The Matthew Effect. Revisiting the original "Makings of a Multibagger" report: which outperformers are still outperforming? And will keep doing so in the future?

In a quest to find the best performing stocks of the next 5 years, we look at companies who did it all before. Do they have the golden recipe for value creation?

Read our preamble to check out our investing philosophy.

Mr Mimetic is pretty sure he once heard Tom Gayner of Markel say on a call that the way to hunt for bargains in the stock market is to look for stocks that are at an all-time high.

Or something to that effect: you want stocks with a continuously rising share price, as proof of the underlying economies that fuel that rise.

(Mr Mimetic did a search through his notes, but couldn’t find the exact quote or source. Mr Mimetic has owned Markel since 2014, so that’s a lot of notes to go through. Apologies.)

What matters is that Mr Mimetic did make a mental note, at that moment, at that time: “Look for all-time high stocks, to find value.” A fascinating thought.

It seems such a counter-intuitive thing to do. Surely enough, when you want to find bargains, you would be better off looking for stocks that are at an all-time… low? Don’t you want the gap between e.g. book value and share price to be as big as possible? For then the gap to close, making you wealthier in the process?

Not really, says Tom Gayner in his 2015 Google Talk:

“I moved from spotting Value to spotting the Creation of Value. Instead of firmly believing that something is worth (a certain price), I’m now asking myself: Well, what will it be worth next year? And the year after that? And the year after that? And the decade after that? ”. - Tom Gayner

Instead of focusing on stocks that are statistically of Value; you look for companies that are able to enhance their intrinsic Value over time, so the price you pay now is cheap compared to the intrinsic value of the company in the future.

This is closely related to “The Matthew Effect”, more commonly known as “cumulative advantage”. The Matthew Effect can best be summarized as:

“Winners keep on Winning.”

Once a company knows how to outperform, it might as well repeat that behavior in the future.

That’s why, as a private investor in the stock market, it pays to not sell your best stock picks. Don’t trim them down. Don’t take any profits. Why? The top-performers you already have are your single best chance to have future top performers.

Spotting a true winner is really hard. So when you find one? Let it run and run along with it. And never let go.

BACK TO THE ROOTS

So, Mr Mimetic went back to the report written by Alta Fox Capital, called “The Makings of a Multibagger”, which analyzed the best-performing stocks between 2015 and 2020.

This report inspired the investing criteria for the Mr Mimetic Fox Fund.

The idea is to find out which companies mentioned in the selection of 105 best-performing stocks before 2020 are still in full force today - maybe on their way to making it to the list in the coming 5 year?

Since most companies on the list were quite small, it might still be early innings for them when it comes to future performance. Who knows?

Let’s find out.

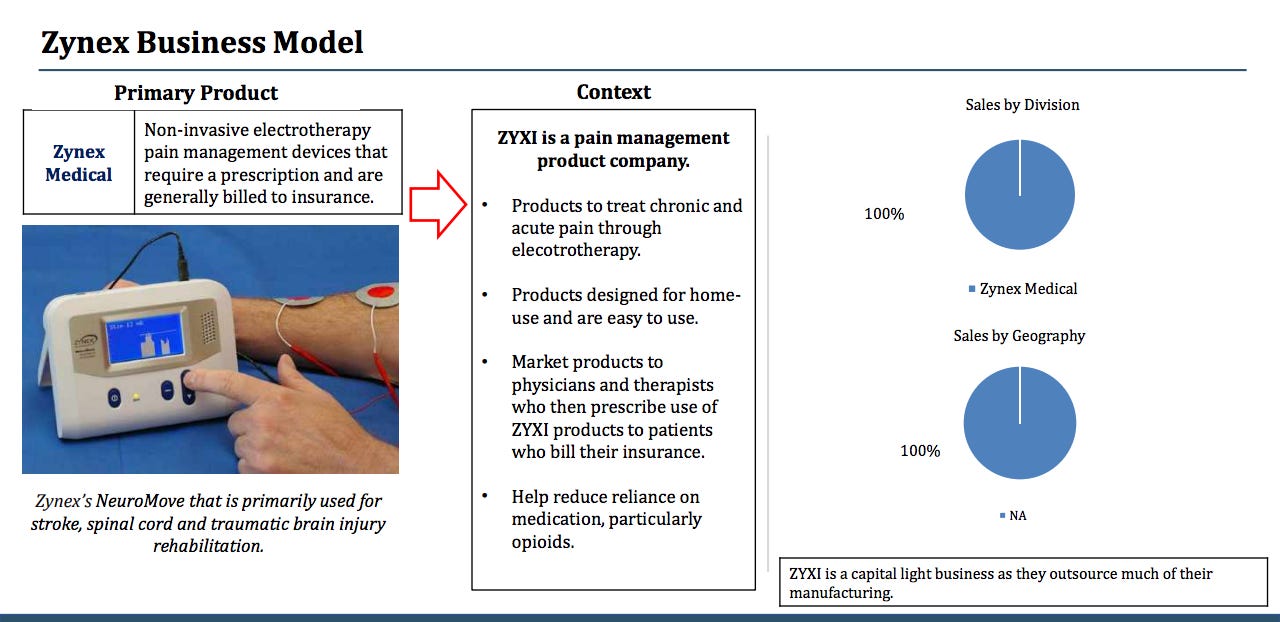

In discussing each company, Alta Fox Capital covers 5 topics:

a performance overview, including a short pitch of the company.

