Can Perplexity (AI-search) help you find great companies? Let's test that.

Where Google meets Open-AI.

This is not an endorsement. Just a little experiment.

Mr Mimetic recently read this lede in his local quality newspaper:

"Searching with Google feels increasingly outdated. An AI chatbot, on the other hand, can behave erratically, and you have to ask the right question. According to more and more people, for the best of both worlds, you should turn to Perplexity."

Keen to find out, Mr Mimetic prompted Perplexity.ai with this:

This was part of the answer:

Perplexity footnoted sources and everything:

So, we land on a page of the Marcellus Little Champions Fund.

First of all, it is a Small Cap Fund from India. A country with the right kind of demographic setup (a lot of young people) and incentives (meritocracy can beat the traditional social immobility of the caste-system) to have a prosperous economy.

Somehow, Mr Mimetic formed the idea that India is not unlike the United States in the 1950’s. The second half of the 21th century might very well be the age of India as a superpower…

Moreover, the Marcellus Little Champs Fund is quite generous with information about the holdings and its philosophy. Quite a few things to like.

THE MARCELLUS LITTLE CHAMP PHILOSOPHY

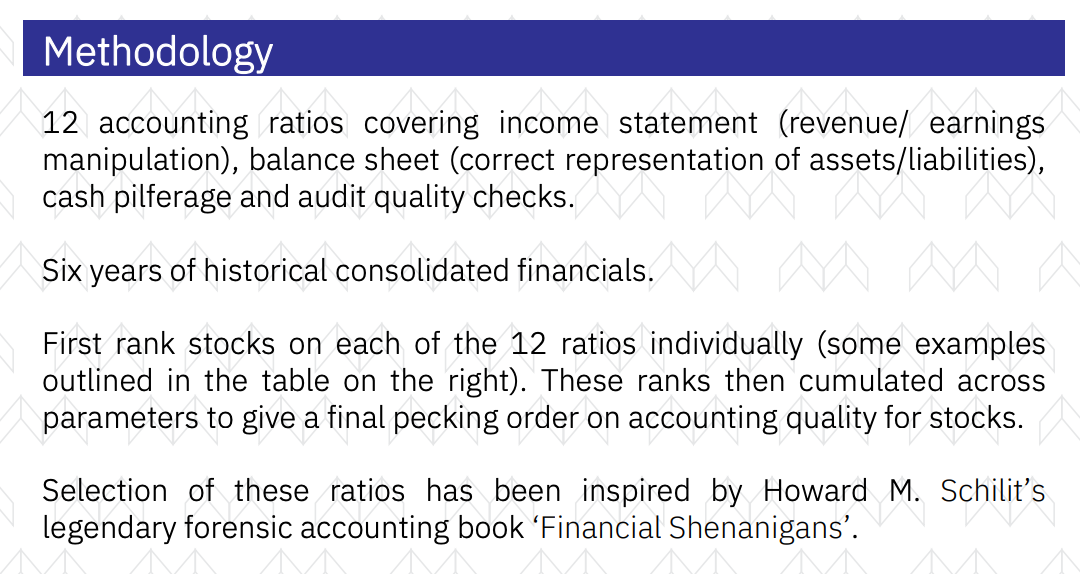

It all starts with accounting hygiene:

Mr Mimetic agrees that one of the few income lines that probably really matters is Cash from Operations* :

“CWIP to gross block” and “Growth in auditor's” remuneration” is something Mr Mimetic hasn’t encountered before as a metric to consider.

Both are listed in this article by the Indian Economic Times as signage of “dodgyness”:

Apparently, auditors can be paid into collusion in India:

“CWIP to gross block” is also something totally new to Mr Mimetic. Mostly relevant for industrious companies?

Mr Mimetic can agree with most of the statements and findings in the presentation. For example, they illustrate exactly the reason why the Mr Mimetic Fox Fund is restricted to under 2 billion US$ market cap companies:

Has Mr Mimetic found his brother-from-another-mother in terms of fund-characteristics?

The proof is in the pudding.

Unfortunately, the recent performance of the fund has been quite underwhelming:

But that is something Mr Mimetic can relate to.

Since 2019 the annualized return is 16%. Not bad, not superb. Very decent.

