Raising our minimal investment requirements

What metrics would have predicted a better run for the Mr Mimetic Fox Fund, so far?

From the outset, Mr Mimetic, wanted to have mistakes weigh really heavily on the performance of the Mr Mimetic Fox Fund.

As an experiment, no holding is ever sold.

And only once a year - after the yearly results - Mr Mimetic decides whether or not to increase an individual position.

You can read those rules on our Mr Mimetic Fox Fund page.

In real life, this would be fiduciary negligence:

Mr Mimetic cannot sell when the fundamentals deteriorate, as Peter Lynch would do.

Also, Mr Mimetic cannot buy more whenever the price drops and the stock becomes temporarily cheap.

In other words: Mr Mimetic cannot do the smart thing to do.

Mistakes will be made

In real life, Mr Mimetc follows the playbook set out by Lee Freeman-Shor in “The Art Of Execution”:

Lee gave a sum between $20 million and $150 million to 45 of the world’s top investors. He sat back and watched how they invested, between June 2006 and October 2013.

In that timeframe, he learned from their mistakes, as much as from their triumphs.

What Lee found is that everybody loses money, and everybody makes mistakes. What sets the champions amongst those 45 reputable investors apart, was an edge in “money management”, not in stock picking.

The key ingredient is this: how much money do you make when you are right?

So, with Lee we can conclude that:

whenever a holding drops to -25% à -30% one of two decisions has to be made: you sell the position, or you buy more.

Staying passive is the killer of overall returns in such a case.

This has consequences:

you must be able to add to a position when it has fallen in price, but the fundamentals are intact; so you need cash at hand for that occasion

you must size a position modestly on the outset, and add whenever the price is right, over time to be able to run with your winners and not let your losers weigh too heavily

In conclusion, this is the pattern that emerged:

“winners make small mistakes, while the losers make big mistakes.” - The Art of Execution: How the world’s best investors get it wrong and still make millions

All this is something Mr Mimetic does with his portfolios in real life. Not here. Not with the Mr Mimetic Fox Fund.

“Why is that?”, you might ask.

Stupidity is one reason. Knowingly not doing the optimal thing is definitely idiotic.

Another reason is “incentive”.

So, when Mr Mimetic makes a mistake or two, it will take a while and/or quite some effort to erase those mistakes and still have acceptable returns for the whole fund.

The incentive has two portions: (1) limit the mistakes and (2) make the search for winners after a lagger even more important.

Turns out the very first 2 holdings of the fund were mistakes: Rick’s Hospitality -(-56%) and Verde Agritech (-90%).

Those were too informed by Hopium (inflated post-Covid numbers + the top of a commodity cycle), while the risks were not contemplated long and hard enough.

Actually, the first 4 positions in the Mr Mimetic Fox Fund have suffered a negative return up until now.

As a result, Mr Mimetic now has to work really hard to find enough winners to compensate for those losses.

That is the challenge. (But it’s a challenge Mr Mimetic happily accepts).

Back to the Roots

As a reminder, the Mr Mimetic Fox Fund follows the playbook described in a study by Alta Fox Capital that syntheses the common characteristics of the winners of the stock market race between 2015 and 2020:

The Makings of a Multibagger. An Analysis of the Best Performing Stocks over the Past 5 Years. 2020. Alta Fox Capital.

Those are characteristics like revenue growth, expanding margins, a healthy balance sheet etc.

9 in total:

Small: only under US$ 2 billion market cap stocks are considered.

Growth: are they growing like cabbage? 15% per year is considered a minimum, in terms of revenue. 25% is preferable.

Financial Health: are they easily able to repay outstanding short-term and long-term debts? What is the ratio between debt and profits? What is the Quick and Current Ratio?

Cheapish: defined by the Alta Fox People as 3x trailing Sales or 20x trailing EBITDA or 30x trailing PE

Acquisitive: when all growth is organic, that is fine - but almost no company with sustainable highish growth has done so without acquisitions. An exception might be a company that opens new locations where there are none. It comes down to great capital allocation, to add value long term.

Margin Expansion: is growth leading to efficiency advantages? In other words: are profits growing faster than revenue? Exceptions are possible.

Insider Ownership: although not part of the Alta Fox Report, this is something Mr Mimetic has a hard time neglecting. Who is looking out for the company? A hired hand? Or somebody who lives and breathes this company?

Barriers to Entry: it shouldn’t be easy to compete with the company. So, restaurants or food items or a new beverage will not likely turn up in the Mr Mimetic Fox Fund. The industry or business model should have some sort of natural defense built in.

Competitive Advantage: This is the hard question. What makes them special? What makes them not easily copyable? What Mr Mimetic really wants to figure out is: are growth and margins sustainable?

Mr Mimetic finetuned those, in due course:

2bis. Compounding Rate. Mr Mimetic looks at the 5-year Compounding Rate of all income lines (EBITDA, EBIT, Net Income, Free Cash Flow) as a better proxy for growth. Not only on the basis of incremental invested capital, but also on incremental capital employed (which is kind of the same, but different).

