Screening for our Next Winner. (part I)

Mr Mimetic takes a different route in search for the best performing stocks of the next 5 years...

Read the preamble to check out our investing philosophy.

Inspired by some of his favorite bloggers -Value and Opportunity, Richard Beddard, and Manyard Paton- mr Mimetic decided to take another route than usual for finding stocks: a screener.

Usually, Mr Mimetic starts with a pressing societal problem and then checks if any companies exist that solve that problem.

Take this link, provided by Value and Opportunity about bacteria feeding on plastics.

The French company Carbios is mentioned in the article. They have built a plant where bacteria, powered by enzymes are munching up plastics. They will scale up in 2024, recycling 50,000 tons of plastics per year (!) into components which then can be re-used. Carbios will then license their IP to other companies.

Since Carbios is pre-earnings at the moment and needs a lot of capex to build that plant, they will not be included in the Mr Mimetic Fox Fund, but Carbios is definitely on the watch list and a source of inspiration for digging a little bit deeper.

E.g. since studying Carbios, Mr Mimetic now understand enzymes a little bit better, so he will be searching for enzyme companies that fit the criteria of the Mr Mimetic Fox Fund. There’s a potential great enzyme royalty business somewhere out there.

(Mr Mimitec also intuits that the “true” future of plastic recycling will be in a combination or cluster of bacteria working together, fueled by enzymes - as predicted by Kohei Oda, the discoverer of those plastic-eating bacteria. A place where Carbios is not really yet.)

But that’s in the future.

For now, mr Mimetic must shamefully admit he was taking Mr Buffett’s advice quite literally when gauging the next societal problem:

"the time to buy is when there's blood in the streets." - Nathan Rothschild

So, Mr Mimetic went searching for Israeli companies that help protect soldiers and civilians, since…

“I don’t invest in guns, tobacco, and meat” - Mr Mimetic

…and was able to find F.M.S. Enterprises Migun Ltd. a company that “engages in the development, production, marketing, and sale of raw materials for ballistic protection.” So they make the material that makes cars and vehicles and clothing unpenetrable by bullets.

However, Mr Mimetic wasn’t convinced by the down-trending margins and ROIC, despite some growth in revenue.

The Google search that landed Mr Mimetic chez FMS, however, was a website he hadn’t seen before: tradingview.com. The cool thing about it: you can screen worldwide!

disclaimer: This is NOT an endorsement. Mr Mimetic is not paid by Tradingview. Just for your information purposes. Also: all graphs used are by Tradingview.com

Now, what to screen for? What criteria to use?

Those who have read the blog post “The Matthew Effect”, might remember that the real source for stock market gains is multiple expansion. First, you need a decent company, alright, with great underlying economics, but the real juice is in Multiple Expansion.

So, Mr Mimetic set out to screen for Market Cap under 2 billion US$, TTM revenue growth, TTM EBITDA growth, TTM ROIC growth, and EV/EBITDA multiple under 15. (TTM = Trailing Twelve Months)

Anecdotally, “EV/EBITDA < 15” was the threshold most outperforming stocks from the Alta Fox Capital report “The Making of A Multibagger” were trading under before they had a real runup in share price.

EV/EBITDA is also the so-called Acquirer’s Multiple coined by microcap investor Tobias Carlisle, who started an ETF-fund based on backtesting that ratio. And wrote a book about it:

So, we are in good company.

Next, Mr Mimetic skipped most companies that weren’t doubling their revenue between 2018 and now.

It has to be said that none of the companies of the Mr Mimetic Fox Fund popped up on the list.

This means 1. that numbers never tell the real story and 2. screening is not exhaustive - you might miss out on great opportunities by only screening or 3. the Mr Mimetic Fox Fund is totally crap.

The attitude Mr Mimetc carried when he stepped into the results of this screen was: inspiration and exploration. It’s like an alternative way of going from A to Z in the old Moody’s Manual, or from A to Z in any given stock market.

So, for each company, Mr Mimetic will provide you with:

