Foxy Dancing towards Outsider Returns? *

A quest to recreate a portfolio of the "Best Performing Stocks over the Past 5 Years" going into the next 5 years.

Following the analysis of Alta Fox Capital of the best-performing stocks between 2015 and 2020, we got inspired to start a quest to find the best-performing stocks of the coming 5 years.

As a template for analysis, we summarized the great work of Alta Fox Capital into a recipe with 9 ingredients.

Let’s cook up some outsized returns, shall we?

Can this stock get us towards 900% in 5 years?

Full disclosure: Mr Mimetic is terrible at predicting the future but really great at history.

Ladies and gentlemen…

Because of the time of the year, this is written, Mr Mimetic has to pick a company that already has reported its Q4. No use in looking at a company that comes out with its annual results in three weeks or so.

So we picked a company that has the end of their fiscal year in September.

This particular company was founded in 1983 and went public in 1995.

But the course of its path changed drastically after a shareholder gave the CEO the book “The Outsiders” by William Thorndike.

In the book, Thorndike portrays 8 CEOs à la Buffett and Malone who did things differently and build legendary companies. Shareholders who stuck around those Outsiders made a killing in the stock market.

* Yeah, I did write “outsider returns” in the headline instead of “outsized” as a pun to “The Outsiders” book. Shoot me, if you must.

Anyhow, from 2015 onwards they started doing things differently at this company: more disciplined in terms of capital allocation & focused on generating free cash flow per share.

Did it pay off? Let’s find out.

step 01: Growth.

The first ingredient, taken from the Alta Fox Capital report is growth: “growth in EBITDA = a minimum of 15% per year”. (although 25% is a better predictor, but not necessary per sé).

EBITDA for our candidate was 36,271 $million in 2018 and it grew to 84,453 $million in 2022. Excel tells me that is about 23% in Compound Annual Growth Rate.

Even better, with the renewed focus on Free Cash Flow they provide a nice graph in their financial reporting:

You can see that 2020 was a bumpy year. They were heavily affected by Covid but made sure to be ready for continued growth once life went back to normal.

Is life ever normal, though?

Since growth is best considered on a per-share basis to be sure, we were pretty stoked when we found out they have a history of cannibalism: they buy back stock whenever it feels like a smart thing to do with the cash at hand.

Mr Mimetic thinks we have the first ingredient covered. “Growth” is in the pocket.

If Mr Mimetic would grow a portfolio of stocks at 22% CAGR, into the next 5 years and beyond, he would consider himself a king amongst peasants. (Hedge Fund managers being the peasants).

So far, so good.

step 2: Begin small

This one is easy:

“is the market cap below 2 $billion or not?”

Well, at the time of this writing the market cap is $868 million, so we’re good.

Two down! ✅✅

7 more to go.

step 3: Rising margins

This ingredient is not officially in the Alta Fox report, but Mr Mimetic likes to check it as an extra precaution.

Is EBITDA growth outpacing Revenue growth? Is there a flywheel of efficiency in place that makes them more net dollars when selling a $1000 vs $100? In others words: are their margins getting better?

Revenue of 165,748 in 2018 netted them 36,271 in EBITDA and 23.2 in FCF.

Revenue of 267,620 in 2022 netted them 84,453 in EBITDA and 58,9 in FCF.

So, in terms of margins, you get this nice little upward trend :

With these numbers, Mr Mimetics’ juices start boiling. 3 out of 3.

We’re off to a good start.

step 4: Insider ownership

Jensen and Meckling already demonstrated in a 1976 study that an owner-manager has more agency than an outside CEO, which matters a lot in the long term.

The nitty-gritty of every single detail adds up to a big outperformance in terms of shareholder return, given time.

Those results have been replicated over and over again in other studies, in multiple time frames, and in various parts of the world (or that is what Google Scholar tells Mr Mimetic when he takes a quick look).

Owner-Operators do it better

Well, the CEO, president, and chairman of the board of our company are one and the same person.

He owns about 7,61% of the company and is in his current role since 1999 after a merger with his own company.

Having the open-mindedness to implement the strategies as outlined in “The Outsiders” book after all those years, deserves a lot of respect.

Which means another check on our list of ingredients.

Growth. ✅

Small cap. ✅

Rising margins. ✅

Insider Ownership. ✅

Now-now, has Mr Mimetic chosen wisely? Might this company be the first candidate for our Foxy portfolio?

step 5: Acquisitions

Acquisitions are not deemed crucial for all outperforming stocks, yet are a great tool to boost growth.

The problem is they should happen wisely, disciplined, and not for the sake of revenue growth. This was exactly the problem before 2015:

“The CEO wasn't always a good capital allocator. I think he thought that needed to grow the top line of the business just for the sake of growth. So he issued a lot of equity to do acquisitions when the equity was cheap and acquisitions he was doing were less cheap. And so he did a lot of things for a longer time that kind of put the company on a path to not grow free cash flow per share at very attractive rates.” - Yaron Naymark on the Equity Mates Podcast

That all changed. The rising margins are already an indicator that things are going just fine in the acquisition department.

