Results are in. Should we add to our positions?

Plus: some additional criteria for our 9-step hurdle.

Whenever a company in the Mr Mimetic Fox Fund can pass the 9-step hurdle on the date of their yearly results (while being part of the Fund for a minimum of 6 months), there will be additions to the position - again for the equivalent of $1000.

Three of our holdings are over 6 months in the Fund and have FY results out.

To remind you: the goal of Mr Mimetic is to find stocks that will be part of the 1% best-performing stocks between 2023 and 2028.

Mr Mimetic was inspired to do so after reading a report by Alta Fox Capital analysing the best-performing stocks between 2015 and 2020:

“The Makings of a Multibagger. An Analysis of the Best Performing Stocks over the Past 5 Years.” - by Alta Fox Capital.

In that report, there was an attempt to summarize common traits between all 150 or so best-performing stocks.

These common traits inspired a 9-step hurdle any stock would have to be able to pass to be considered in the Mr Mimetic Fox Fund.

To summarize the 9-step hurdle:

Small: only under US$ 2 billion market cap stocks are considered.

Growth: are they growing like cabbage? 15% per year is considered a minimum, in terms of revenue. 25% is preferable.

Financial Health: are they easily able to repay outstanding short-term and long-term debts? What is the ratio between debt and profits? What is the Quick and Current Ratio?

Cheapish: defined by the Alta Fox People as…

3x trailing Sales OR 20x trailing EBITDA OR 30x trailing PE

Acquisitive: when all growth is organic, that is fine - but almost no company with sustainable highish growth has done so without acquisitions. An exception might be a company that opens new locations where there are none. It comes down to great capital allocation, to add value long term.

Margin Expansion: is growth leading to efficiency advantages? In other words: are profits growing faster than revenue? Exceptions are possible.

Insider Ownership: although not part of the Alta Fox Report, this is something Mr Mimetic has a hard time neglecting. Who is looking out for the company? A hired hand? Or somebody who lives and breathes this company?

Barriers to Entry: it shouldn’t be easy to compete with the company. So, restaurants or food items or a new beverage will not likely turn up in the Mr Mimetic Fox Fund. The industry or business model should have some sort of natural defense built in.

Competitive Advantage: This is the hard question. What makes them special? What makes them not easily copyable? What Mr Mimetic really wants to figure out is: are growth and margins sustainable?

Mr Mimetic’s 9-step hurdle rate has been improved a little bit since the inception of the Mr Mimetic Fox Fund in January 2023:

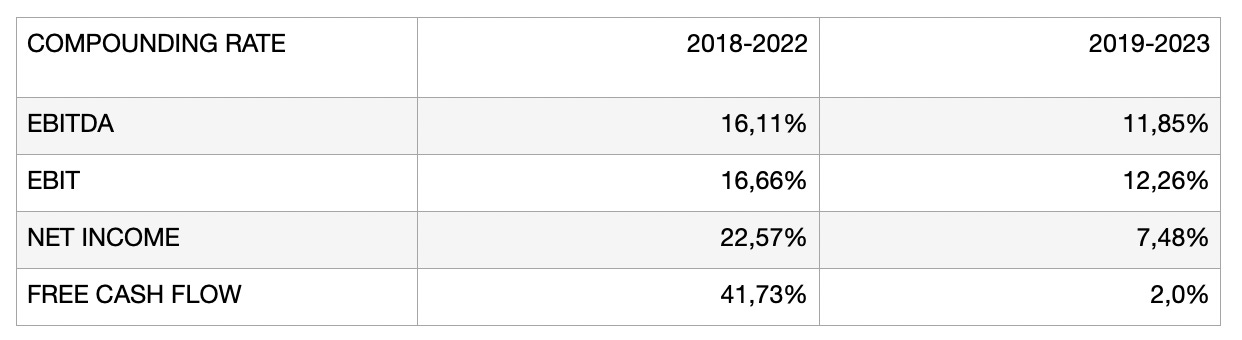

2bis. Compounding Rate. Mr Mimetic looks at the 5-year Compounding Rate of all income lines (EBITDA, EBIT, Net Income, Free Cash Flow) as a better proxy for growth. Not only on the basis of incremental invested capital, but also on incremental capital employed (which is kind of the same, but different).

4bis. Multiples. Mr Mimetic considers 15x EV/EBITDA as a hard-to-cross upper bar in terms of cheapness. Mr Mimetic also considers the Mr Mimetic Fox Score, calculated as “(EV/EBTIDA)/EBITDA Compounding Rate” as an own proxy version for the PEG Ratio.