a description of their activity

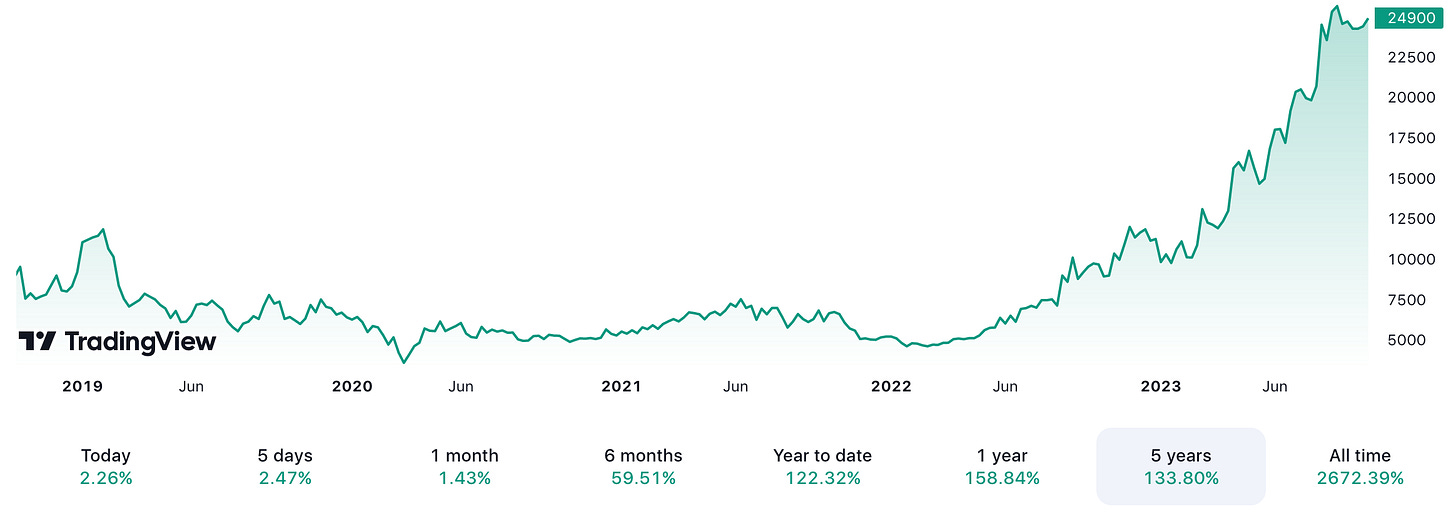

5year price history

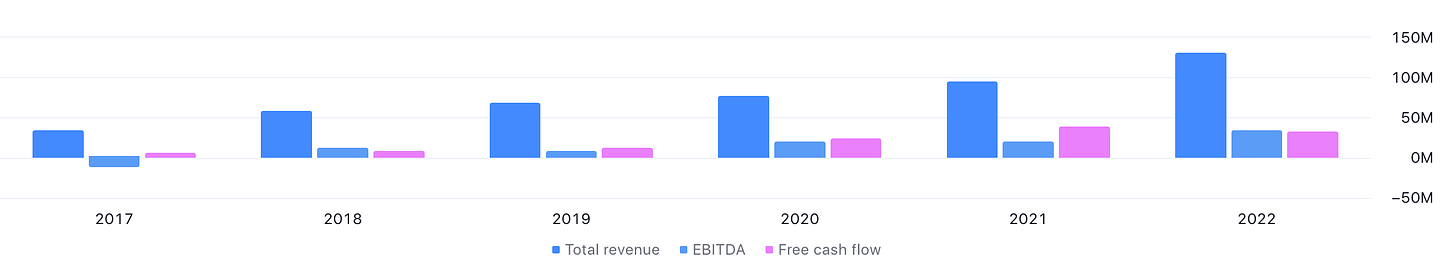

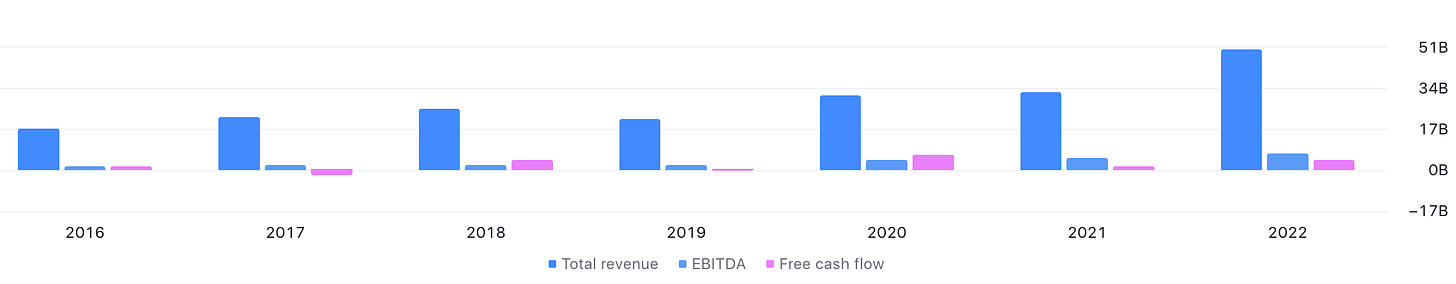

5year CAGR in revenue and EBITDA, and a look at Free Cash Flow (CAGR = Compound Annual Growth Rate)

