Aquamen. The quest to beat POOLs 10YR 899.30% return.

We are trying to build a collection of the "Best Performing Stocks of the next 5 Years", based on 9 criteria nicked from research by Alta Fox Capital.

The makings of a compounding darling

Pool Corp (POOL) is a distributor of pool supplies and equipment. It’s a poster child of compounding. Risen from 90 $cents per share in November 1995 to $403 in January 2023, those are the kind of returns that fortunes make. We are talking about a +25% Compound Annual Growth Rate.

In that period they were able to drive margins higher and costs lower - due to rationalizing inventories and a better negotiation position towards suppliers.

This is quite a feat for a retailer, be it mostly a wholesaler. POOL was able to do this because…

“The pool industry is highly fragmented on the distribution side as well as the customer side.” - YoungHamilton from Analyzing Good Businesses

With every new location, it will be harder for non-scaled competitors to compete with Pool Corp in terms of price, customer service, and margins.

Now, POOL tends to look for “under-penetrated markets” to find a spot for new businesses, or pick up your regular mom and pops supplier that is looking for a takeover. This gives POOL a long runway still to keep on grinding toward market dominance.

This is a great strategy. The best competition is no competition at all. And while there might be multiple candidates to buy a particular acquisition; it’s always best to look for local monopolies instead of driving each other to the ground.

If Mimetic Theory can teach us anything, it is not to desire what others have.

There are plenty more fish in the sea.

Although this seems like a no-brainer and an easy-to-copy strategy for any competitor in Pool Corps market, it is actually quite hard to pull off. Find and train the people, have the supply chain in order, be disciplined in capital allocation, have a repeatable “business system” in place, …

Now, if we would look at the numbers, ratios, trends, and quality of POOL then we are a close match to all the criteria we are looking for.

Except, POOL is too big by now:

So, what is our quest? First, to find an industry that is equally fragmented as POOLs; then to find a company that resembles Pool Corp when it was still an under 2 billion$ market cap hidden gem/champion/Cinderella.

A boatload of boats

We actually don’t have to look that far. We can keep up with the water theme:

“boating retail is a highly fragmented market” - everybody who writes about this

and:

The boating retail industry is primarily small mom-and-pop locations, meaning they have few large competitors. - Engineer Investor

Sounds familiar? The boating retail business is indeed similar to the land-based water leisure market POOL is in.

There are actually two listed companies that conduct a similar strategy as POOL in this space. Both are in the early innings of their potential trajectory - although one is frontrunning the other.

We’ll call them COMPANY A (market cap 464 $m) and COMPANY B (market cap 673 $m) for now. Let’s compare the two and see if one of them deserves the accolade to be part of the soon-to-be illustrious Mr Mimetic Fox Fund.

Outperforming a growing industry

Boating is actually a solid market. To Mr Mimetics’ surprise, 1 out of 10 Americans is a boat owner.

The U.S. Coast Guard recreational boat owner statistics show that about 11.9% (about 14.5 million) of U.S. households own a recreational boat

Total "Annual U.S. Sales of Boats, Marine Products and Services" are growing, and outpacing Inflation at a CAGR of 8%:

Companies A and B are both outpacing their industry in terms of Revenue and EBITDA growth, with some room for error:

Margins are clearly rising since EBITDA outpaces Revenue:

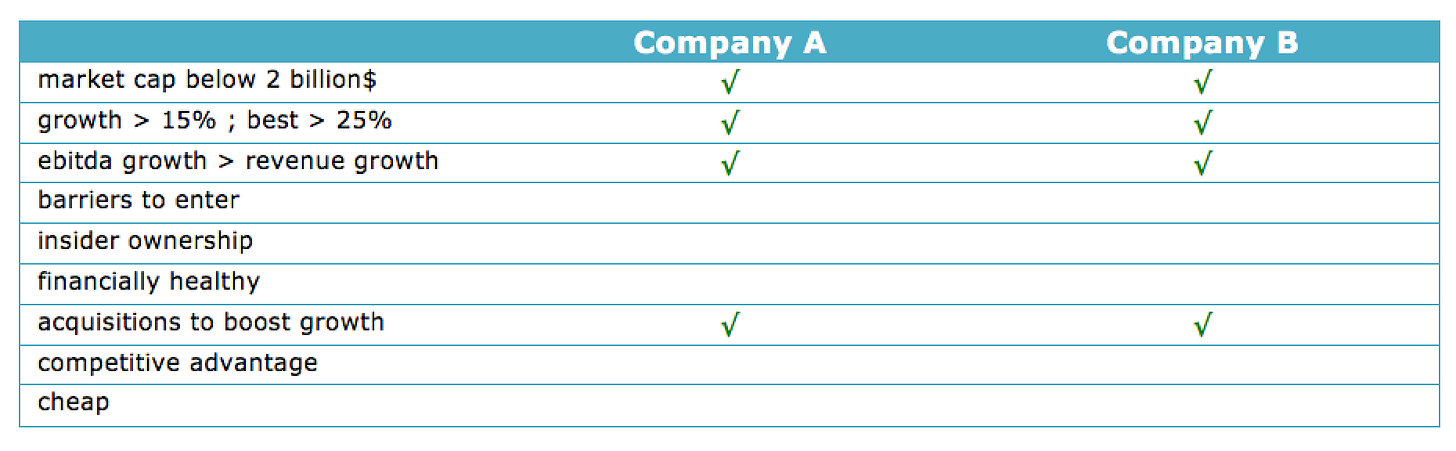

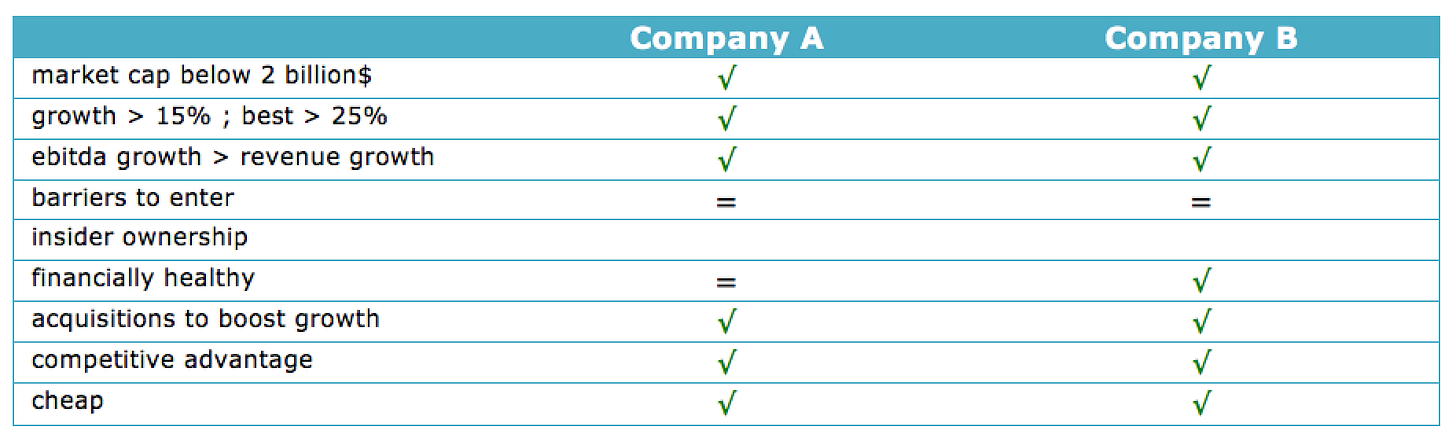

This makes them both eligible for the first couple of criteria in our 9 ingredients recipe for stellar future returns:

Now, before we all get fired up - there is some cyclicity to the boating space. Both in terms of quarterly sales as a natural sensitivity to recessions. Boating is expensive and although for a lot of owners, the cost of owning a boat doesn’t make a dent in their bank account…

61% of boat owners have an annual household income of less than $100,000 - https://quicknav.com/boating-statistics/

People love the lifestyle and are willing to cough up the dough for it, but when times get dire it’s something they will have to give up.

This is reflected in the revenue of Company B after the 2008/2009 banking crisis:

The thing is, crises are opportunities. To learn and to fuel the future. Both Company A and B are actively diversifying their revenue mix with repeat, higher-margin businesses to solidify their Income statements in case of negative macro-events.

Company B is focussing more on high net worth customers who are not affected by a recession because their hobby is such a small part of their overall budget.