The goal of Mr Mimetic is to search among the 24 Little Champions of the fund, in the hope of finding a special kinda company, that might be on track to be a future elite company.

If we put those 24 little champions through our own 10-item filter process, which company would turn out on top?

THE 24 CHAMPIONS

All the holdings are neatly listed, with some relevant information.

Let’s go through them, step by step.

STEP 01: MARKET CAP

Since all the companies meet our first requirement (under 2 billion US$ in size), step 01 is de facto the whole list.

STEP 02: REVENUE GROWTH

As ever, let’s weed out the companies that weren’t able to grow revenues at a 15% CAGR clip (or in the last year). A company that isn’t able to grow earnings consistently at a decent pace, over a longer period of time, isn’t likely to become part of the 1% best-performing stocks of the next 5 years.

And that is exactly what we are looking to build: a collection of elite companies.

Taking the revenue growth into account, we are left with a list of 19 contenders:

Now, Mr Mimetic is well aware that some of those companies might be poised for great future revenue growth - something you can only find out when you dive into the Annual Reports, Call Transcripts, and Presentations and make a judgment call.

It’s just a question of efficiency: as for now Mr Mimetic is looking for a company that has been growing at a great pace, to then figure out if it will continue to do so.

In other words: companies mid-journey, not at the start of their upsurge.

STEP 03: MARGINS, RETURNS, RATIOS…

Not all margins are created equal. Depending on the moat, a lower margin might be more valuable in the long term, and a high margin can be vulnerable.

The “RoCE” in the Marcellus table seems to signify Return-on-Common-Equity, which is most likely:

Net Income / Last Years Equity

Or the average of the equity of (current year + last year).

Since both Net Income and Return on Equity don’t accurately show real-world economic value nor value creation, and can be obscured by leverage…those aren’t the best indicators.

Apart from that, we can expect a RoCe of 15% to be necessary as a minimum to play with the elite pack.

So now we have 14 companies that we should check on expanding margins:

Expanding margins is a possible sign of a flywheel effect, where every extra dollar contributes more to the bottom line than the previous one.

With some benefit of the doubt, these 10 companies are still standing:

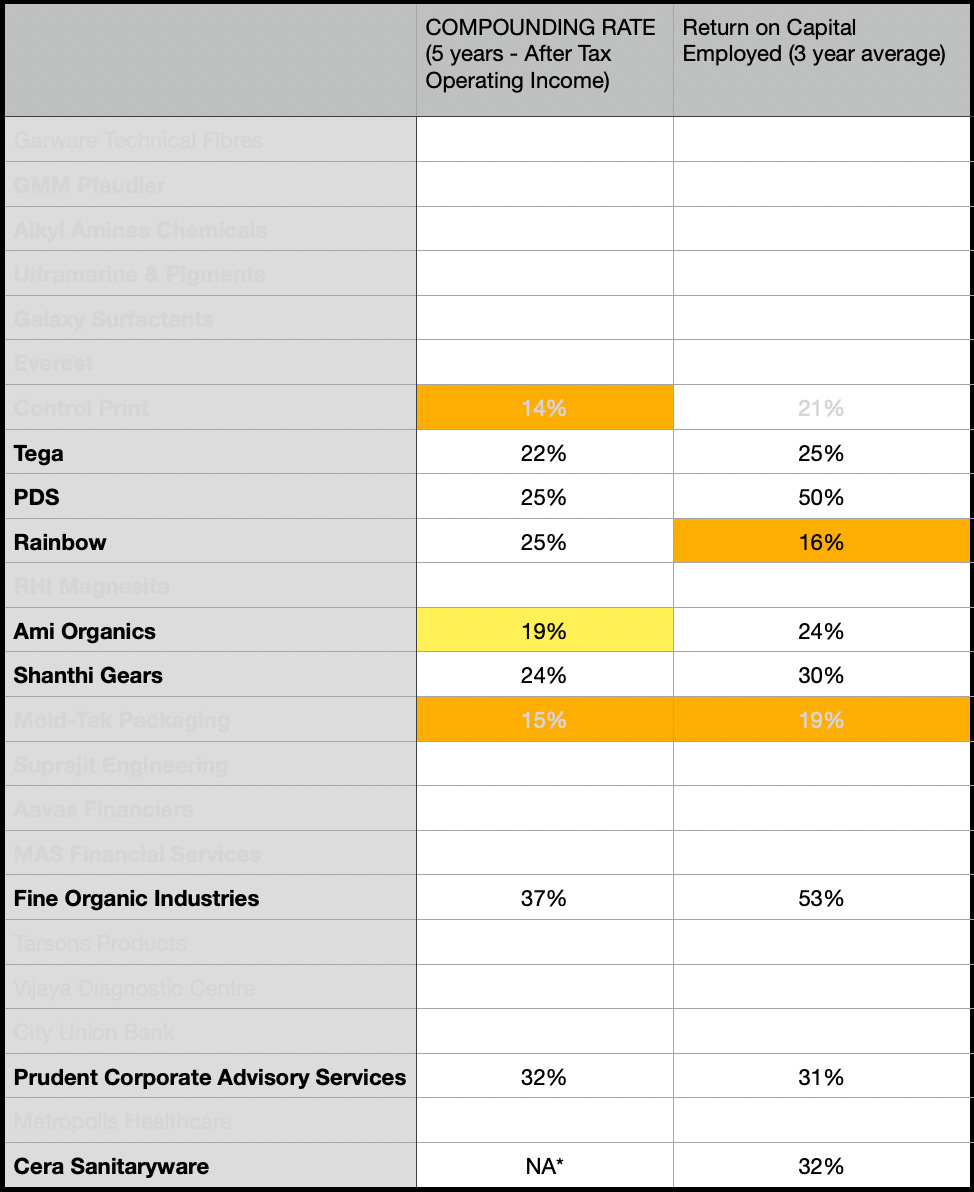

As we have noticed with previous companies that are part of the Mr Mimetic Fox Fund, one particular metric (or “ratio”) seems to be the best predictor for future success: Compounding Rate.

(Now up over 300%)

As you might recall this metric was the basis of our prompt.

Basically, it measures if the company can invest in growth at a high enough return.

Since we are looking for companies that can grow their share price at around 25% per year, and Charly Munger warns us that…

"Over the long term, it's hard for a stock to earn a much better return than the business which underlies it earns. If the business earns 6% on capital over 40 years and you hold it for that 40 years, you're not going to make much different than a 6% return—even if you originally buy it at a huge discount. Conversely, if a business earns 18% on capital over 20 or 30 years, even if you pay an expensive looking price, you'll end up with a fine result."

…we are looking for companies with a Compounding Rate of at least 20%.

(The last 5% can be achieved through margin-expansion).

Moreover, as a rule of thumb, Mr Mimetic likes to see a rather high and consistent Return-on-Capital Employed.

Capital Employed is usually:

Total Assets - Current Liabilities - Short-Time Cash & Equivalents.

20% on average is the threshold.

8 companies left. Some of them look impressive.

STEP 04: INSIDER OWNERSHIP

As per usual in India, there is strong insider ownership with all 8 companies.

“In India, promoters play a significant role in listed companies. Since 2001, the average proportion of shareholdings by promoters has been stable around 50%.” - OECD report

Promoters are people who founded the company or who are running it.

“In principle, “promoters” denotes those persons that were instrumental at the time of establishing the company and those who are in control of the company” - OECD report