5year trend in margins and current Operating Margin

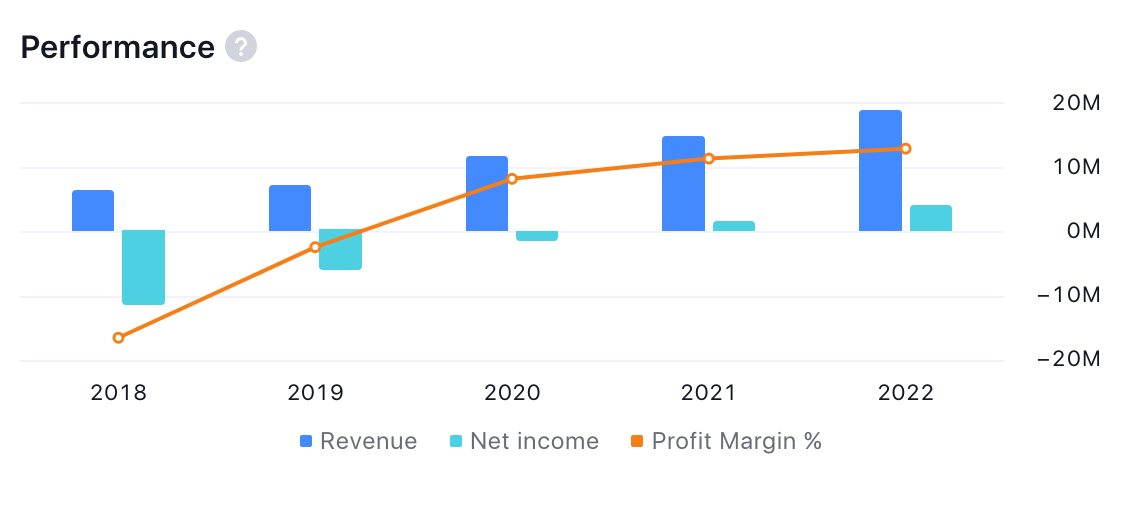

Net Income performance (merely as a confirmation check; Net Income doesn’t seem to be the best of metrics)

ROIC and ROE trend

Insider ownership

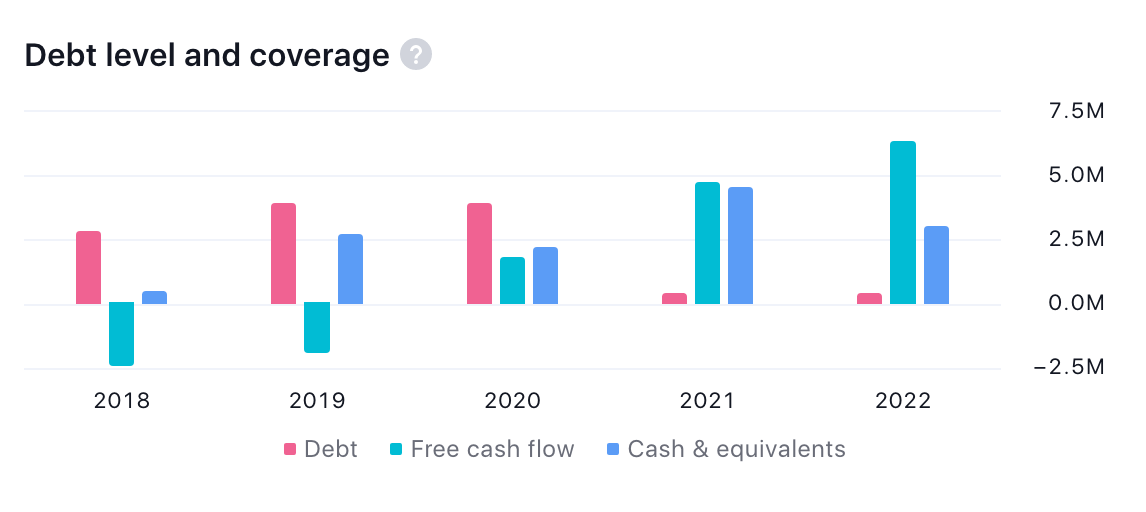

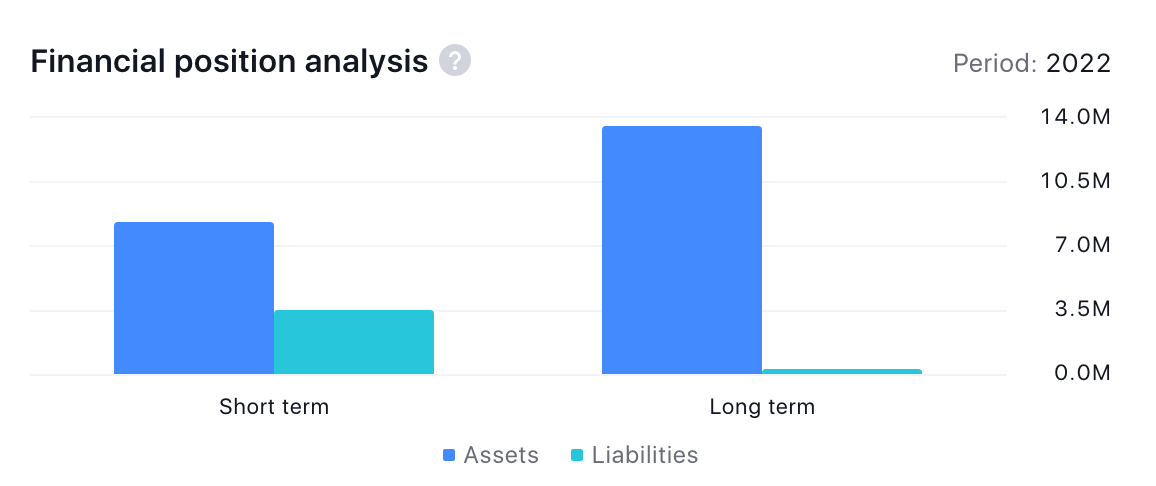

Financial health (debt vs cash + FCF ; solvency)

EV/EBITDA multiple

a preliminary conclusion focused on the moat and competitive advantage

Without further ado:

A RANDOM GLOBAL SCREENER SELECTION OF 11 POTENTIALLY INTERESTING STOCKS

1. UPSALES TECHNOLOGY

Upsales Technology AB is a software company, which engages in the provision of a sales and marketing platform for B2B companies. The firm focuses on providing marketing automation, lead scoring, website tracking, and event marketing. The company was founded by Daniel Wikberg in 2003 and is headquartered in Stockholm, Sweden.

