This company increased its income fourfold in just 4 years, with no end to the growth-curve in sight. Yet now you can buy it for half the price.

We are still on a quest to identify the best performing stocks of the next 5 years. Have we found one?

Mr Mimetic has turned so many rocks in the last couple of months to identify a stock that could be part of the 1% best-performing stocks in the coming next 5 years, that his fingers are blistered and sore. Hélas, for the longest time we couldn’t find a prince or princess we fancied.

To serve your memory, Mr Mimetic identified 9 ingredients a stock should possess to combine in a recipe for success (stolen from a research report by Alta Fox Capital).

GROWTH. The earning power should rise and rise at an above-average rate.

EXPANSION. With rising revenue, margins should improve.

STRENGTH. The business should be hard to replicate or the space they hold in their customers’ hearts and souls should be hard to enter.

START SMALL to finish big. If you could invest in Rookie Michael Jordan or Peak Michael Jordan, where would you invest? A lot more is to be made by riding the wave with Rookie MJ.

OWNERSHIP. All accounts point towards the advantage of founder-led or owner-controlled companies as better stewards of capital.

HEALTH. To finish first, you have to first finish. Some debt is helpful, but overstretching out of greed is not.

BUILT to build. Acquisitions are hard to pull off but are a money-making machine when done with wit, long-term perspective, and common sense. Decentralization seems to be the best modus operandi.

X-FACTOR. An advantage that makes you stand out of the crowd, and keeps you a step ahead of the competition.

PRICE perspective. Cheap relative to growth and future earnings. This can mean: pay up now, to be rewarded later.

One way or another, we stumbled upon mostly frogs.

Mostly frogs, but not all. Some were too expensive, some were overleveraged, some were not defensible, and some were outside of Mr Mimetics’ limited circle of competence.

Mr Mimetic changed his approach somewhat and started to look at business areas with hidden potential, ending up looking at venture capital, niche roll-ups, marketplaces, and education.

You can expect some write-ups in the next couple of weeks on those.

But for now, we’ll start counter-intuitively with a genuine melting ice cube: education.

MEDITATIONS ON THE FUTURE OF LEARNING

Why is education a melting ice cube?

As a shareholder of Graham Holdings in his personal portfolio, Mr Mimetic could hear Andy Rosen (the CEO of Kaplan) utter these words during the Graham Holdings Shareholder Meeting in May 2023:

The US has seen a decade-long decline in college enrollment, with demographics suggesting that will continue for at least a decade to come. That means less competition for entry to US institutions, but more competition by institutions for students.

- Andy Rosen, CEO of Kaplan during Graham Holdings Shareholder Meeting, May 2023

It seems like the point of maximum pain when it comes to tuition fees might be reached. In the future, the power might shift back to the student, away from the institutions.

Mr Mimetic suspects education is ripe for a makeshift where institutions will no longer just provide you with a diploma in lieu of an obscene amount of money, trying to milk their students for a short amount of time.

Instead of the student investing in post-secondary education, Mr Mimetic can see a future where the educational provider will be the investor.

The thing they will invest in? Their students’ careers.

Why miss out on an opportunity to be lifelong rewarded for the value you can provide to someone brilliant? Especially when you can prove to them that they will make more money by paying you?

Education could and should be about enhancing the career of someone, lifelong, much as a sports agent invests time and effort in the career of a promising young athlete and receives some percentage of the athlete’s profits in return.

Mr Mimetic can see a future in education, where “schools” get paid in royalties based on income and where it would be in the interest of the education provider to guide and help their lifelong “students” towards better careers and higher salaries.

Actually, it’s a suggestion that was done in an alternate form by some rimpled old fellah, a while back:

Right now, I would pay a hundred thousand dollars for 10 percent of the future earnings of any of you. So, if anyone wants to see me after this is over ... (laughter and applause). If that's true, you're a million-dollar asset right now, right?

- Warren Buffett on a 90-minute CNBC Town Hall Event hosted by Becky Quick in 2009.

Instead of education being a location-based exclusivity, it might become a global commodity based on the student’s return-on-investment.

During the Graham Holdings Shareholder Meeting, Kaplan CEO Andy Rosen mentioned one particular word 9 times: “global”.

The future of higher education is largely GLOBAL. (….) The rest of the world (…) is looking at a dramatic surge in higher education demand, with projected growth of hundreds of millions of students in tertiary education worldwide over the next 15 years, mostly in Asia. That’s far more than existing universities can handle using traditional models.

- Andy Rosen, CEO of Kaplan, May 2023

Those who are able to engage students with a higher-than-average quality outcome, in territories where there is no network of traditional education institutions, might have a competitive advantage façe à façe the traditional institutions.