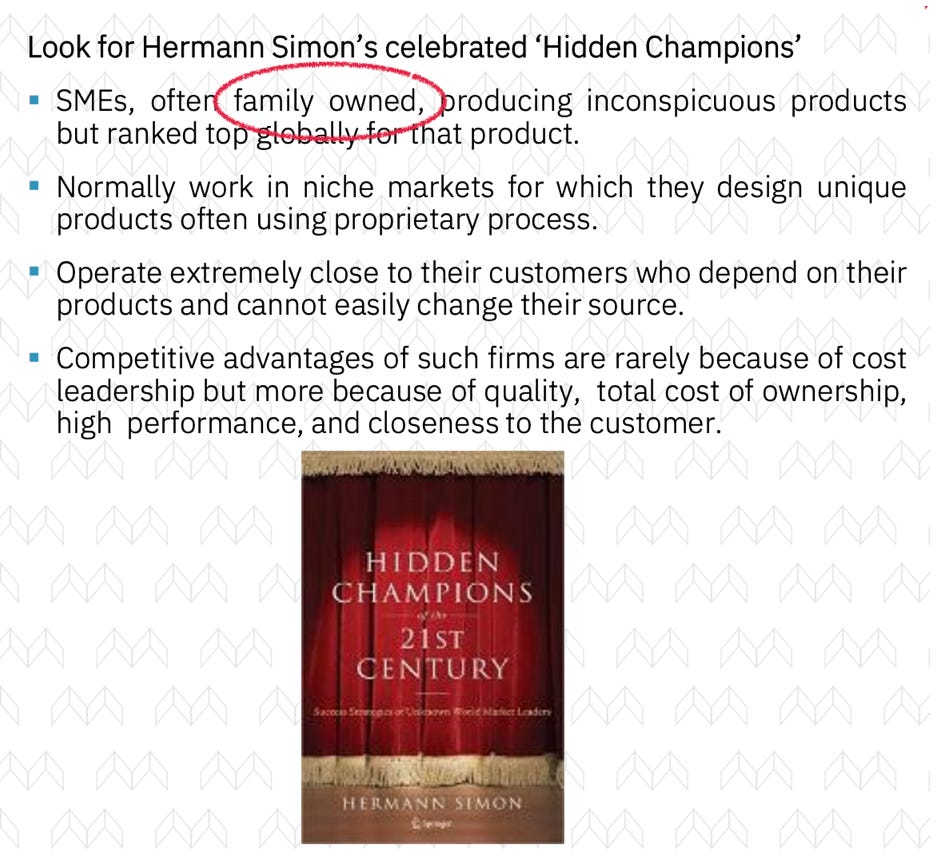

When we look at the philosophy of the Marcellus Little Champions fund, they mention the “Hidden Champions” research by Hermann Simon as an inspiration and strategy. One of the characteristics of those Hidden Champions is that they are often majority family-owned:

STEP 05: FINANCIAL HEALTH

Marcellus should have taken care of this already (Net debt/equity for all 8 companies is under 0.5), but just to be sure, we do a quick check on some metrics:

Looking good. Marcellus did all that work already.

STEP 06: THE REAL DEAL

As always, this painting-by-numbers process is the easy part. But it’s not the part where investment returns are made.

Investment returns are made by predicting the future:

Will this company be able to keep on achieving a high Compounding Rate in the coming years?

To consistently achieve a high Compounding Rate a few things must happen: the company must be in an industry or region or mindset where it makes sense to keep on investing in growth, the company must be able to do so while staying highly profitably in every step of the way, and the company must have a competitive position in its market that doesn’t allow for other companies to steal customers.

TLDR: can they acquire more customers in the future, while keeping their current ones, and be highly profitable in doing so?

In practice, Mr Mimetic needs to find out, first:

the Competitive Advantage: have something unique that is not easily copied

then:

the Barriers to entry: competing in an industry that has a natural moat

Since the Marcellus Little Champions Fund follows the “Hidden Champions” path, there is reason to believe the remaining 8 companies are in a good competitive position, as typical “Hidden Champions” are usually market dominant or even monopolistic.

Is this so? Let’s have a closer look.

Since Perplexity couldn’t give me an answer…

…we turned to traditional Search:

That works! They neatly describe the investment rationale for each company when added to the Fund:

Mr Mimetic did this for the other 7, then asked Perplexity to summarize the findings in 1 sentence:

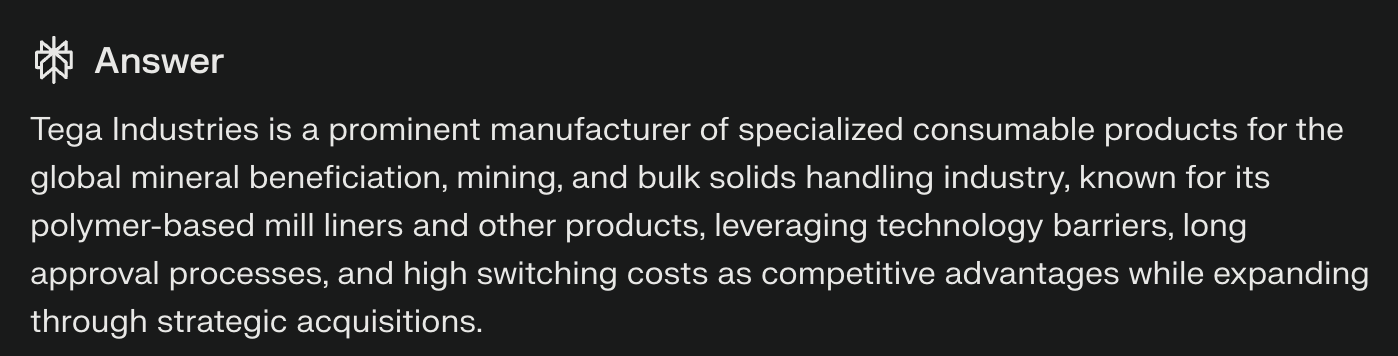

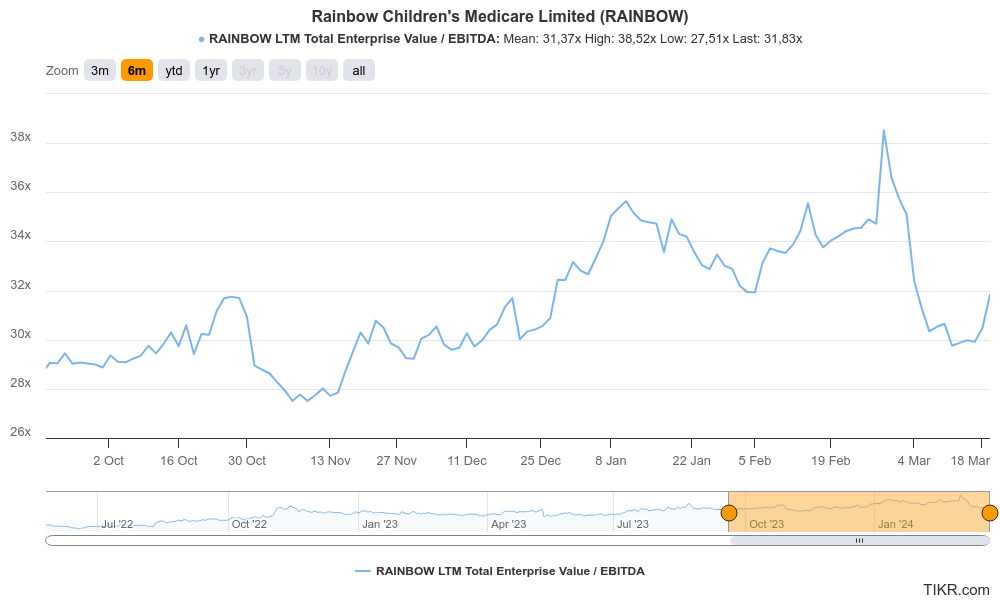

TEGA

PDS

AMI ORGANICS

SHANTHI GEARS

This is too sparse, so we asked additional questions until Perplexity produced this:

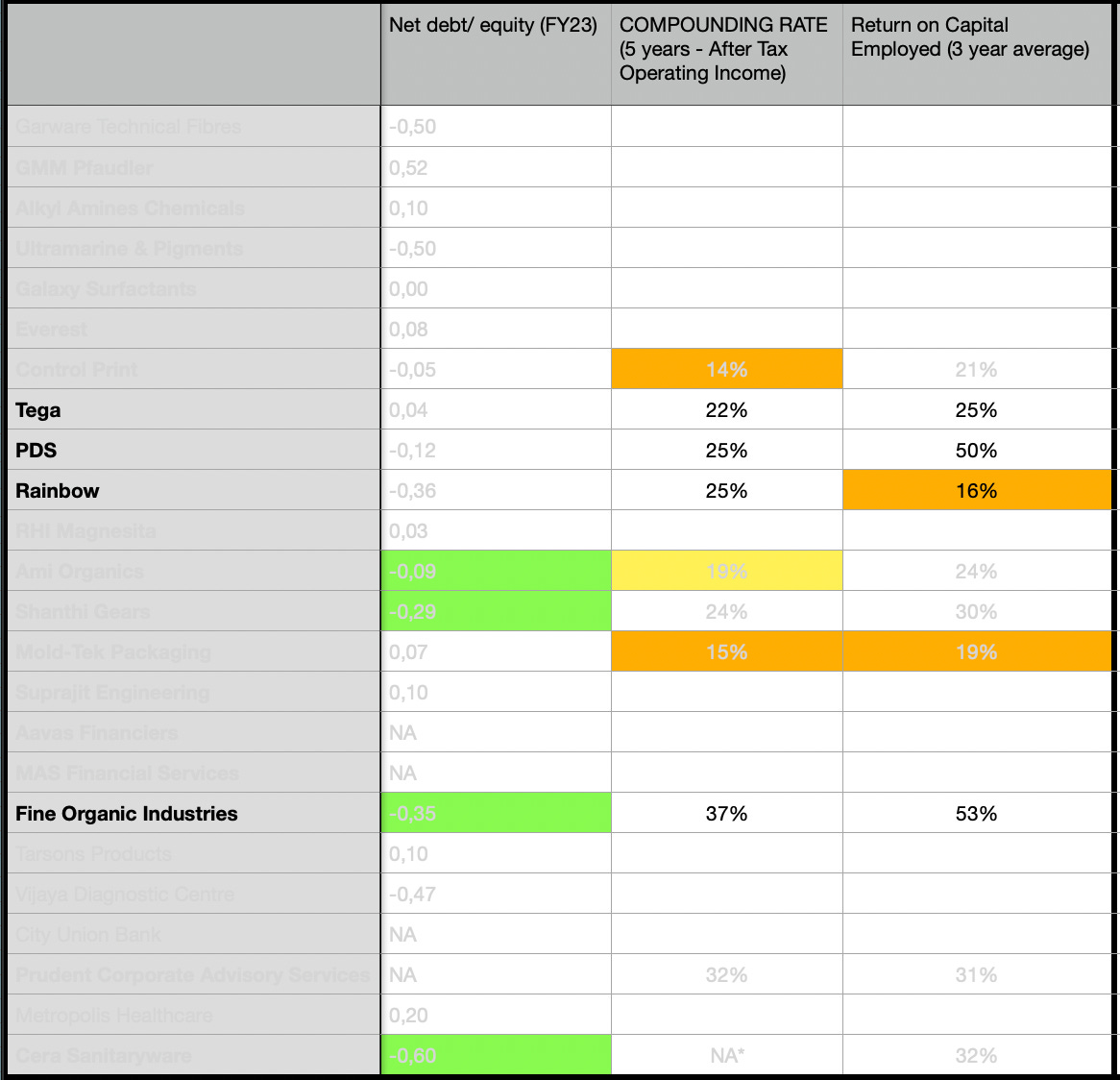

FINE ORGANIC

PRUDENT CORPORATE ADVISORY SERVICES

CERA SANITARYWARE

Based on the information given, Mr Mimetic deduces that Shanti Gears, Ami Organics, and Cera Sanitaryware are the most vulnerable in terms of competition.

Mind you, Mr Mimetic can be totally wrong about this assessment. This isn’t a deep dive. This is pattern recognition, motivated by efficiency.

Or laziness, you can call it.

CERA (they make faucets and sanitaryware) will most likely be part of a growing market, but is the nr 2 player and relies on distribution and brand awareness. They will probably do great, but Mr Mimetic can find too few reasons for their customers not to ever switch suppliers and too many scenarios where they could.

SHANTI GEARS recently changed from being a bespoke gearbox builder to being an efficient standardized product supplier. This is great for the short-term financials but makes them more vulnerable to competition. From premium, they stepped into a more commodity-like environment.

AMI ORGANICS made some acquisitions to diversify away from dependence on the Pharma Sector. This is like admitting to guilt in a court of law when it comes to competitive advantage.

About PDS, Mr Mimetic doesn’t have enough information as of yet - but does like the “value-added-seller” platform business model, how counter-intuitive it might be. (How can a simple reseller of other people’s products be a sticky, moaty business model? Through relationships, local monopolies, and the network effect, that is…)

STEP 07: BARRIERS

How hard is it to do what they do? How easy is it to do the same? Is it technically difficult, juridically impossible, or financially costly?