The 5-year average return-on-investment is 6,15%, with last year ROI of 10,15% and Return on Capital Employed around 11% - according to my DeGiro platform. These are not Constellation Software kinda numbers.

Revenue per share has a 5-year CAGR of 13,91%, while debt has a CAGR of 10,24% for the same time frame.

What does it all mean?

It means they are slowly but steadily climbing up that hill. The nature of the business doesn’t allow for software-style returns, but they must be doing something right if you look at the growing margins.

They fund Acquisitions with debt. And rightly so, because the new Assets are able to spit out cash and the Assets themselves become more valuable vis à vis the price that was paid. This helps the Return on Equity.

The Outsiders playbook, actually.

In practice, they buy on lower multiples then they are able to generate themselves, after the acquisition.

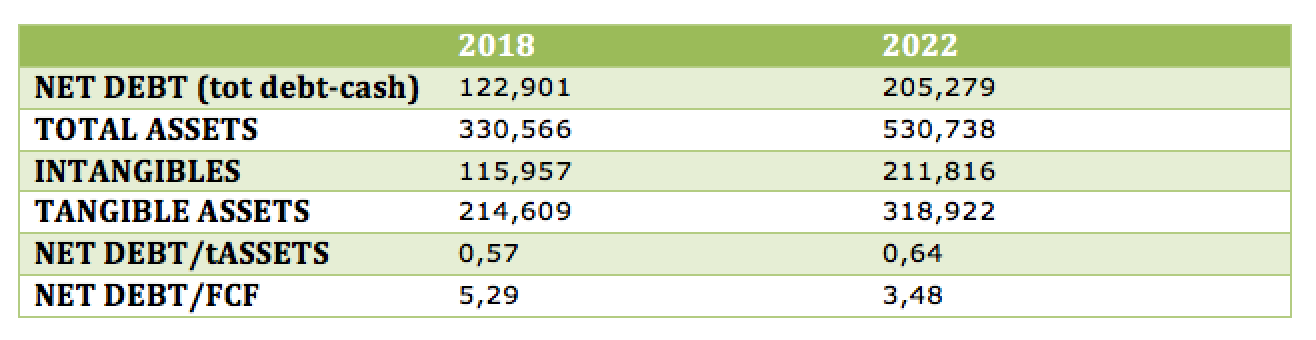

You want to see Net Debts over Tangible Assets shrink in time. So that’s a little red flag over there. It might be because they accelerated Acquisitions and need some time for the cash to come in to cover the debt?

This is indeed the case: they invested circa $67 million in 2022 versus $26 in 2018, $27 in 2019, $1 in 2020, and $7 in 2021.

So, we’re comfortable with that. Returns on that $67 million should start to show up in the bottom line pretty soon.

After +50 acquisitions to date, “management has identified approximately 500 that are attractive for purchase”.

So, expect the company to continue on this path until they 10x.

Btw: since the new strategy was implemented in September 2015 the stock price rose from $10.41 to $94 at the time of writing or something close to… 900%

In the same time period, the S&P500 has grown from 2080 to 4048, or only a near double.

How are we doing so far? 5 out of 5.

Surely, this cannot continue?

Step 6: Healthy

Current Ratio is 1,62. (> 1 = good)

Quick Ratio is 1,50. (> 1 = good)

So, not strapped for cash any time soon. They can meet their obligations.

Marty Whitman measures financial health as :

“how creditworthy is the company?”

How easily can they attract fresh outside capital?

You cannot lend against Intangibles and Goodwill. So, we have to subtract those from Total Assets.

With all that Free Cash Flow going on they can be debt free in 3 and a half years if they wish to do so.

Moreover, there is plenty of room to lend against their tangible assets - even if they wouldn’t buy extra tangibles with those fresh funds.

However, the rate they have to pay on their outstanding loans is rather high, in my opinion. Even with maturities 3 decades into the future.

There must be some crazy ass bank out there who can do better than that? Although Mr Mimetic has to admit he’s no CFO material. What does Mr Mimetic know about corporate debt facilities? Close to nothing.

Although they were hit pretty hard in 2020, it doesn’t seem like they got into problems at any time.

Any possible upcoming recession doesn’t scare the CEO either:

“We are not recession-proof, but recession-resistant” - the CEO

Let’s leave it at that.

Mr Mimetic thinks we can conclude this company is financially healthy enough to pass this test.

What comes next?

Step 7: Barriers to entry

This company operates in a very protected industry.

They need a whole slew of licenses to operate. And once you are set up in one region, it is near to impossible for a competitor to get a new license. So Mr Mimetic is told, at least.

Cities grandfather this business: they allow one top player but are reluctant to have many competitors pop up nearby.