Addressable Market. Mr Mimetic also considers to include a “distance analysis” in what would be the new 10-step hurdle: how far can this company go? How much growth is reasonable? Ideally, Mr Mimetic can envision a path where the company becomes 100 times bigger. If not, a path to growth of 10x versus the position now should be easily on the table.

WHAT ABOUT RCI HOSPITALITY?

What Mr Mimetic Likes

What Mr Mimetic Learned

What Mr Mimetic Doesn’t Like

To summarize

Post-Mortem on the Initial Position

When will Mr Mimetic be wrong?

Serial strip club owner RICK’s was the first holding in the fund.

Here is the original write-up:

What has happened since?

Down 32%.

Was it a mistake to add RICK to the fund?

What Mr Mimetic likes about RICK:

Around 60 locations on a total of 4000 clubs in the US, whereof 500 they consider investible

natural barriers to entry: each club is a local monopoly through regulation constraints

supposedly recession-proof

competitive advantages:

first (and only?) operator to call when you want to sell your club(s) - they have the capital, and a quick decision process

strict security processes in place to reduce theft, fraud, but also possible difficult behavior by clients

an Outsider mindset: free cash flow oriented

acquisitions happen around 4 à 5 times EBITDA, but they are usually able to improve cash flow on newly acquired locations - which leads to very short payback times for acquisitions (typically only a couple of years)

looking to expand their market:

they want to start a franchise model with the Bombshell’s themed restaurants

they are building a strip club themed casino

At the time of the write-up, Free Cash Flow had grown over 10 years at 22% CAGR, margins were expanding, debt was very manageable (although an average 6% interest rate seems quite high).

What Mr Mimetic learned since owning the stock:

they earn 1 million in cash flow every week

there is a cultural shift going on around strip clubs: women and men go to strip clubs together (women make up a substantial part of the audience) and the vibe is that of a dance club where you go to dance and mingle and flirt and hook up

2022 was an exceptional year - there was the so-called “post-covid bounce” driven by the fact that the clubs were open sooner than the local bars and people had to go to the clubs to get their weekend beer

this made owners asking a sell price for their club at 2022 multiples. RICK management thinks this is too expensive and that is why they have seemingly paused acquisitions. So, they rather sit on their ass and do nothing than overpay.

management is no-nonsense and very communicative, very open. No bullshit corp-talk.

a location brings in 20% Free Cash Flow margins

same-store growth is (only) roughly 3% - in line with historical inflation, you might say

every strip club is a multi-million dollar operation in and of itself

the real estate was in the books at cost and they haven’t really made loans against the real estate (which might change in the future)

they time their buybacks based on the FCF yield of the stock

their priorities in capital allocation are: acquisitions/expansion ; paying back debt ; dividend

Mr Mimetic can easily see a trajectory where they own a bigger market share: 100 locations, 200 locations,… But also a path where another cash-rich operator swoops in to copy their model and makes the acquisition environment a lot more competitive.

Mr Mimetic can also see them expanding into other territories. Why not own Stringfellow’s in London? Or why not export e.g. the Tootsie’s Cabaret concept (voted “Overall Club of the Year”) to other locations worldwide?

So yes, 10x growth is on the table. There is quite some optionality to grow in expected and unexpected ways.

What Mr Mimetic doesn’t like:

Same store sales were down.

The acquisition pipe line has dried up a bit, although management assured there will be new acquisitions in the new year. Managment is seeing other operators having a similar though year as RICK but without the cash cushion to weather the pain. So they are kinda forced to sell. RICK is appraising the value of the real estate to take on a credit line against their hard assets to have a war chest for acquisitions.

Military themed restaurant chain Bombshells seems a deworsification at the moment; although Mr Mimetic can understand the rationale of building a franchise model and can appreciate the flexibility to experiment with new income streams. The CEO seem to agree since they are exploring “strategic options” for joint-ventures or a sale of the Bombshell brand.

Should they not be laser focused on their core business?

Politics and Religion have become more and more intertwined in the US, so the risk of a ban on adult clubs is growing. It is certainly not nonexistent.

Return-on-Capital-Employed is only around 15%

2022 distorted the view of the company. 2018-2022 Compounding Rate came in at around 15% to 20% and 10-year FCF CAGR at 22%, but it seems that was exceptional. Around 10% to 15% growth seems to be the norm going forward.

