engages in the provision of customer communication solutions. It offers outsourcing and output services; technology and development services; intelligent imaging; and marketing campaign and document management. The company was founded in 1996 and is headquartered in Albany, New Zealand.

That is a nasty price-action graph. Negative on a 5-year period.

In the Annual report of 2023 we can read that revenue was flat, despite:

“a refreshed focus on new business activity that commenced in late FY2022, following staff changes and restructuring the sales team.”

This does sound a lot like a turnaround story, not a visionary, hard-to-replicate business strategy, or a competitive position from strength.

Higher margin business, however, did land them record profits, despite no revenue growth.

What do they do? They send your mail out: your global mass marketing mail, or invoices, and other official papers, including bespoke printing of your envelopes and postages. And they have some SAAS for you to manage all that.

The majority of revenue is still from printed material.

Yes, this is a declining market, under inflationary pressure, which makes…

sustained growth difficult to achieve — AR 2023

They do have a lot of mid-term contracts, which gives them predictability - and optionality if new business wins would occur.

Numbers in the last decade have been quite good: 14% CAGR in Revenue and 26.5% CAGR in EBITDA. This is all thanks to the move to software and digital.

Enthusiasm has waned around the company and the SAAS innovation, leading to a negative 5-year record in share price.

Insiders do have a decent chunk of the business, collectively, but individually all just around a few percent.

All in all, a clouded, unclear destiny. Maybe interesting, as a dividend investment? (yield 8%, payout ratio around 50%)

16. CALNEX

Calnex Solutions Plc engages in the design, production, and marketing of test instrumentation and solutions for network synchronization and network emulation. It operates throughout the Americas, North Asia, and the Rest of World. The company was founded by Thomas Cook in 2006 and is headquartered in Linlithgow, the United Kingdom.

This one dropped hard, this year: down -60%

Just recently we found this news:

Calnex Solutions shares fell after the company said it expects to miss market revenue expectations for fiscal 2024 due to challenging conditions….revenue is expected to miss market expectations by 20%-30% - DowJones NewsWires, 10.10.23

Calnex tests the flow of data in networks, be it data centers or telecom networks.

The telecom business as a whole is under pressure - with a pause in investments; but founder-CEO Tommy Cook (20% of shares) is confident the long-term prospects of Calnex are secured, once 5G is rolled out in a new global capex round.

18 million net cash on a market cap of 44m makes it dirt cheap, but Mr Market is panicking in thinking Calnex will have to spend a lot of that cash on new solutions to convince their customers they are mission-critical and at the forefront.

This beating can prove to be an opportunity.

Contracting margins (revenue grew faster than EBITDA) are reason enough, though, for Mr Mimetic to venture towards other possibilities.

While the future is always clouded in uncertainty, the future of Calnex is a bit extra foggy.

17. YOUNGONE CORP

Youngone Corp. engages in the manufacture and sale of outdoor sportswear and shoes, backpacks, and special function materials. The Brand Distribution business offers wholesale and retail of premium bicycles, sports equipment, and outdoor branded products. The company was founded on July 1, 2009 and is headquartered in Seoul, South Korea.

Despite the lackluster revenue growth, another one that is so extremely cheap, Mr Mimetic just had to look into it.

Youngone is not really a fashion brand, but a production partner for the likes of Patagonia and The North Face. They have factories in Bangladesh. In 2018 they had to shut down a 10,000-person factory in China due to Korean-Chinese politics. They are building new factories all over the world, e.g. 12 new factories in India.

Glassdoor reviews are not that great.

ROIC and Operating Margins are surprisingly high. And the valuation is dirt cheap: EV/EBITDA is about 2; P/E is 3; trading under book value, with a ROE above 24%. Net cash. The Chairman appointed his second daughter as his successor in August 2023, and the stock price has been tanking ever since.

Misogyny?

Youngone Holdings, the mono-holding controlling Youngone Corp (which itself is controlled by the chairman), has not suffered that big of a decline but is even cheaper. Negative Enterprise Value at the end of 2022 (1.46T cash, 451.68B debt, net debt −1.01T, market cap now is 888.935B). So the company held more cash on the books than the current market cap of about 655m US$. Since then dividends have been paid, pushing Enterprise Value above zero again. Price to TTM free cash flow under 2, EV/EBITDA of 1,75.