How about this pitch on the Investor Relations Website:

Upsales is a Software-as-a-Service company with a long track record of profitable, organic growth and over 90 % recurring revenue

The company is founder-led, and about 41.9% % is owned by the board and management. Upsales serves a niche market segment in which they are the clear leader.

The niche market would be B2B Customer Relations Management aka chasing sales.

However, the stock lost 47% in value year-to-date - contracting from an EV/EBITDA multiple of 41 to an EV/EBITDA multiple of 15, just within our screening range.

Why? Growth has stalled.

First, growth was not growing. And then, in Q3 growth even fell behind inflation. Since they are a company that claims they can easily boost your sales…and they are very cockey in their communication about that…

Move fast and get shit done. Take extreme ownership. No primadonnas allowed

…those results look a bit funky. As if Karma bit them in the butt.

The question is if they are more than a database with a fancy layout and some workflow software?

Of course, they are.

Even so, Mr Mimetic doesn’t regard their product as very niche, nor does he see how they have a clear competitive advantage over the competition.

Do they have a nice commodity product? Yes, they have.

Two thoughts:

The thing is, Mr Mimetic always thought of sales as Value Add, not attitude.

If you have to work hard on sales, you better work harder on product development. - Mr Mimetic, sometimes, alone to himself

Mr Mimetic is indeed not able to quickly find any of the intrinsic attributes of a Persuasive Product, as dr Robert Cialdini coined them, with regard to the Upsales Product Range.

Charlie Munger’s favorite: Incentives rule the world. Lack of sales comes down to a lack of incentives. You can’t bully people into making a sale; but you can give them the prospect of becoming financially free.

Is Mr Mimetic being too simple? Or just simple enough?

They do have some spare cash to consider what Swedish companies do so well: serial acquirement. Might clever acquisitions boost sales, where cockiness stumbles?

2. GAMING REALMS

Gaming Realms Plc engages in the provision and marketing of interactive casino services. The company was founded on March 8, 2001 and is headquartered in London, the United Kingdom.

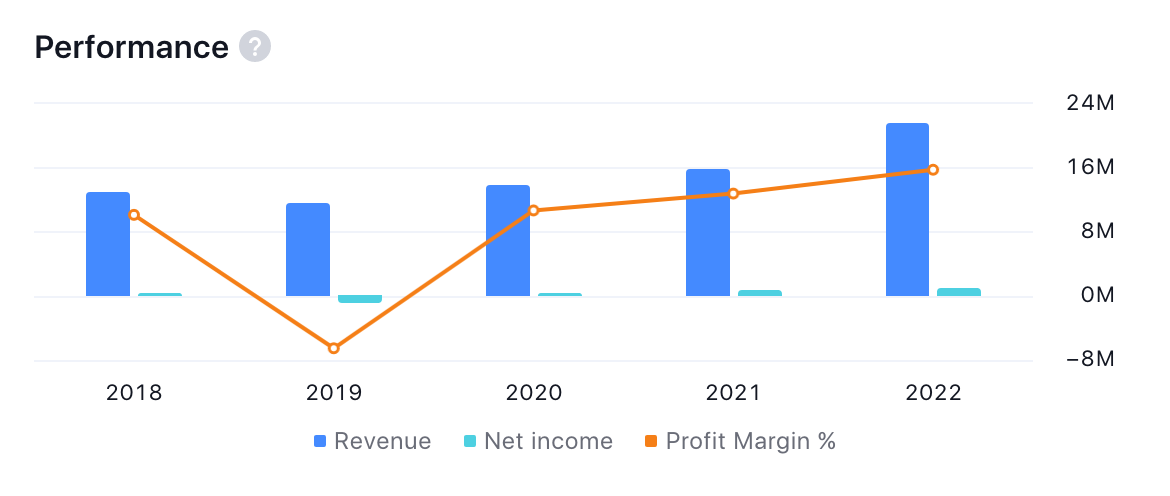

Gaming Realms develops games in the Slingo-format -a slot and bingo combination- for all the big gambling companies. They license popular brands to make games around, e.g. “The Masked Singer”. Each year they grow their portfolio of games or IP and boast about “12 consecutive half years of growth”. They have been profitable only since 2021.

The driving force behind the company seems to be chairman Michael Buckley (8,77% of shares), who set up a few companies after selling an online gambling websites company. CEO Mark Segal is not listed among the biggest shareholders (which is a red flag), but is seen as an “industry veteran” and has been working on and off for Buckley since 2009.

Mr Mimetic suspects Gaming Realms is comparable to a publishing house of licensed graphic novels à la IDW Media, but then in gambling. Very hard to predict how long Slingo-games will be popular, if they are here to stay, and how Gaming Realms is comparing with the competition.

“In an industry where M&A still thrives, we believe Gaming Realms is an attractive potential takeover target,” - Investec.