Company A actually started as a family mom and pops, but saw so much opportunity in the years after 2008 that they started to take over other local distributors much like themselves at highly depressed prices. They simply couldn’t resist:

Well, during the downturn a lot of people put their heads in the sand. They pulled back and tightened everywhere they could, laid off good people and really just tried to survive. A lot of them went into a turtle shell and hunkered down. We just took a different approach. We got super-aggressive.

We just focused on the things that were still going because people were stillbuying boats and using boats. What really hurt during that downturn was new-boat sales. So we took our focus onto something we could get margins in, versus something we weren’t getting margins in, and stayed away from new boats. We still did new boats. We were still the No. 1 dealer for many brands during the downturn, but our focus wasn’t there. Our focus was on pre-owned, parts and service, storage— things we could do to get margin dollars.

Plus, during the downturn a lot of dealers who had availability of credit or cash did really good because you were able to benefit from some of the issues in the industry.

CEO of Company A in 2016

Any downturn in industry-wide spending will hurt the rest of the industry so much more than Companies A and B, that they will be able to dramatically gain market share.

Surely, Company B won’t make the same mistake again?

“I was at (Company B) for 20 years and became the top selling yacht and brokerage salesman as well as the top Hatteras salesman. In late 2008 and early 2009, (Company B) began pulling their lines in to weather some very turbulent times and they wanted to minimise and get back to selling small boats.” - a former sales man, who founded his own company, now acquired by Company A

I trust them both to be quite aggressive when a next recession rears its ugly head.

If they really wanted to, they could even compensate for any drop in same-store revenue with the acceleration of….

Acquisitions

In our industry, there is no exit strategy for principals in dealerships. Most of the succession plan has to do with the next generation, but if there’s not a next generation, there’s really no way for anybody to exit - CEO Company A

There are about 4300 dealerships in the US nationwide. The only networks of scale are Companies A and B, although together they hardly cover 10% of the market.

There are goods and services to be sold for every life cycle of your boat: from your first buy, to the upgrade, the repair and maintenance, supplies for trips, docking fees, fishing gear, diving, navigating….

Company A and B are trying to cover that whole cycle, be it that Company B is older, larger, with a more premium client list, and with a large acquisition under their belt where they bought a group of marinas - which is apparently a more high margin business.

Part of that deal was a private membership platform for owners of superyachts that pools all services.

Company A, on the other hand, buys up businesses where they see “an easy doubling of EBITDA within 24 months.”

This has to do with the economies of scale effect. A local mom-and-pop shop is not able to carry the kind of inventory larger-scale outfits can, in terms of items on display, price negotiations, and supply chain smoothness. A small-scale operation has various hiatuses when it comes to the whole cycle of owning a boat. Companies A and B can cater the inventory to the demand. They get more buck from the same pool of customers because they can better cater to their needs and wishes. Or dreams, even.

Not to be underestimated, it also gives them negotiation power in luring away the best people:

“Just prior to the Covid-19 pandemic, we had been looking to offer our employees’ health benefits and 401k’s, but had been struggling to offer a competitive benefits package. (CompanyA) made an offer I never dreamed I would see that was in the best interest of everyone, with a fantastic package for my employees and allowing me to keep everyone on board and stay at the helm myself. It relieved me of the personal liabilities with banks and allowed me to do what I do best, selling large yachts.” - a founder who sold to Company A

So, within the industry, there is a long runway for both companies to compound through acquisitions. In the US and worldwide.

But what about the industry in and of itself? Isn’t demand fickle like a teenager’s mood?

Is there enough moating in the boating?

It is clear that Companies A and B have huge advantages vis à vis the thousands of independent shops out there. They have IT systems in place to monitor stock and logistics; they have superior service capabilities and can basically provide you with whatever you want within days and they are both testing the waters with online platforms.

And compared to each other? It’s not very clear what the unique culture or business system would be, that sets them apart from each other. We see both evolving in a market domination duopoly where it would be better for the remaining shops out there to work with one of them.

Their respective Online Marketplaces might be the most important battleground, in the coming years - who knows? Can one of them become the Copart of boating?