And those who are able to provide lifelong learning, at a reasonable price, might have a double whammy.

HOW IT STARTED….

We started with evaluating 26 listed public institutions.

Those located in China were eliminated, due to accounting and reporting insecurity.

Those who were above 2 billion US$ in Market Cap were eliminated, for being too big.

Those with a revenue or EBITDA CAGR over a 5-year period that was negative or quasi-flat were also eliminated since they violated the GROWTH-ingredient.

Following Mauboussin ….

The ROIC to WACC spread is a better indicator of valuation than any other widely used value proxy.

- Michael Mauboussin “Plus Ça Change, Plus C’est Pareil”

…we eliminated all companies where the Weighted Average Cost of Capital was higher than the Return on Invested Capital, Excluding Cash, Goodwill, and Intangibles.

After that exercise, we were left with 7 companies.

PERDOCEO was considered but swiftly put aside due to the multiple red flags, like false advertising, numerous SEC violations and fines, and the overall lack of integrity with management.

Of the 6 remaining companies, this is what the 5-year CAGR REVENUE and EBITDA/share look like:

All 6 had growing margins when measured as REVENUE-to-EBITDA during the last 5 years.

Actually, Companies E and F, which had the lowest growth, also had the lowest margins and also are unsatisfactory in terms of insider ownership.

...HOW IT IS GOING

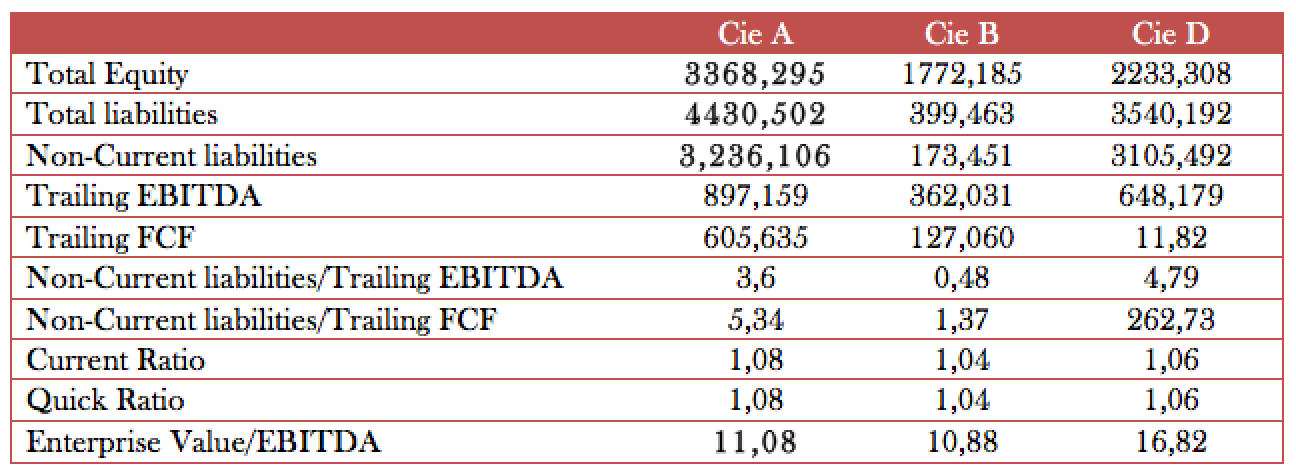

This is where we stand with the 4 remaining companies:

In terms of INSIDER OWNERSHIP:

Company A has the Bertelsmann family (owner of the RTL Group; a collection of “old skool” media assets in Europe) as controlling shareholders, next to the founders-operators. Together they own over 50%, with Bertelsmann a net buyer month by month.

Company B has the PSG Group as the controlling shareholder, with a holding of about 20%. PSG is a family-controlled (now) private holding with multiple assets across multiple industries in South Africa. The CEO has limited ownership, but insiders all together come in at around 30%.

Company C is more peculiar: it has a dual class of stock, where the founders control 90% of the voting rights through their ownership of B-shares, although their economic ownership is under 5%. The founders are the chairman and CEO.

Company D its founders control about 15% of the company.

All of them are CHEAPish (when measured according to the criteria conducted by Alta Fox Capital in their report):

Now, the fact that Mr Market rates them all 4 (which we can consider best-in-class by now) as rather cheap, might have something to do with the industry as a whole: education.

Are education businesses fragile for a competitive sweep?

BARRIERS TO ENTER

Obviously, Yale, Harvard, and Princeton will not be shy of full capacity when it comes to student enrollment for the coming decade.

And there are laws, and audits to consider if you want your program and diploma to be certified.