Mr Mimetic doesn’t see a real moat or USP in a game developing company (being a developer in media production companies himself) and suspects at one point the Chairman will sell before growth will start to top off, as he did with different companies in the past. It is probably cheaper than it ever was and likely to grow quite well, but the product popularity is a bit fickle. For Mr Mimetic it is a pass.

3. MUZA

Muza SA engages in the publishing and sale of books + organization of fares and exhibitions; and management of rehabilitation centers and spa facilities. The company was founded on October 30, 1991 and is headquartered in Warsaw, Poland.

Extremely cheap on paper, despite the run-up.

Unfortunately, this might be because of the revaluation of an investment property (a Spa). Unrealized gains in property value must be recorded in the Income Statement.

The property valuer determined the value of the property at PLN 16,130,000 as at 31 December 2022. The Issuer holds a 69.74% share in this property, thus its balance sheet value increased as a result of the revaluation by PLN 1.407.353 to PLN 11.249.062. The increase in value will be included in the gross result for 2022.

It is suggested this is the best result in over 13 years (Polish press talks about “a record with a long grey beard”). Even then, this revaluation doesn’t explain all the growth in revenue.

Besides financial information, there is very little to find about the company. The biggest shareholder since recently is Małgorzata Czarzasty, the 64-year-old wife of a politician who was accused of having an affair, despite taking a high moral stand in public before.

It’s hard to determine where the revenue comes from. Mr Mimetic likes a business model based on organizing fairs for professionals or leisure fairs for niche fans because those can boost a high Return on Investment. Mr Mimetic doesn’t like the bookselling and - publishing business all that much. One year you have a hit, next year is a dud. It’s like the movie business, where only 1 in 7 films breaks even. As for retail of international books? A rather low-margin business.

Market cap is under 11m US$, so very small. And -4,61m in net debt. (8,76m cash&equivalents) After perpetual trading under book value, now P/Book of 1,24.

Too much of a black box, unfortunately.

4. JOURNEO PLC

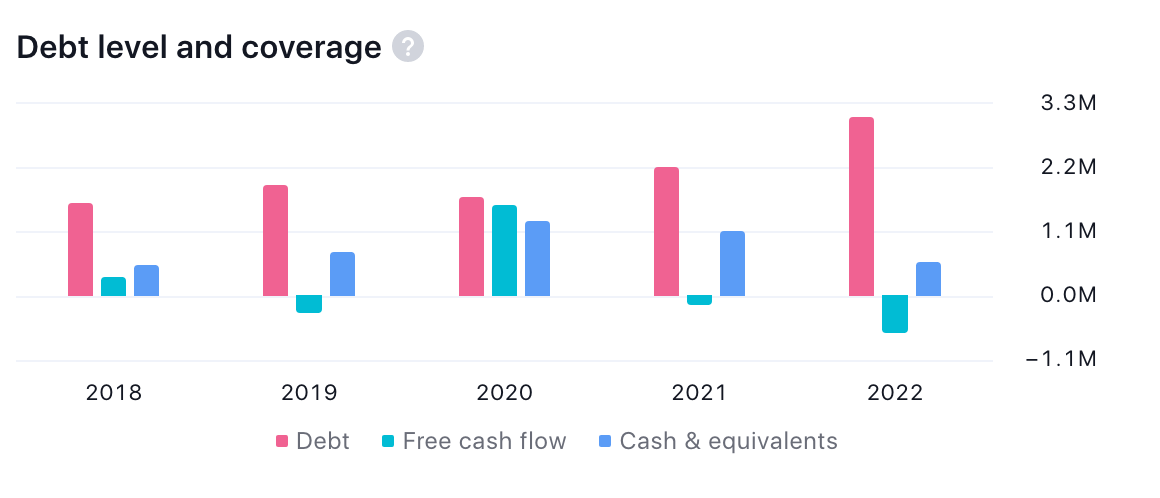

Journeo Plc engages in the provision of tailored solutions to the public transport community: on-board CCTV, Wi-Fi, and passenger information systems, on-street interactive way-finding totems, bus shelter displays, and transport interchange departure boards, and content management software, which enables users to inform passengers with graphical real-time departure information. The company was founded in 1993 and is headquartered in Ashby-de-la-Zouch, the United Kingdom.

Say you want to take a bus? How do you know when a bus will arrive? In the UK you can see a screen with real-time arrival info, indicating how many minutes you have to wait. Those screens and that info? This is Journeo.

Bus routes; scheduling of drivers? Hey, Journeo can handle that for you.

Most people seem to think only the CCTV in buses and such is Journeo.

It turns out this is a tough market to be in. So tough, Journeo does not have a lot of competition:

“We work in a number of niche market segments with few competitors and high barriers to entry due to enterprise risk combined with technical complexity” -AR report 2022

Since they solve problems in Public Transport, their biggest risk is Government Spending.

Their solution to that risk is two-fold:

They create value and reduce costs. (And they think they can do this better than anyone because of their scale and the network effect)

“We share the benefits of our scale economies, to reduce costs for our customers” -AR report 2022

They go where the money is. E.g., the UK government announced a new budget for modernizing train travel, so they did do an acquisition into rail.

Journeo also acquired a company in the Nordics (Denmark), to scale internationally.

We penetrate “new markets where we believe our technology can add value to the customer.”