But that has been the case for a while:

The share price is not catching up with the underlying growth in value:

Many foreign investors for years have been discouraged from investing in the South Korean stock market despite its valuation discount vs. other equity markets. - Dalton Investments

Cited reasons for this so-called Korean Discount are higher currency volatility, geopolitical risks, poor capital allocation, and especially poor shareholder rights: e.g. companies can do spin-offs without compensating shareholders.

New legislation might change this, however.

Only investable when your time horizon is long enough? Or whenever the law has been changed?

18. ENVELA

Envela Corp. buys and sells within the re-commerce sector. All kinds of jewelries including diamonds, fine watches, rare coins and currency, precious metal bullion products, scrap gold, silver, platinum, palladium, collectibles, and other valuables. The firm operates within the circular economy, providing value through both retail and commercial services. The company was founded on September 16, 1965 and is headquartered in Irving, TX.

Secondhand jewelry and IT equipment for recycling or re-sale.

The luxury hard assets part of the business is 3 times as big as the scrap business, but the latter has better margins (recycling and extracting precious metals).

Envela kinda fell off a cliff since late July. (7,75 then vs 3,8 now)

They stalled in terms of revenue growth, but mostly they had to write off some bad debt from customers who weren’t able to pay back credit. Nothing dramatic, though.

The nature of the business makes Envela sensitive to economic upheaval.

In 2016, after recently celebrating its 50th anniversary, it was named by S&P Global Market Intelligence as the second most likely company to go bankrupt, behind Sears Holdings - AR 2022

Since then current CEO and majority shareholder John Loftus stepped in and turned the company around - leading to a string of profitable years and great growth numbers.

The direct-to-consumer has an online component, while the brick-and-mortar part of the business is mostly around Dallas, only recently expanding to other areas.

In September 2023 they announced the acquisition of Steven Kretchmer Jewelers, a jewelry manufacturer, for an undisclosed cash amount.

we are still in the early stages of expanding our store footprint. We aim to elevate our brand and create something extraordinary, and we strongly believe that we have only scratched the surface of what we can achieve,” said John Loftus. (HY 2023 Results Press Release)

Indeed, the footprint of Envela is still quite small. There is a plan to …

double its retail business in the next two years - press release, April 2023

There have been some buybacks and (minimal) insider buying.

The Envela line of businesses requires some expertise that is not easy to copy. Their own history is witness to that.

It also seems like they know very well where their brick-and-mortar locations can grow some footing.

The scraping of precious metals from outdated IT equipment is exactly what company does Mr Mimetic has been following closely for over 10 years: Umicore (market cap 5 billion €)

Great company. Hard to copy. Also got a beating (-33%) this year….