Still, if you’re not a household name? Then education is simply a commodity.

The obvious barrier to entering the education game before the internet was: location, location, location. You had to have buildings that can act as a campus.

That’s all gone now. When pressed, you can enroll from the comfort of your gaming-chair and never ever have to put on pants to get a degree.

So, education is fragile as a defendable business.

For one, Harvard can put up campuses all over the world, if they want to. Why would they not? Harvard in Shangai, Harvard in Tokyo, and Harvard in Mumbai. Why not? Recruit and train the smartest on every continent? Have spin-off campuses popping up like daffodils?

Or even recruit thousands of students online, for that “wonderful” Harvard-eduction?

“Language” used to be an issue, but no longer today. Every child and his mother is proficient enough in English thanks to Youtube and Netflix.

As of today even Mr. Mimetic can pay for and enroll in individual courses at University Level, do the exam, and get a certificate for that. Easy peasy.

Since education is a commodity you either have to have a Harvard-like Brand, either be the low-cost producer, or…

….master a niche, where technical, hands-on expertise is needed, preferably on-site.

Doctors need to operate. On humans. Vets need access to animals. Biochemists need labs.

So, although the space is fragile to competition, how or our 4 remaining musketeers faring in that aspect?

COMPANY A

Company A is specialized in medical postsecondary training. For students and practicing doctors or other medical professionals alike. They are based in Brazil, where there was a 5-year window that limited the licensing of new institutions that could offer this type of course. That window has now opened, and other institutions can now apply to give those technical niche courses as well.

You do need to have a great network of hospitals that can act as a training ground.

Company A should be able to handle this new competition: the education market in Brazil is still underdeveloped, and it’s a huge market with enough space for multiple offerings that can compete on quality and location.

And language is still an issue: if you can’t talk to the patients in their own language, you cannot have an effective education.

They are doing a great job at providing lifelong learning tools for a variety of medical professions, that can boost their income stream.

They have done 40 acquisitions to date and see opportunities to double their seats.

COMPANY B

Company B offers post-secundary education in 9 schools to over 30.000 students in South Africa. They give courses on-site, online, and blended.

80% of courses are online, 20% are on site.

They claim they acquired prestigious names in higher education, but that is hard to asses from far away.

Although growing nicely at 20% a year, and with margins improving, the numbers of Company B are the least impressive from our group of 4.

Actually, Company B is a spin-off from a secondary private school group in South Africa, that was long on Mr Mimetics’ watch list but was ridiculously expensive before margins, reputation, and growth numbers started to deteriorate.

Now, Mr Mimetic isn’t such a big fan anymore of private secondary school for the masses.

Since 30.000 is a relative small number of students, there is still a lot of room to grow.

Despite the relative underperformance of Company B, Mr Mimetic is a bit biased due to the majority shareholder (PSG Group) and likes to keep Company B on board for consideration into the Mr Mimetic Fox Fund. Just a little bit longer.

COMPANY C

Also based in Brazil, this company has great numbers but serves schools before post-secondary education, with technology and platforms.

Mr Mimetic thinks the spades and shovels for education are even more commoditized than straight-out schools.

Growth and margins are more scattered and are not following a nice consistent upside trend.

Mr Mimetic thinks investment needs will be high in this space, to keep up with AI personal tutors and the like.

The biggest issue is with the alignment between management and minority shareholders, though. The Class B situation where the founders have all the voting power, without having the economic power doesn’t sit well with Mr Mimetic in terms of integrity.

Based on that, Company C will no longer be considered for inclusion in the Mr Mimetic Fox Fund.

FYI: they are called Arco Platform and you can find them here.

COMPANY D

Company D is also based in Brazil, and they moved into the space where Company A was the obvious winner, through a merger.

Growth numbers are inferior to those of Company A, but margins seem better. They are more digitally oriented than Company A, which might explain that.

They claim the barriers to entry are high due to physical hubs, that provide in-person weekly interactions with tutors, which gives them an advantage over pure digital offerings.

Let’s keep them around.

This gives us:

HEAD TO HEAD

All 3 companies did acquisitions; all seemingly at a reasonable price.

How far are they stretched? Can they continue on this path to fund future growth? Or are they playing a fool’s game: competing for students in their seats, and sacrificing their bottom line to do so?

All 3 are doing alright. You typically see management tries to keep it under 3x EBITDA, though. So, although slightly elevated, this amount of debt should be easily financed with future growth. No worries there.

Company D is narrowly at a disadvantage when you would sum it all up.

Company B is front-running when it comes to financial health.

Where will come down to? Who will make it to the Mr Mimetic Fox Fund?