Of course, they are building out a SAAS model, connecting a fleet of buses.

So, what is not to like?

Insider ownership… Tradingview indicates over 20% is closely held, but this does not include a lot of shares by the CEO and other directors. Together they hold about 5% of shares. (They might increase their ownership through an option incentive program).

No traces of the founder, either?

Mr Mimetic is no fan of leaving the fate of a company in the hands of hired hands. How much do they really care?

The biggest shareholder is Robert Millington & family (about 10-ish%). He appears to be an asset manager, and Mr Mimetic guesses Journeo is part of his family portfolio? He’s a passive investor and doesn’t have a seat on the board.

So, all in all, that makes two red flags: Government contracts and Insider Ownership.

Anyway, there is still a lot to like: a dominant niche player, with room to expand.

5. ATLAS PEARLS

Atlas Pearls Ltd. produces white & silver South Sea pearls and farming operations in Indonesia. It operates retail stores in Perth and Bali. The company operates through three segments: Wholesale, Loose Pearl, and Jewellery. Atlas Pearls was founded in 1992 and is headquartered in Perth, Australia.

Shiny, white pearls? Nice!

We know all about the Pearl Divers, but did you know those pearls were grown? In the sea? Like a farm underwater.

How cool is that?

The only thing Mr Mimetic really wants to know: Are pearls a commodity or not?

And if so, is Atlas Pearl the low-cost producer?

The chairman gives a great overview of the business in his AR 2023 letter:

“prices in some categories two to three times higher than in the recent past.” - AR 2023

So, yes a commodity.

And even more, when discussing capital allocation, they want to be prudent, since:

“the inherent uncertainties of aquaculture” - AR 2023

And:

The last few years have seen a remarkable turnaround in the Company’s fortunes

Auch.

Additional risk may lie in how the weather is affecting the growth of the pearls:

Pearl quality (…) reached a low point in the middle of the year

This is a trend.

On the up-side: they have been debt-free since this year, have now have a substantial cash chest (about 1/3 of Market Cap) to invest in efficiencies and growth (acquisitions of other pearl farms)

Yet they decided to do a special dividend.

As for Mr Mimetic: low competitive advantage, combined with structural risk.

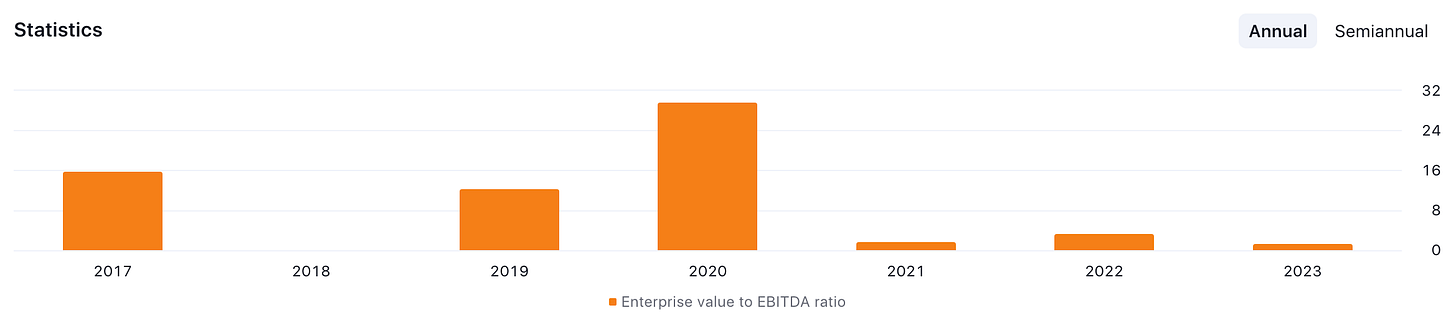

6. SHOEI CO

Shoei Co., Ltd engages in the manufacture and sale of helmets. Its products include full-face, system, jet, off-road and trial helmets, shields, screws, levers, ventilations, visors, and other related accessories. The company was founded on March 17, 1959 and is headquartered in Tokyo, Japan.

There are a lot of “Shoei” entities: ShoeiCorporation, ShoeiCompany, ShoeiCo, ShoeiFoods, ShoeiYakuhin,… All were founded decades ago, all in different businesses.

Only the “helmet”-one popped up on our radar. Reminds Mr Mimetic about Leat Corp.

South African LEAT was a growth darling for a few years: founder-led, patented protective gear, etc… The next big new thing. But then suddenly revenue fell off the cliff.

The Company “saw the increased popularity of motorcycles as means of transportation or recreation (…) amid the COVID-19 pandemic. Under the post-COVID-19 situation and the above global economic conditions, developed countries and the Chinese market were losing momentum, and inventories were increasing at distributers.” - Shoei Q3 2023 report

(Mr Mimetic did look into Leat, but decided not to pull the trigger.)

Shoei is in direct competition with Leat.

Yet, they do think they have the only real premium helmet:

“Top quality product is realized by applying Toyota production system as only one firm in the whole industry” - IR website

And have the numbers to back that up:

SHOEI's share in the world's premium helmet market is in excess of 50%. About 80% of sales is for overseas markets. - IR website

Growth will continue due to new standards, they reckon.