a description of the business model

a competitive analysis

What investors missed:

and a scorecard, summarizing their opinion on the company and its future

As a shortcut for turning over rocks himself, Mr Mimetic decided to take a closer look at the companies in the list that had a score of at least 4.5 on the scorecard (in their words, a “great business”), but are still trading under 2 billion in US$ market cap.

The reason for the 2 billion threshold is that 85% of the companies on the list started off under this seemingly magical number.

So:

What companies scored at least 4.5 out of 5?

What cies are still under a 2 billion US$ market cap?

This exercise resulted in 17 candidates.

THE LIST

Mr Mimetic was totally surprised to find only one company based in the US on this list. When Mr Mimetic counts the Scandinavian countries or the so-called Nordics he counts seven out of 17. 4 in Norway, 2 in Sweden, and 1 in Denmark. (Whatever did Finland wrong, you might wonder?)

4 companies are part of the Euro-zone, as you might expect, 2 from Great Britain, and 3 from Australia.

Asian, African, and Latin American stocks were not included in the original study by Alta Fox Capital.

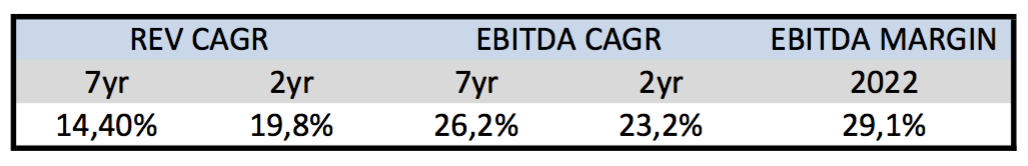

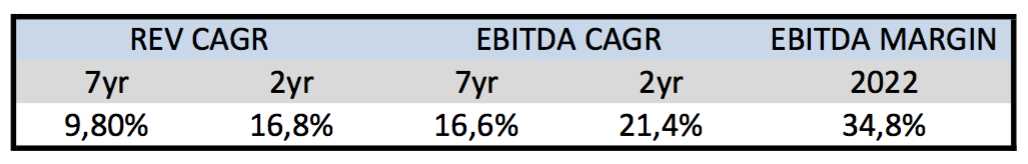

The next thing to do is to make a short snapshot of each company, in terms of performance. Did they grow revenue since 2020? Did they grow EBITDA? (EBITDA is used as a short-cut, not as a means of sure-shot economic value) What are the current multiples?

Here is that snapshot:

There is a lot to digest right here.

Mr Mimetic has highlighted some particularities with different colors.

First, BLUE means the stock price now is lower than in 2020. This is the case for a stunning 11 stocks out of the 17. In all cases but one this is due to contracting multiples.

No matter what, the price you pay is the best predictor of future performance.

Mr Mimetic is by heart a Deep Value Investor who likes his stocks on the cheap (and his companies on a growth trajectory nonetheless); there is this lingering feeling the people at Alta Fox Capital were a bit too generous when handing out adequate multiples in their report:

“If we were to screen for future multi-baggers, we believe the following criteria would return the highest percentage of success (…): companies trading below 3x NTM Sales, 20x NTM EBITDA, and 30x NTM PE (…) These leave room for multiple expansion.”

- Owen Stimpson, Max Schieferdecker & Elizabeth DeSouza (= the authors of the report)

NTM means the Next Twelve Months of Revenue. Mr Mimetic has been using Trailing or the Past 12 months instead.

Even so, we can see that in 2015 all the companies but 2 started out with a gigantic advantage of an EV/EBITDA multiple under 12. This means you set yourself up for a so-called Davis Double: not only will the company grow its revenue and income, but the stock is also more likely than not to gain traction by expanding multiples.

Mr Mimetic wonders if a stricter discipline in that regard wouldn’t be a great addition to the criteria for acceptance into the Mr Mimetic Fox Fund.

Mr Mimetic is totally fine with a concentrated portfolio with higher optionality, compared to a more diversified portfolio with a higher level of contraction risk.

About those 17 stocks: you all wanted to catch them in 2015, only 6 of them in 2020. Even worse, only 3 of them had an inspiring rise in stock market price between 2020 and now: Kitron, Invisio, and Atoss.

We’ll look for the reasons behind that a bit later.