A phenomenon you wouldn’t have so easily in other industries (because of regulation) is the so-called “Laptop Broker.” You set up a fancy website and you can start selling boats. Chances are big, however, you will not do a consistently good job for your customers in the long term without the proper IT system, data analytics, etc in place.

“The barriers to entry for one broker working from his laptop remain low, but the barriers for a small brokerage company to grow into a big company are increasingly high, because of systems.”

But when it comes to anything boating, location location location seems to be de adagio. Physical assets in the best places in the world where people go to enjoy their boating hobby.

So, the verdict is mixed. Scale is a huge competitive advantage; barriers to entry are lowish on the boat sales side, but the bar to grow (or survive) is quite high. The higher margins are not in Sales but in services and maintenance, and because of expertise and inventory those barriers are higher.

Thou shalt not covet thy neighbor’s house

One potential concern to have is this:

When you zoom in on the maps, some stores are at the same location. Hard to scuttlebutt from a country far far away but there is the possibility that Company A and Company B will get on each other throats, competing for the same piece of the pie.

The pie is so big and diverse, I rather have them stay out of each other’s way and look at each other from the other side of the bay.

Let’s hope they stay disciplined, in that way.

No beef for turf.

Wanting the same thing as your competitor is a recipe for a slow-burning disaster when it comes to Margins.

Company B is mentioned 13 times in the 2022 10K of Company A, mostly because two key Officers used to work at Company B, and a few times in the “competition section”. Company A is not mentioned in the 10K of Company B…

The chaser vs the chased?

So, who is the better of the two?

Finances, culture, and price are the remaining defining factors.

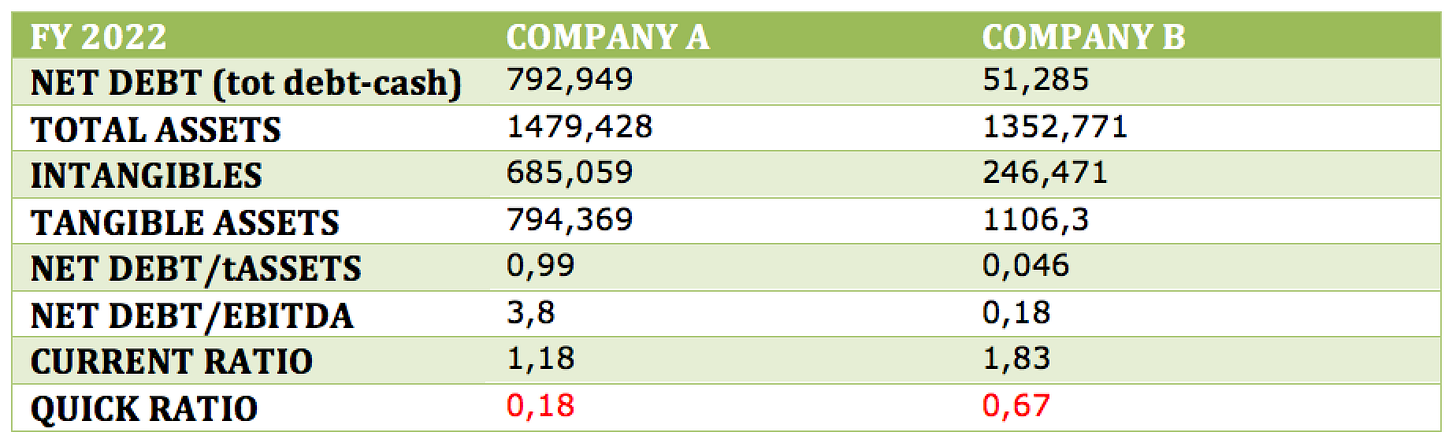

Acquisitions are sponsored with debt in both companies, but a factor is also that inventory levels were very low because of supply chain issues; there is a lot of re-stocking going on.

Also, areas hit by Hurricane Ian had to catch up with delayed demand.

Still, inventories are nowhere near pre-covid levels:

We continue to expect leaner inventory. Compared to December 2019, we now have about 58% of what we carried then in terms of units on a same-store basis - CEO of Company B

In terms of debt, it is clear Company B is a lot more conservative and in better shape.

When demand would fall off a cliff, Company B has a lot more wiggle room to draw credit and bring out the big guns.