“the Company does not expect demand to decline decisively in the future, given demand for new models resulting from revised standards.” - Q3 2023 report

Shoei seems like a wonderful company, with a great culture. Look at those expanding margins! Look how cheap it is!!

Mr Mimetic is not comfortable, though, with B2C businesses unless they are in the luxury category (Ferrari, Hermes,…), or you need a physical pied-à-terre that you can grow through acquisitions or expanding your footprint (in a splintered market).

Mr Mimetic is probably wrong when it comes to Shoei, but he is rather wrong than right for the wrong reasons.

7. NOMURA MICRO SCIENCE

Nomura Micro Science Co., Ltd. engages in the design, construction, maintenance, and sale of ultra-pure water systems: water treatment plants and equipment, water treatment units, process-related equipment, functional products, chemicals, piping, and environmental materials. The company was founded on April 2, 1969 and is headquartered in Kanagawa, Japan.

We live to learn another day. The Chairman of NMS taught us that only 0,007% of Water on our planet…

is in a form that can easily be used by people. - Letter from the Chairman on the IR page

NMS reminds Mr Mimetic of Ekopak, which installs recycling water systems for factories and charges per m3 used (recycling the water is cheaper than buying it from the tap).

NMS seems to focus on companies that need “100% pure water” in their production process -like pharma or chip production?- so it is more of a '“traditional” filter play.

Maybe in the future, they can adopt “water-as-a-service” like Ekopak does?

Mr Mimetic likes:

the structural tailwinds when it comes to water (Michael Burry of “The Big Short” fame famously said at one point that he saw water as the new gold; and the only real investable asset)

the acquisitions to grow

the first mover advantage they try to pull off: being the first in countries that only started to discover the need for pure water purification

Sales in the new quarter (Q1 2024) are up like 50%, and that doesn’t even show in the TradingView stats. (So it is cheaper now than EV/EBITDA of 5,91) If they can expand their margins accordingly?

It is hard to gauge their competitive context. Yet:

“It is the smallest of the three top Japanese ultrapure water specialists (behind Kurita and Organo) but it was the first to expand abroad, first to Korea, then Taiwan, China and the USA. Now it is looking for growth mainly from the industrial wastewater recycling market. Nomura's UPW technology particularly focuses on dissolving gases into water.” - Ultrapuremicro.com

Have they found their niche? The numbers point in that direction.

All of which warrants a deeper dive…

8. TRANSPORT TRADE SERVICES

Transport Trade Services SA engages in the provision of river and maritime transportation services: logistics, cargo transport, and port operation solutions, shipment of chemicals, minerals, and agricultural products, cargo loading, unloading, storage, packaging, drying, and weighing, as well as direct and indirect transshipment works. The company was founded by Alexandru-Mircea Mihailescu in 1997 and is headquartered in Bucharest, Romania.

Mr Mimetic did take a hard look @ Logistec, which manages ports in the North America’s and is majority owned by 3 sisters, led by one of them. Alluvial Capital is a shareholder. Mr Mimetec, however, was awaiting the “strategic exploration” they announced and didn’t dip in.*

(Mr Mimetic learned a lot as a young investor, back in the day, from Alluvial Capital’s blog “OTC Adventures”. A recommendation.)

As for TTS, the Chairman-founder does own 25% of the float.

A local analyst report considers the results of the last few quarters “unprecedented”, due to higher traffic because of the War in Ukraine (Romania is next door) and sees only “ample upside”.

They applaud management for their M&A and the building up of cash for future investments, though.

However, not the moment right now to trust that history is a great predictor of future results.

9. CHERYONGELEC

CHERYONG ELECTRIC Co., Ltd. engages in the manufacture and sale of general power electric equipment: transformers, power transmission and distributors, metro railways, lightning arresters, hybrid cutout switches, gas-insulated switchgear, and others. The company was founded on December 18, 1986 and is headquartered in Seoul, South Korea.

It looks like Cheryong completely transformed since 2021/22, with a big capital spend, since then a doubling of revenues, with quasi-software-like margins.

What is going on?

There is a lot of innovation going on, that’s for sure: first to pioneer an earthquake-resistant tranformer? First one to build a transformer (based on a new foundational concept) that can function underground, in an enclosed space, in seawater, and has no explosion risk.

Reuters headlines indicate they had some big orders inflow, without revealing any details. Couldn’t find a decent Investor Relations page; and Google Translate only brings Mr Mimetic thus far.

This is where global investing shows its limits. Maybe the steal of the century, but Mr Mimetic is unable to know.

So, if you, dear reader, speak Korean or know somebody who ventures in the South-Korean markets, and can get some insight on what is going on right here: please drop a message - and who knows?

10. T&L

T&L Co., Ltd. develops medical polymer material products. The company was founded on June 9, 1998 and is headquartered in Yongin-si, South Korea.

So, when you need a cast for a broken arm nowadays, you can choose the color. (Yet somehow it turns out mostly blue?) And the casts are made of a different material than they used to be. Not that messy white gooey stuff. That new material is polymer. And that colorful cast material is exactly what T&L produces.

They also make other stuff, like bandages for wet wounds.

Stock Price appears low, yet they seem to suffer from margin contraction a bit. (higher costs?)