About TEGA we can read:

“The application is so niche that products not having sound technical standards tend to fail”

They do a really hard thing, that is mission-critical for their customers, with a really high cost of failure.

FINE ORGANICS isn’t so easily replaced, either:

high quality alongside consistency, customisation, safety (since these are used in food products) and environmental considerations create strong barriers to entry

RAINBOW CHILDREN’S MEDICATE is a niche pediatric medical hospital chain, retaining top talent and thus creating a strong brand:

Rainbow’s scale allows it to retain the existing talent (high volumes means more money for doctors) as well as run one of India’s largest govt. approved fellowship programmes for DNB pediatrics to create a continuous talent pipeline for fresher pediatric specialists. This flywheel is difficult to replicate for any new entrant in Rainbow’s core markets.

PRUDENT has great economics and can grow without extra costs, in a market that is far behind and has a lot of catching up to do. But in the end, it is a mere distributor of Mutual Funds to non-bank Financial Advisors. For Mr Mimetic this screams “commodity” and “disruption”. The bulk of Funds just doesn’t have an edge when compared to ETF’s and Mr Mimetic personally really despises people who try to push financial products (they don’t need) down people’s throats, with absolutely unnecessary administration fees. Prudent will do well, but there is no reason to.

PDS is part of a very competitive industry. They were part of a Business Harvard Case study, that doesn’t beat around the bush:

But we are not done with PDS as of yet, since they innovated their value proposition to clients - and this might be somewhat harder to replicate.

STEP 08: ACQUISITIONS

Only 4 are left:

PDS

RAINBOW CHILDREN’S MEDICATE

TEGA

FINE ORGANICS

When we look at the 50 years history of FINE ORGANICS there is no mention of any acquisition:

The others do:

TEGA

RAINBOW

PDS

Judging by their Compounding Rate (the amount of cash invested in future earnings and the returns on that), they didn’t do foolish things in that area:

Obviously, a more in-depth look is needed before pulling the trigger.

STEP 09: DISTANCE ANALYSIS

Inspired by Nick Sleep of Nomad Partners fame and Atmost Invest…

…we included an extra hurdle to our investment checklist: distance analysis.

How far can these companies likely grow? There is nothing wrong with being the dominant player in your limited niche market and this can make a great investment, but it isn’t what we are looking for.

We are looking for future dominance. Can the company grow 10 times or even 100 times, when they continue what they do and do it well?

It comes down to their value proposition to the customer, how hard that is to compete with or to replicate, and how big the potential market is.

One that is really easy to judge, is RAINBOW:

“As on date, the Company along with its subsidiaries has an existing total bed capacity of 1,715 beds in India.” - jan 2024 press release

When Perplexity is asked “how many pediatric hospital beds are there in India” the answer seems double encouraging:

With a population of over a billion, India has only 900.000 hospital beds?

The source Perplexity gives is solid, though: a 2012 article Mr Mimetic can find on PubMed. The numbers are by the WHO, although that link is dead.

A recent Economic Times article gives us:

And Business Today article (featuring Rainbow) from 2015 gives us:

There are close to 2,000-plus paediatric beds in India. This translates into a market size of about Rs 1,500 crore. The overall paediatric market in India is about Rs 55,000 crore

From the latest Investor Presentation, we can see the growth plans up to 2027:

So, can Rainbow become twice as big, 3 times as big, 10 times? Yes, they can. Only the pace they do it in is at about 10% per year. A 50% growth in 3 years time is respectable, though.

Can they -in time- have 20.000 beds in capacity? Yes, they can. They grew to where they are now from 50 beds at the outset.

Next in line is TEGA.

Management highlighted global steel mill liner market (ex-China) currently stands at US$900mn (Tega’s market share is 5%) and composite mill liner market size is US$400mn (Tega’s market share is 16%) which is likely to grow at 2-3% CAGR. - Trendyline

Meanwhile, TEGA bought McNally Sayaji Engineering (who were in financial trouble) to expand their addressable market.

As they see 15% CAGR in the coming years, it it easy to see a path where they double in size.