The EV/EBITDA multiple is a very reasonable 10,07 at the moment. The Mr Mimetic Fox Score however is 0.85. Which is not high, but not super cheap either.

The Mr Mimetic Fox Score is calculated as (EV/EBITDA)/Compounding Rate

To Summarize

It comes down to this:

Mr Mimetic likes the company a lot, but at the moment RCI HOSPITALITY is not on track to become one of the best-performing stocks between 2023 and 2028. Mr Mimetic can easily see a future where RICK grows at a 15% rate. It’s a bit harder to see a 20% Compounding Rate, yet a 25% or 30% rate seems off the books.

Acquisitions would have to ramp up dramatically to make it so. And/or margins would have to improve quite a bit. Will they? That’s as good a guess as any.

The verdict? For a 10% à 15% compounding stock, RICK is a tad too expensive at the moment.

So, regrettably, Mr Mimetic will have to decline to add to the existing position.

Post-mortem on the initial position

Was it a mistake to add RICK to the fund?

Mr Mimetic has neglected to see that the 2022 numbers were outliers, not a trend.

Although the business model of a serial acquirer with local monopolies is a really good set-up, the returns on Capital Employed and the Compounding Rate are structurally too low to be a 1% kinda business.

Therefore, Mr Mimetic shouldn’t have bought RCI Hospitality, especially not at those prices.

When will Mr Mimetic be wrong (again)?

When acquisition volume ramps up dramatically and margins start to expand or returns on capital employed start to grow, maybe because Mr Mimetic underestimated the tsunami of acquisitions coming in, or the returns on Bombshell franchises, or the income streams from a potential Adult Casino (chain).

When the overall market goes into a recession and RCI Hospitality will be protected by its local monopolies and appetite for its product and services. During that recession RICK will probably be able to gain market share. Maybe at a pace that makes it a 1% stock anyway…

So to be clear:

RCI Hospitality will not be sold (as per the rules of the Mr Mimetic Fox Fund) & will be re-evaluated anew next year for a possible addition.

So, what about OneWater Marine & MarineMax?

Here is the original write-up:

Although there are enough differences between both companies, Mr Mimetic will look at them in sync, since they play almost entirely in the same industry, albeit partly in different segments.

Marinemax concentrates a bit more on high-net-worth boating and owns more harbors in and of itself. Nevertheless, Mr Mimetic considers them as twin stocks.

Mr Market also seems to think of them as such:

Not bad, not great.

The following questions will be addressed:

What Mr Mimetic Likes

What Mr Mimetic Learned

What Mr Mimetic Doesn’t Like

To summarize

Post-Mortem on the Initial Position

When will Mr Mimetic be wrong?

What Mr Mimetic Likes:

the natural monopoly of harbors; buying a boat is location-based

the dedicated fan base of the industry; boating is part of an identity that you will not easily give up and/or will return to when it’s financially possible

12% of American households own a boat, but the market is growing as more people want to live near water

the fragmented nature of the business: a lot of mom&pop stores, that have no succession in place

boating is maintenance-heavy; things break down and wear out. The water is brutal for equipment. So, you will always return to their shops for one thing or another.

the economies of scale effect for inventory and more pieces per square meter in the stores: once they buy a mom&pop store, they can improve on the sales-per-square-meter or the dollar-per-costumer quite easily

OneWater and MarineMax own together about 10% of the dealerships in the States. Both can grow 10 times bigger over time.

International expansion is on the table.

Synergies are possible between owning a Marina, a repair shop, and a dealership.

both companies outperform the growth numbers of the industry

the price of the stock; both companies seem cheap enough

inflation is easily transferred to the customer

the pause in acquisitions; capital discipline is more important than a straight line of growth

management of both companies is optimistic about the future; they see the harder sales climate as an opportunity to gain market share (which was the principal investing thesis of Mr Mimetic all along)

What Mr Mimetic Learned:

inventory is really important. Mr Mimetic knows a few people who own retail shops and it is indeed a returning concern: inventory management. For most mom&pop stores it’s an art, for OneWater and MarineMax it should be data-driven. OneWater stressed a lot in their end-of-year conference call how they have a lot more of the new 2024 inventory available, which should give them an edge.

inventory clouds the acquisition climate. Smaller dealerships built up inventory during the Covid-boom in the boating business, but are now stuck with a lot of old inventory but are still looking to get paid for inventory - but that is off the table since old inventory sells really bad.

the difference between a network of mission-critical location-based stores (like Pool Corp, who deliver equipment to pool builders and pool maintenance crews) and a network of leisure stores. It’s not quite the same.

any additional sales per location do a lot toward margins

Mr Market is short-term correct in depressing the stock price of both companies; the industry saw an inventory-problem and a slowdown in demand

both companies speak about healthy balance sheets and a low ebitda-vs-debt multiple. This is not apparent in the financial statements.