Same problem as with Cheryong, however: not enough information is available for Mr Memtic, besides the numbers.

Are they market leaders? Low-Cost producers? Is it proprietary? What is their edge? What is their shtick?

The same applies: whoever can dig into our South Korean bandage-maker is welcome to do so. And mr Mimetic will happily share that info with all of you.

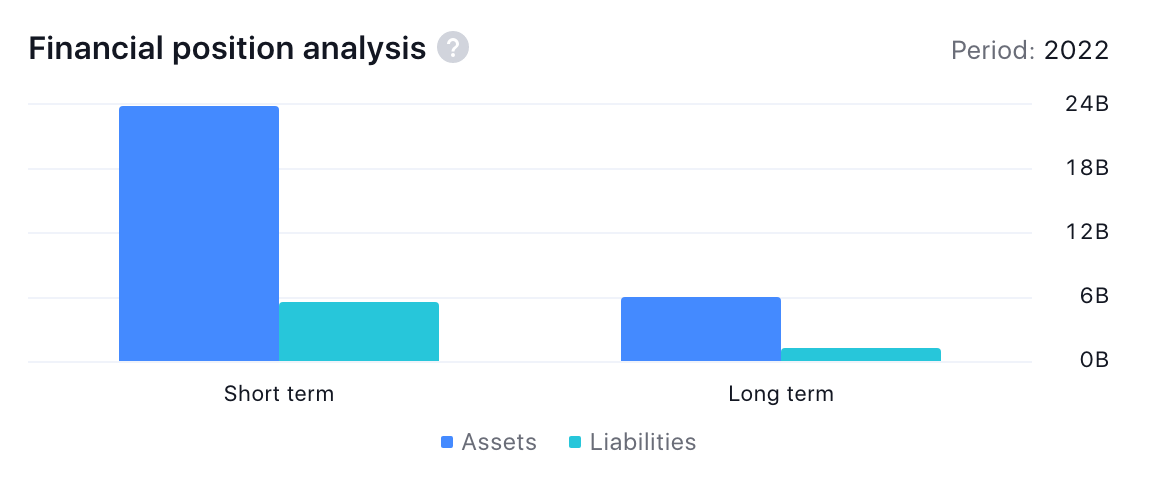

11. GLOBAL EDUCATION

Global Education Ltd. engages in the provision of educational services: the training of soft skills, consultancy, financial management advisory, information technology, and marketing and branding. The company was founded on June 30, 2011 and is headquartered in Nagpur, India.

India is Mr Mimetic’s favorite market for the coming decades. Demographically there are a lot of similarities between India now and the United States in the 1950s, so the hypothesis of Mr Mimetic is that India has the best cards to become the SuperPower of the 21st Century.

Due to the traditional Caste System, education is the best bet for young people to secure and control their own future; which fuels an upward dynamic akin to The American Dream. Who cares about Caste when you can build an App?

“The focus of GEL has been in delivering skill and educational interventions to the sections of societies and parts of the country where they are most needed and where the youth have limited exposure and lack access to opportunities to achieve their career or livelihood goals” - 22/23 AR

Competitive Advantage?

The company is “standing a class apart due to technology enabled business processes, digital content delivery and 24 x 7 support for the skill development and professional courses offered” - 22/23 AR

Mr Mimetic is having doubts about the moat of the business, although he understand there is a relationship with physical universities/schools? (In reality, they simply do some management/logistics for these physical universities?)

Growth prospects?

The aim of the Government to raise its current gross enrolment ratio to 33 per cent by 2023 will also boost the growth of distance education in India. India has the largest population in the world in the age bracket of 5-24 years with 580 million people, presenting a huge opportunity in the education sector. - 22/23 AR

So, slam dunk?

Nah.

Apart from moat (the pie is really big at the moment), the biggest hurdle is Insider Ownership again. Over 70% is owned by someone who is not even on the board, through 2 different entities. Information is super scarce. Again, management & directors don’t have their fortune and livelihoods vested in the company. Also, there were some shady “conflicts of interest “ in the past, with personal loans to executives and insider dealings with a university and such.

You know what? Mr Mimetic plans to do a deep dive into the education industry in “demographically highly optional countries”, with a special focus on India.

The structural tailwinds are such, that we don’t have to settle with the first company we come across. The ground is so fertile, that we might take some extra time and effort to maximize the potential harvest.

Something might be off about Global Education, and we might find our Cinderella yet.

TO WRAP IT UP

One of the above did make it into the Mr Mimetic Fox Fund. Mr Mimetic's guess is you will esily figure out which one exactly?

However, this is not the end of it.

The list continues (there are 3 parts), including 2 other companies that made it into the Mr Mimetic Fox Fund. Expect the rest of the list in the coming weeks. (As the evaluation of our “Multibagger” shortlist).

Hmm, it turns out that screening isn’t such a bad starting point for inspiration, after all.

As for now, thank you for reading. Much appreciated.

Kind regards,

Mr Mimetic

*As of the 17th of October, the sisters decided on a sale of the company, pending shareholder approval. A win for Alluvial Capital and Wintergems; a missed opportunity for Mr Mimetic.

If you like this post, you may want to click on the like button or share it with your investing friends and acquaintances.