Second, GREEN in the table indicates that EBITDA has grown slower than revenue. Our ideal scenario is to find a business where any extra revenue adds relatively more money into the coffers of the company than the aforementioned growth in revenue. If this isn’t the case this signals contracting margins: less profit per unit sold.

Third, Mr Mimetic colored those squares YELLOW which need further inspection because the numbers duck the trend and contracted. If this would be a temporary problem (Covid e.g., or heavy investing) there is value to be found. If not, the growth scenario was too rosy or the moat or competitive advantage wasn’t that strong anyway, in hindsight.

Now, the very next thing Mr Mimetic wants to do is to find out which company had expanded margins and which company had contracting margins. The hypothesis here is that margin contraction might be a great indicator of future decline in share price.

Let’s have a look:

THE GRAVITY OF MARGINS

Numbers are RED when they are smaller compared to the previous collum. In other words: red is bad, because there is less relative profit.

GREEN labels those companies with disciplined expanding margins since 2015: ChemoMetec, Genovis, Ivu Traffic, Mensch und Maschine and Yougov. The benefit of the doubt is granted to Biotage and Medistim (only the Trailing Twelve Months margin is contracting).

Mr Mimetic hypothesis suffers immediate defeat: contracting or expanding margins doesn’t predict which stocks have higher share prices now versus in 2020.

Something else must be going on.

So, let us compare how they have grown recently versus how relatively cheap they are:

Again: only Atoss, Invisio, and Kitron were able to show nice gains in share price since 2020. But growth cannot explain this (especially versus other companies with decent growth). Only the high multiples can.

Remember, we were planning with this exercise to find companies who deserve a place in the Mr Memetic Fox Fund. The researchers at Alta Fox Capital all deemed these companies as “great” in 2020 with thumbs up in terms of moat, competitive advantages, and growth prospects.

Therefore: let’s check which companies have reasonable multiples, expanding margins, and highish growth (> 15% per year).

THE SHORTLIST

Of the 105 best-performing stocks between 2015 and 2020, only 5 make it on our shortlist. That is not the outcome Mr Mimetic could have predicted. Mr Mimetic was thinking that maybe 20 or so would make it this far.

One conclusion can be that The Matthew Effect is harder to establish than commonly thought.

It’s actually very hard for winners to keep on winning.

Now, GENOVIS is just too damn expensive, but will be put on the watchlist.

These or the 5 remaining candidates:

BIOTAGE

“BIOT provides technologies and solutions for separating molecules and synthesizing chemical substances. BIOT’s customers include pharmaceutical companies, biotech companies, and academic institutes.”

Biotage has a leading niche market share, patents, regulatory barriers, reputation, technological expertise, and multiple avenues for growth.

EV/EBITDA 22,5

CHEMOMETEC

“headquarter in Allerod, Denmark, designs, develops, and produces instruments for a range of applications in cell counting and evaluation.”

operates in a strict regulatory environment, relationships and reputation take money and time to build, their tech provides their customers with a competitive advantage, good service, patented technology, and tailwinds for immunotherapies globally.

EV/EBITDA 21,2

MEDISTIM

“a Norway-based company engaged in the provision of medical equipment and technology. It develops, manufactures, and distributes medical devices primarily for cardiac and vascular surgery.”

82% market share, only 4 in 10 surgeons use the quality checks Medistim provides (in 2020), regulatory approval is tedious, clinically proven tech, patents, the world market is largely untapped.

EV/EBITDA 21,9

MENSCH UND MASCHINE

“a leading supplier of engineering software, such as Computer Aided Design, Manufacturing and Engineering, Product Data Management and Building Information Modelling/Management solutions.”

leader in fragmented market in German-speaking countries, mission-critical software, high switching cost, highly specialized niche products, reputation, globally big competitors + mature industry prevent above-average growth.

EV/EBITDA 13,7

YOUGOV

“an international research and data analytics group based in London, UK, that helps companies, governments, and news outlets gather actionable data for decision making.”

market research has NO barriers to entry, a worldwide panel of 9,5 million participants, high reputation, increasing reliance on data for decision-making in years to come, a great incentives plan.

EV/EBITDA 12,8

Who will make it to the Mr Mimetic Fox Fund?

It’s a bit early for that. The numbers have been crunched, the data are clear, but now is the time for Mr Mimetic to dive into the 10Ks, the presentations, the ITVs, the industry publications, the articles, … to get a few more data points to see which one is an actual fit for the Mr Mimetic Fox Fund.

As always we will use our 9 criteria checklist as a guide. Equally as always we will keep you informed whenever one of these companies makes it to the Fund.

Thank you for reading. Much appreciated.

Kind regards,

Mr Mimetic

If you like this post, you may want to click on the like button or share it with your investing friends and acquaintances.

SOURCES

Tom Gayner’s Google Talk “The Evolution of a Value Investor”

The Matthew Effect or cumulative advantage

The Davis Double Play in a Focused Compounding Letter.

The original Alta Fox Capital report: The Makings of a Multibagger.