It all comes down to…

THE X-FACTOR

Or Competitive Advantage.

When reading the presentations, the annual reports, the ITV’s, and the conference calls you do have the feeling that Company B is still more old skool in its approach., despite having 80% of its courses online.

They admit South Africa is struggling and affordability will be a major factor.

They see an 8% growth in student year after year by adding new courses and ultimately new locations. For them, the path to 100.000 students is clear, without external capital.

Growth in students should improve margins, or the infamous flywheel effect. Steady she goes.

Mr Mimetic likes Company B for its vision, but doesn’t like the dividend; when there is an opportunity for re-investment 100% of profits should be re-invested in growth. Dividends are not a great capital allocation decision when growth is still feasible.

For this, we will not incorporate Company B in the Mr Mimetic Fox Fund, but will keep it on our watchlist.

Company B is called STADIO HOLDINGS. And you can find them here.

(Incidentally: not a great website, for an 80% online school….)

Company D could show off the results of the merger in Q1 2023:

This resulted in a margin expansion: “Adjusted EBITDA margin reaching 37.9% in 1Q23 vs 26.7% in 1Q22”

To be fair, growth numbers before the merger were also not that shabby:

They will buyback 500.000 shares on 33 million outstanding shares, which is about 1,5% of outstanding shares.

But all in all, the vision is a bid…muddy. As the presentations are. A lot of different types of info on one slide. (Not a pleasant visual experience)

The merger seems like a good idea, and they talk about all the financial gains the synergies will bring, but Mr Mimetic wonders if they don’t have a two-headed beast to manage.

Since decentralization seems to work best when it comes to acquisitions and mergers…are they not overdoing it? Killing valuable culture in the process?

All in all, a bit early in the game for Mr Mimetic, who first wants to see this one roll out a bit further.

Company D is called VITRU, and you can find them here. They have every chance to be a wonderful company in the future, but it is just not clear as day at this point in time.

Compared to…

…when you look at the communication of Company A, the vision is clear as water.

They are laser-focused on the medical profession. And you can see the value they provide: how their students fall in the 1% of best salaries, how there are 7 candidates for every seat available, how they can help general practitioners by training them as specialists to boost their income, self-esteem, and motivation…

The vision is clear, insightful, and focused on delivering added value for their “customers”.

The real X-factor might be the capital of Bertelsmann and Softbank behind closed doors to fund future growth. Therefore Mr Mimetic thinks he has to choose for…

…AFYA as a new addition to the Mr Mimetic Fox Fund.

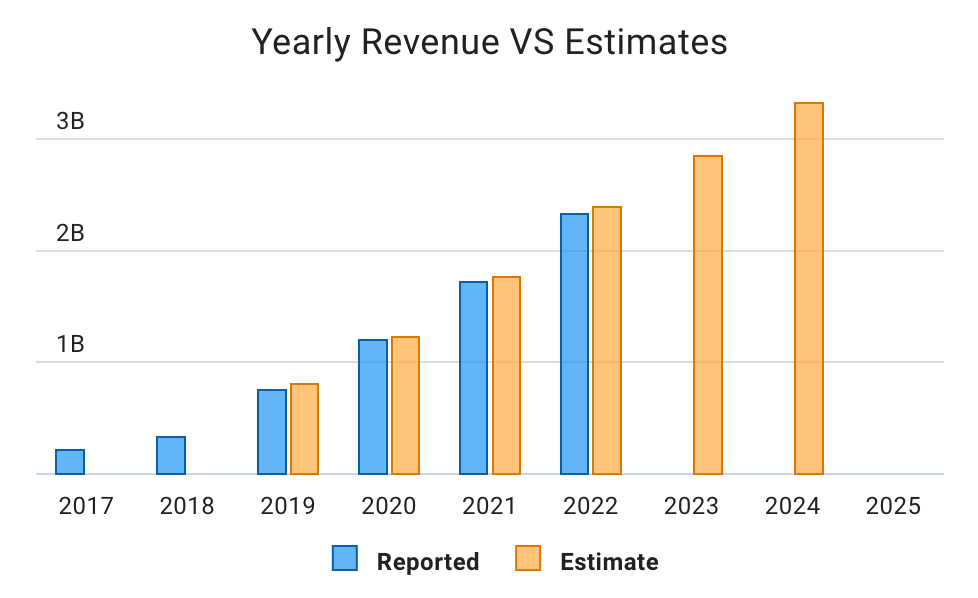

While earnings did this:

The stock price did this:

This might be due to inflation, the end of cheap capital to fund growth, and the changing legal context in Brazil, but Afya is able to counter those.

Mr Mimetic is confident they will be able to counter other problems in the future as well….