Company A has been very acquisitive, in a way that is maybe overstepping the boundary; although they claim to keep a very conservative balance sheet - within 3x EBITDA. In the next couple of months, they are thinking about pushing the pause button a little bit:

For the short term right now, we're probably just going to sit back and watch a little bit, but we will be doing some M&A. I think we're just going to be really prudent to make sure whatever we do has tremendous upside because we're going to have to let these new boat margins normalize for a little bit. - CEO Company A

On the flip side, this means that Company A has better returns on equity than Company B.

So, what is too much? Can Company A manage potential stormy weather? Would they get into trouble when EBITDA suddenly is cut in half (like it was in the wake of 2008)? Can they draw enough credit to profit optimally from a recession?

Anyhow, Company B is the safer bet.

Eschatologists

By the criteria given to us by the Alta Fox Capital report, both Companies are EXTREMELY cheap:

Mr Market isn’t punishing Company A for its relatively heavier debt load, yet instead Mr Market is punishing both companies - in other words: the industry as a whole.

Are Companies A and B undervalued by a factor of 10 as suggested by the Alta Fox Capital multiples or does Mr Market knows something we are missing?

Eschatologists are believers in the end times. Mr Market seems to think the good times for the boating space are over for good, in a way that would cut the EPS of both companies by over 65%.

Moreover Mr Market seems to think growth on the company level is from now on impossible, gain in market share is irrelevant… All that Mr Market sees is the possibility of a recession and the impact of lesser economic times on the overall boating market, and the negative effects of that on the companies.

Short term, Mr Market might be right. Short term, Mr Market might be wrong. The odds might be fifty-fifty, or 40-60, or even 30-70. But Mr Mimetic is convinced that the probability of both companies doubling, tripling, quadrupling, quintupling,… their market share, their revenues, Ebitda and EPS is way higher than 50% - in the long term.

Let’s say that both Companies see an average of $3 EPS in the coming next 5 years, instead of $9 now. This would have them earning $15 a share cumulative in 5 years. On a share price of 30ish, this is a 50% net return in 5 years.

Not brilliant, but not catastrophic either.

Will they be able to cover their debts? Yeah - inflation would lessen the debt load relative to the ramped-up prices. Recession would make credit harder to get, but acquisition costs would implode.

As a matter of fact, Company A has a share buyback in place that would have them cutting over 10% of their current market cap. Company B has a share buyback program that authorizes buying up to… 10 million of its 22 million shares outstanding.

Cheap? Cheap enough alright.

Judgment Day

Are Companies A and B of Mr Mimetic Fox Fund kinda quality? If yes, who are we choosing? Company A or B?

All criteria seem to point at Company B. Slightly higher margins, lower debt, larger and older,…

However, when pressed for an ultimatum, Mr Mimetics’ gut feeling would surprisingly go for… Company A, anyway.

This has to do with the fact that insider ownership is 30% for Company A and a mere 3% for Company B.

But also, a sort of intuitive feel that Company A keeps decentralization more at its heart and has a higher natural respect for the local brands and local people. And the fact that I trust them more to be the right kind of aggressive during bad times. Balanced out with a slight unease concerning the debt load.

It’s a gut feeling and because feelings can be wrong, it’s not enough to make a judgment call.

Do the stocks deserve a place in the Mr Mimetic Fox Fund? Yes, they do.

Which one, exactly?

Both. We would like to add both companies to the Mr Mimetic Fox fund, but at a ratio of 60-40.

20 shares of Company A and 13 shares of Company B will be added to the fund!

Now, who are they?

Those familiar with the space knew the names from the start.

Company A is called OneWater Marine (ONEW). Company B is called MarineMax (HZO).

Just Value has its own 9 characteristics of “a good acquirer”. OneWater ticks many boxes:

Will they both be the next POOL? Can they be part of a group of best-performing stocks in the next 5, 10 to 20 years?

Mr Mimetic thinks they have a real shot.

Kind regards,

Mr Mimetic.

SOURCES

Numbers about the boating space

ITV CEO of OneWater in 2016 about strategy during the 2008 recession.

A founder who sold to OneWater and worked for MarineMax

Superyacht Times about consolidation in the industry

A Seeking Alpha author is worried about ballooning inventory

MarineMax as the top pick for 2023 by a Seeking Alpha author