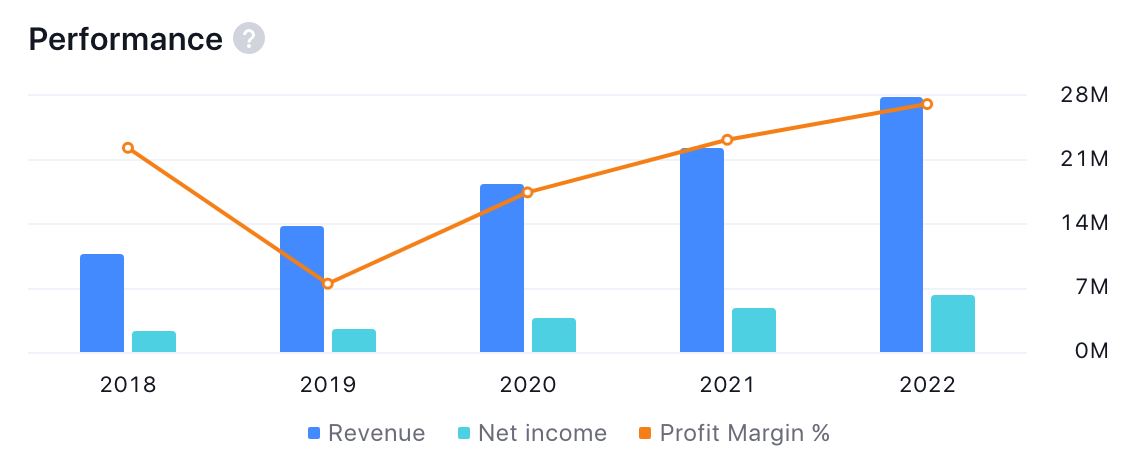

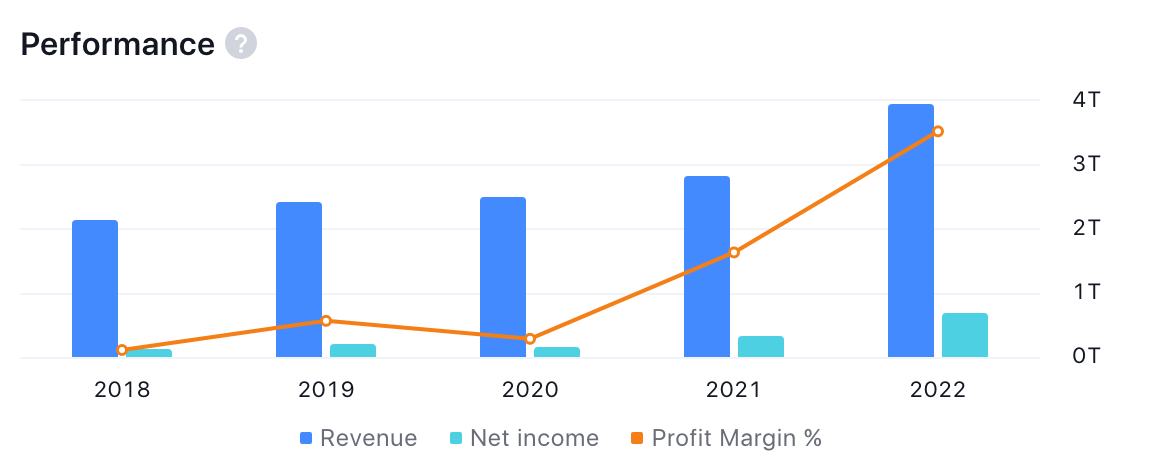

Can Envela become 4 times bigger in 5 years’ time, like they did between 2018 and 2023? Can they keep expanding margins? Can they hold on to their good ROIC? Can you buy it now at 1x the future total 2028 à 2030 EBITDA?

Mr Mimetic thinks so.

the second-hand luxury market is expected to grow at 19.61% annually until 2027 (from $444 million in 2021 to %1.3 billion) - Statista

the electronic recycling market is expected to grow at a CAGR of 14.2% globally until 2032, according to Allied Market Research

Now, those growth numbers might be overly optimistic. Besides, Envela doesn’t need the market to grow, they only need to gain market share.

Key points to track will be: can Envela grow its brand enough to compete with the legacy luxury brands when those step up their second-hand game? And: can they find enough qualified expert staff to fuel their growth plans?

Although there are some macro risks, Mr Mimetic thinks the good outweighs the bad. We might -indeed- only be in the early innings when it comes to Envela…

Now, will they pass the 9-step hurdle to be admitted to the Mr Mimetic Fox Fund?

IN CONCLUSION

Narrowing it down from hundreds of companies worldwide to a handful proves to be an efficient strategy for turning over rocks and looking at what is beneath them.

Mr Mimetic must admit the strategy is more methodical, but a little bit less fun than when you start from a problem that needs to be fixed.

All of a sudden, Mr Mimetic has a lot of themes to chase:

The duel of the Value Added Resellers.

An evaluation of the short list of the companies that kept on doing well, after their 2015-2020 winning streak. (cf The Matthew Effect)

Mr Mimetic is interested in looking for education companies in countries with favorable demographics (The Mr Mimetic Fox Fund already has a Brazilian specialized education company as a member in Afya)

“Enzyme Royalty” is a play that is comprehensible and promising enough to invite some wanderlust.

Yet, before going on that path, Mr Mimetic has one more thing to do. Mr Mimetic noticed that one region in the world was over-represented in our screening results. So, Mr Mimetic bundled those companies together in…. part III of the “Screening for Our Next Winner” trilogy.

Including one company Mr Mimetic really likes.

Kind Regards,

Mr Mimetic

If you like this post, you may want to click on the like button or share it with your investing friends and acquaintances.