Our liquidity position remains strong. At year-end debt-to-EBITDA net of cash was less than 1. - MarineMax

We are comfortable with our liquidity and leverage position. Net debt to adjusted EBITDA ratio is 2.2x. - OneWater

Both have almost a billion in total debt. This seems like a multiple in the range of 5 to 10 times last year's EBITDA. Most of that total debt is current, though.

This is important since they will need enough dry powder to pick up single stores that have a hard time navigating a tougher environment.

And it’s important since you want them to be able to pay off debt handsomely.

What Mr Mimetic Doesn’t Like:

the deterioration of margins, as illustrated in the ROCE or Return on Capital Employed

negative “cash from operating activities” for both. This has to do with a write-of in inventory value

the communication by both could be more frank

the debt levels are borderline

“adjusted" EBITDA aka “bullshit earnings” (dixit Mr Munger)

The Compounding Rate on a 5-year basis of both has fallen back to around 15%, coming down from 30%

To Summarize:

Mechanically, both companies fail the test. There is red and orange, so the “rules of the fund” are not met:

Whenever a company in the Mr Mimetic Fox Fund can pass the 9-step hurdle on the date of their yearly results (while being part of the Fund for a minimum of 6 months), there will be additions to the position - again for the equivalent of $1000.

Same-store sales were mostly flat, with less traffic versus higher prices. Inventory write-offs hurt the bottom line.

Both companies did, however, quite better than the industry.

Telling is that the Compounding Rate still hovers around 15% in what seems to be a tough time for the industry and the companies.

Might these tough times still continue for a while? Yes.

Are both companies best placed to profit from those tough times? Also yes.

Will margins and Compounding Rate improve in the coming 5 years? Yes.

Will they gain market share? Yes.

Will their sales mix evolve toward higher margin items (like maintenance or the higher net-worth segment)? Yes.

So we are looking at a moment in time where growth and valuations are both depressed. Mechanically, Mr Mimetic shouldn’t add to the position? Right?

Rationally, however, it is the best time to invest. Mr Mimetic believes that both companies have all the ingredients in place to improve ROCE, same-store-sales, acquisitive expansion, control of the debt position, and thus Compounding Rate in the next 4 à 5 years.

Which should lead to the double whammy of EV/EBITDA multiple expansion.

Mr Mimetic also believes they can grow to be 10 times bigger in the future and that a 15% yearly growth is the low end of long-term growth.

At a Mr Mimetic Fox Score -calculated as (EV/EBITDA)/Compounding Rate- of less than 0.5, both companies are quite cheap. Therefore, it might be wise to add to the position.

To be clear, Mr Mimetic considered each company as a half position and will continue to do so:

15 shares of OneWater and 13 shares of MarineMax will be added to the fund.

Post-mortem on the initial position

Mr Mimetic learned more about the dynamics of the industry since the initial write-up.

Pool Corp was in hindsight not the best model to compare OneWater and MarineMax since Pool delivers a mission-critical service for professionals and not a nice-to-have expensive albeit identity-building leisure thingy.

Could Mr Mimetic have waited a year before entering the companies in the Mr Mimetic Fox Fund? Yes, but that would have been hard to predict with the data available.

When will Mr Mimetic be wrong (again)?

When acquisitions dry up. Those are necessary to get towards that 30% Compounding Rate again.

When same-store-sales don’t material get better.

When cash doesn’t flow to the bottom line and long-term debt becomes a problem.

The companies seem good enough, positioned good enough, but not really really great. Should Mr Mimetic only stick to really great companies?

As always, thank you for reading. Appreciated.

Kind regards,

Mr Mimetic.

If you liked what you read, consider sharing this post with your investing aficionados.

SOME SOURCES:

RCI Hospitality Q4 2023 Conference Call

MarineMax Q4 2023 Earnings Call Transcript

Onewater Q4 2023 Earnings Call Transcript

If you want to follow the Mr Mimetic Fox Fund in real-time, consider subscribing to the paid version. Since Mr Mimetic sternly believes in value over price, the subscription is only US$ 30 per year. This way subscribing is more a token of appreciation, than a real cost.