4bis. Multiples. Mr Mimetic considers 15x EV/EBITDA as a hard-to-cross upper bar in terms of cheapness. Mr Mimetic also considers the Mr Mimetic Fox Score, calculated as “(EV/EBITDA)/EBITDA Compounding Rate” as an own proxy version for the PEG Ratio.

Addressable Market. Mr Mimetic also considers to include a “distance analysis” in what would be the new 10-step hurdle: how far can this company go? How much growth is reasonable? Ideally, Mr Mimetic can envision a path where the company becomes 100 times bigger. If not, a path to growth of 10x versus the position now should be easily on the table.

Which is all dandy, but it’s certainly not science: not all companies between 2015 and 2020 that had exactly those characteristics were absolute winners.

You can fail for very unique reasons of your own.

As always, it’s more of an Art. Understanding an industry, understanding the reflexes of management, understanding the edge of a company, understanding what is temporary and what is structural.

What is Unique about a company? How does it solve a problem? How pressing is that problem? How sticky is that solution? How do their tactics and strategy differ from the industry?

So far, the 10-item yard-stick has produced very mixed results. Ranging from -90% to +200%.

Obviously, mistakes are unavoidable - as Lee Freeman-Shor demonstrated in his experiment.

But still: how can Mr Mimetic do better?

And not only better; consistently better, preferably.

Raising our minimal investment requirements

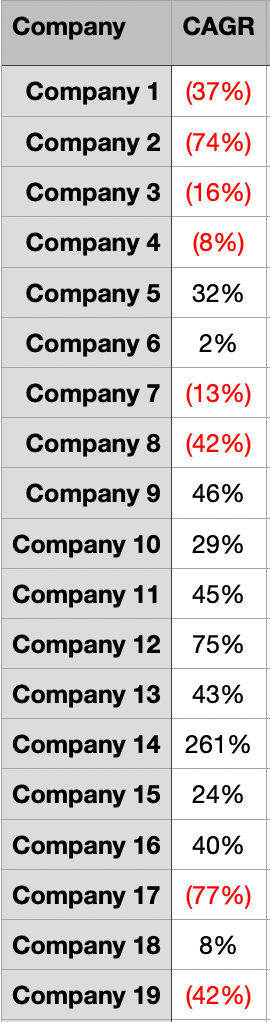

There are 19 holdings in the Mr Mimetic Fox Fund right now.

Company 1 was the first buy (Rick’s Hospitality in Jan 2023), and Company 19 was the most recent addition. “CAGR” is calculated since the addition to the Mr Mimetic Fox Fund.

The last buy was in May 2024, and we are looking at a -16% result so far on that position. (Since our buy revenue and profitability suffered).

As for the Mr Mimetic Fox Fund:

Some holdings have Full Year Results in, and will soon be evaluated: should we add to the position or not?

Apart from that, some extra write-ups in the Mad Men Series are coming up. There are still a few money-making niches to cover in the advertising space.

But before doing so, … Mr Mimetic is not willing to give up on the multibagger checklist just yet.

Moreover, out of curiosity, Mr Mimetic would like to investigate if certain metrics would have predicted the winners from the laggers in the Mr Mimetic Fox Fund so far.

This could inform our future decision-making.

Intuïtively there are 3 metrics that Mr Mimetic thinks might hold promise to have predictive power:

high Return-on-Capital-Employed

high return on Net Operating Assets

high Compounding Rate

What Mr Mimetic will do now, is look at those metrics for each stock in the fund at the time of purchase to find out if any of those 3 has any predictive power.

After that, Mr Mimetic will combine those 3 metrics, to see whether some clusters or combinations instead of individual metrics have predictive power.

Let’s start with…

ROCE

Return on Capital Employed, defined as:

EBIT / Total Assets - Cash - Current Liabilities

Why this metric? What does it measure?

Well, you take a look at how well the money that has been put in the business performs, in terms of earnings.

Money was spent on Equity, maybe Debt was taken on, and Physical Assets were bought or built.

How much can you earn before Interest and Taxes, per year, working with this setup?

David Barber of Halma fame (1626% price return over a 20 year period) gave a great speech called “DELIVERING SHAREHOLDER VALUE”. His take was: to deliver real value, you need an average ROCE of 40%…

“We deliberately chose to develop a group which would be completely self-financing but which would also be able to sustain a growth in e.p.s. in the range of 20%- 30% compound per annum or, as we later defined it, 15% plus inflation.

We determined that in arder to achieve this, we needed to be achieving an average Return on Capital Employed of 40%.”