Since the market they play in, is already rather oligopolistic (5 dominant players) however, a path towards 10x is only achievable through big acquisitions or mergers.

Anything goes, but the path is less clear and the total addressable market more cornered.

Revenues for PDS are flat on the quarter, declining the half year before that, and there is no optimism:

Though global markets impacting growth - latest Investor Presentation

At the moment PDS does about 1 billion US$ in revenue, translating in something like 25 million US$ net income or 60 million US$ in Cash from Operations. (These are the margins Amazon used to have, before the AWS engine.)

But that platform though… What is it? How do they make money?

built a design and innovation-led, plug-and-play platform that not only performs in an asset-light manner – infusing scalability and robustness into the business – but also promotes a large entrepreneurial ecosystem alongside its entire value chain.

Basically, they give individual entrepreneurs a chance to join their network and are de facto a mediator between fashion brands and textile producers/manufacturers. They manage that relationship, manage overhead and logistics, etc.

PDS boasts a network of 550+ compliant partner/vendor manufacturing facilities and over 150 designers

This is a great idea and visionary. But Mr Mimetic isn’t convinced it is enough to sweep the competitive landscape and turn 1 billion into 10 billion or 100 billion.

Although they are willing to try:

FINE ORGANICS is the go-to source when you want to replace your synthetic chemicals with natural additives. Usually, the cost of those additives is less than 1% of production cost, but they can make all the difference. Like a pinch of salt in a dish.

Fine Organics has already an extensive network of clients and distributors but has under 400 million US$ in revenue.

“There is a huge opportunity for growth in the oleochemicals market. This growth is driven by increasing demand from pharmaceuticals, food and feed additive segments.” - Annual Report

Although revenues are down for the year (compared year-over-year), Mr Mimetic can see how they become a 4 billion US$ company in terms of revenue.

CONCLUSION:

Rainbow and Fine Organics have a clear path ahead.

But is that enough to become part of the Mr MImetic Fox Fund?

STEP 10: PRICE - VALUE IS WHAT YOU GET

Mr Mimetic sets the bar at around 15 times EV/EBITDA.

As an alternative measurement -to account for growth- we conducted the Mr Mimetic Fox Score, calculated as:

(EV/EBITDA)/Compounding Rate

Currently, EV/EBITDA for FINE ORGANIC is 21,10

This translates in a MMF Score of 0,66 - while Mr MImetic likes to see a score under 0,50.

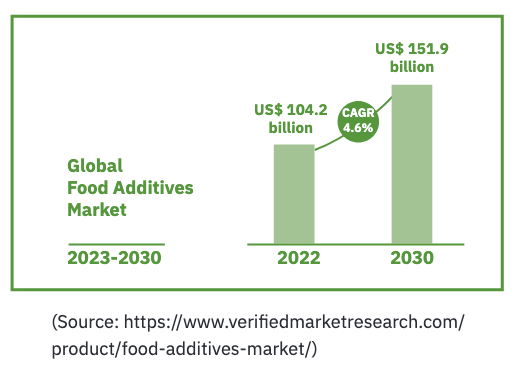

RAINBOW CHILDREN’S MEDICARE is even more expensive: an EV/EBITDA of 28,39 and an MMF Score of 1,19.

This elevated pricing is part of an overall trend in the Indian Stock Market:

So no, how wonderful those companies both seem to be, the valuation is not to Mr Mimetic’s liking.

Patience is a virtue.

IN TERMS OF “PERPLEXITY.AI”

Is it an additional tool for the eternal search for great companies? Yes, it is.

It doesn’t know all the answers and is to be used in addition to traditional search and AI agents that can read pdf-documents.

But Mr Mimetic was happily surprised and added Perplexity.ai to his bookmarks.

Kind regards,

Mr Mimetic

If you liked what you read, consider sharing this post with your investing aficionados.

A FEW SOURCES

*the most relevant would probably be “Residual Earnings”: operating earnings above the cost of capital, as defined by Accounting Hall of Famer prof. Stephen Penman.

The original article where Me Mimetic learned about Perplexity

Insider Ownership in India.

Spotting shenanigans in the Indian Stock Market

Pediatric Hospitals in India

Hospitals Beds in India

PDS is innovative - a puff piece.

Indian Stock Market Overheated