To be fair: more in-depth research is required here. How protected are their businesses really?

In the meantime, we have a 7 out of 7 - with a little question mark next to it.

Step 8: Competitive advantage

In their line of business, reputation is everything. As a layman living on another continent, this one is hard to assess for Mr Mimetic. Luckily we can do some digging:

They have great reputations, great brands. - Yaron Naymark on the Equity Mates Podcast

This is their Glassdoor score:

One entrepreneur who sold to our (potential) company:

“(these businesses) have been my father's and my life's work. We're pleased to have realized their value. Their future will now be in the best hands in the industry. We look forward to being significant shareholders and participating in the company's long-term growth."

Not all is shiny under the sun, though.

There was an SEC probe into them not disclosing the family relations between some directors of the company and board members. They were fined for that.

The Bear Cave was skeptical in june 2022:

“the company’s main business faces allegations of illegal behavior”

“lackluster concrete progress in expanding”

“the SEC has previously charged the company with accounting improprieties, including corporate donations to a private school affiliated with the CEO”

“the company continues to have accounting concerns”

In 2018 there was an anonymous short report that scared some shareholders away. According to 1 Main Capital:

The allegations made by the short seller were thoroughly investigated by the SEC and by an international law firm hired by the company’s board

By September 2020, both the SEC and internal reviews concluded their investigations; the company admitted failure to disclose less than $1m of exec perquisites in total between 2014-19, which were fully expensed in the company’s financials.

We do have the feeling this company is quite vulnerable to a scandal because there are a lot of moving parts, a lot of people involved, and a lot of potential vulnerabilities. We equally have the feeling those potential scandals will not have a long-term effect on the economic prospects of the company.

Short reports have been screaming hell and fire in the last couple of years, without substantial evidence, in hopes of manipulating sentiment.

Anyone can write a short report about grandpa Buffett, that looks bad on the surface. Substantially? Not so much.

That doesn’t mean we don’t have to look into it and take their arguments seriously. Observe. Analyze. Assess. Decide.

In terms of competitive advantage, though, Mr Mimetic is giving this company a “yes”.

A moderate yes, so to speak, but a YES nonetheless.

One last question to ask.

One last ingredient to the recipe.

Step 9: Is it cheap?

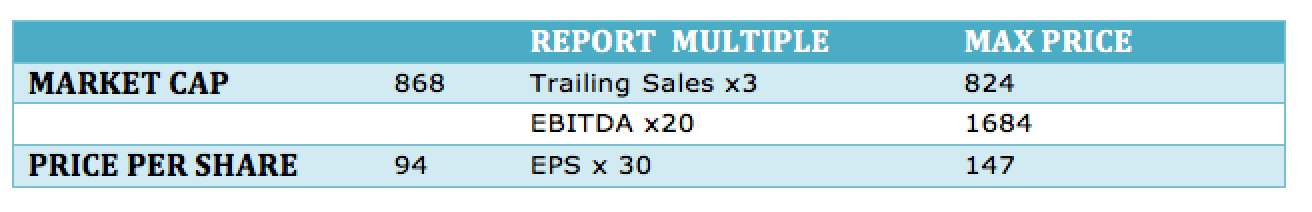

According to the report “Best Performing Stocks over the Past 5 Years" anything above these prices is considered expensive:

3x trailing Sales

20x trailing EBITDA

30x trailing PE

Since not all trailing data are available at this moment (only revenue for Q1 is published), we settle for the Full Year 2022 numbers:

Conclusion: do we have a winner?

Any serious investor would have to check out the Bear Cove short report for themselves.

And dig into how high the barriers to entry really are.

While we feel comfortable with their Competitive Advantage based on the sources we scouted, we do think some more work needs to be done in that area as well.

But for the purpose of this experiment, we are proud to say we have a first entry in our Mr Mimetic Fox Fund. Whoop! Whoop!

We will add 11 shares priced at $93,42 to our portfolio.

But who is the damn company? What industry are they in?

Haven’t you guessed, yet?

A picture tells a 1000 words:

RCI Hospitality Holdings

RICK is the only publicly listed owner and operator of adult gentlemen's clubs in the US, ranging from quality strip clubs to themed restaurant sports bars like Bombshell's (think Hooter’s in military outfit).

Obviously the licensing part was not a lie: liquor licenses, zone licenses, entertainment licenses, etc.

The vulnerability to scandal is not an exaggeration either.

Recently they started to franchise Bombshells. Two franchises are in the start-up phase.

And they started an OnlyFans-style platform for dancers - inspired by the son of the founder-CEO. (Nepotism or training your successor?)

Here he is, CEO Eric Langan:

He calls himself the “chief janitor”.

All fun aside, he did do a wonderful job the last 7 years. Will the next 5 years even be brighter?

Kind Regards,

Mr. Mimetic

Sources

@RicksCEO