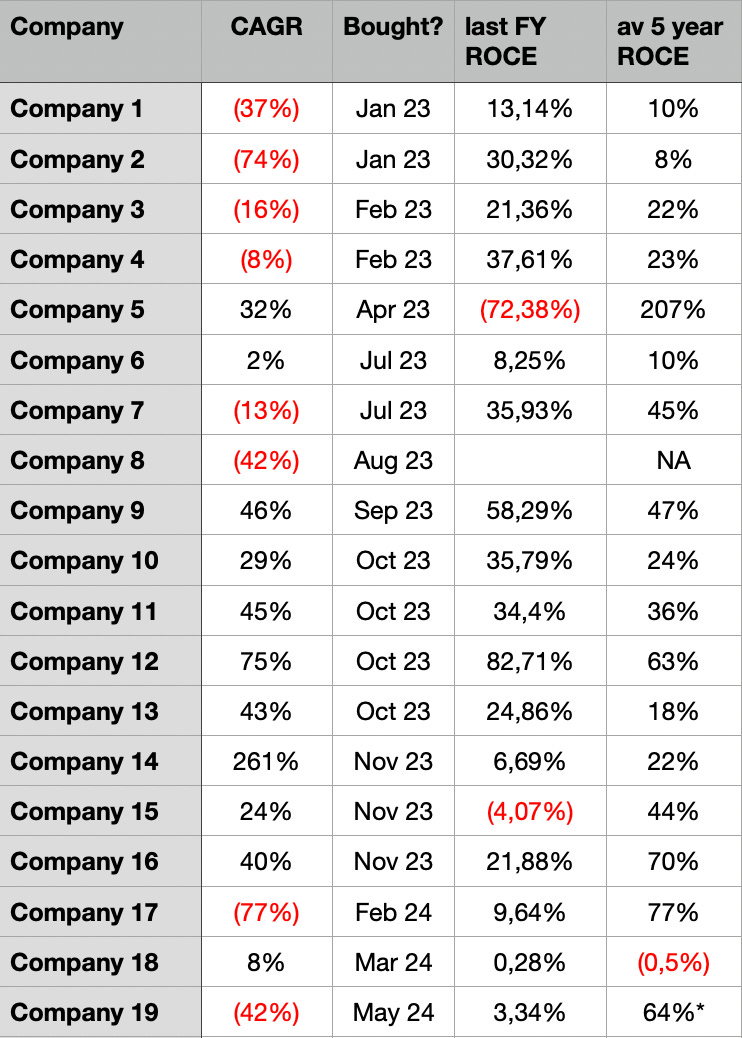

This is how our holdings measured in terms of ROCE at the time of addition to the fund:

At first sight, you would conclude that a higher 5-year average ROCE translated into a higher price CAGR.

However, statistically, there is no strong, relationship. (Higher ROCE doesn’t lead automatically to an equally higher CAGR). Maybe the period is too short?

Demanding an average ROCE of 20% minimum seems to be a good rule of thumb, though.

Removing Company 1, 2, 6, 13, and 18 from the Fund (= average 5 years ROCE lower than 20%) would have brought the average price CAGR to 25,28% and median CAGR to 26,5%. That’s a nice glow-up.

However, Consensus (an AI that searches scientific papers) suggests that other metrics besides ROCE might be a better predictor of stock market returns:

RoNOA

Or, return on Net Operating Assets, defined as:

(After Tax) Operating Income / Net Operating Assets

Net Operating Assets or Net Enterprise Assets are calculated as

Total Assets - Cash - (Total Liabilities - Total Debt)

It is basically what you need to run the business. In other words: operating assets, less operating liabilities.

It’s a metric we picked up through accounting professor Stephen H. Penman, from Columbia Business School.

This is how the positions in the Mr Mimetic Fox Fund looked like, at the time of purchase:

Again, demanding a 5 year average RoNOA of 20% minimum seems to be a good rule of thumb.

Doing so, would reduce the holdings in the fund from 19 to 8.

The Average CAGR would become 41,8% and the median CAGR would become 42,5%

What if we would demand the COMBINATION of high ROCE + high RoNOA?

Unnecessary, since all high RoNOA stocks, also had high average ROCE.

Seems like Mr Mimetic is on track to find a certain extra hurdle in the 10-point check list, to improve our returns?

But what about…

Compounding Rate

It’s Mr Mimetic’s favorite metric since it measures how many opportunities there are to re-invest profits, and how good the returns are on those investment opportunities.

It is calculated as:

EBIT/ Re-investment Rate x Return on Incremental Capital Invested

You can read all about here.

Doing so would reduce the holdings in the fund from 19 to 10, average CAGR would become 32% and median CAGR would become 15,5%.

In and of itself it’s a great but not fantastic measuring stick?

However…

Combining high Compounding Rate (+20%) with a high 5yr average RoNOA (+20%) would have resulted in an average CAGR of 127% and a median CAGR of 101%.

There would only be 3 positions in the Fund.

The kinda concentration anyone would sign up for?

It will be hard to beat those numbers.

As such, Mr Mimetic will use that hurdle going forward.

As always, it was a pleasure.

Kind regards for reading.

If you like what you’ve read, please feel free to share it with your investing aficionados

All the best,

Mr Mimetic

To find out what stocks will be part of the Mr Mimetic Fox Fund going forward, you can upgrade your subscription (only $30/year)

SOURCES

The speech of HAlma CEO David Barbera

Consensus on ROCE

Prof Penman article