This stock outperformed Constellation Software, Lifco and Judges Scientific. Will it do it again?

This company had a better run in the past 5 years then those famous serial acquirer All-Stars. Will it outperform them again in the next 5 years?

PROBABILITIES OF FINDING A TOP-PERFORMING STOCK

“At the end of Q1 2022 the total number of listed companies stood at 58,200” according to The Word Federation of Exchanges Research Team. Off those 58200, about 10.000 companies are good for 90% of the market cap worldwide.

When we are to believe the analysis by Alta Fox Capital, you have a lot more probability of finding a company that is among 1% best-performing stocks over a period of 5 years, when the market cap is under 2 billion US$ at your time of purchase.

So, give or take, you have circa 40.000 companies to choose from, which would be under a 2 billion US$ market cap. Maybe more, maybe less - but this is irrelevant to the point Mr Mimetic is trying to make.

And that point is this: when looking for the best 1% performing stocks over a period of 5 years, starting with a market cap under 2 billion US$, there are about 400 companies out there in the wild that would fit the bill.

That is quite a lot.

The only thing Mr Mimetic has to do is NOT choose one of those other 57.400 companies, which will be the 99% worst performers over a 5-year period.

Right?

To do so, Mr Mimetic uses a little help from his aforementioned friends: the boys and girls at Alta Fox Capital -they don’t know Mr Mimetic, but he loves them anyway- published a research report that had one simple question:

What features have the top-performing stocks between 2015 and 2020 in common?

Combine those ingredients and you might have a sort of algorithm to minimize your chance of picking one of those 57.400 worst-performing stocks.

Starting off with a market cap under 2 billion US$ is one such factor. There are 8 more.

After reading that report Mr Mimetic decided to run an experiment: can a random fool like Mr Mimetic, using that algorithm, assemble a collection of stocks that will be among the greatest performers in the next 5 years?

Mr Mimetic decided to call that experiment The Mr Mimetic Fox Fund. You know, since there is no ego involved at all.

How many of those 400 stellar stocks that will outperform all the other listed companies worldwide can Mr Mimetic find?

Hopefully, right now, Mr Mimetc found just one more…

HANDS IN THE AIR: THIS IS A ROLL-UP!

The Poster Children for niche roll-ups are Constellation Software, Judges Scientific, and Lifco. This is how they fared against the S&P500 during the past 5 years:

The recipe for niche roll-ups is quite simple: you find a company with a critical mission product, that is the solid market leader within its niche, small enough for outside competition not to bother.

You buy them at a multiple that is lower than the run-of-the-mill multiple in the public markets (e.g. because growth is limited within the niche OR because the founders cannot find a successor and they want to retire, you can buy them at a reasonable price).

You then get out of their hair, and let them do what they do best, maybe with a few tweaks here and there based on the best practices you picked up along the way.

Do this a few times, combine those niche players together in a public entity, au passant you use the cash they send you to buy more of those niche beauties, and what you have right there, ladies and gentlemen, is a money printing machine.

Constellation did it in software, Lifco in tools (among others for dentists), and Judges Scientific for specialized lab equipment.

Of those 3 Constellation and Lifco are too big in terms of market cap for our criteria and Judges is too expensive. (Full disclosure: Mr Mimetic holds some Judges in his personal portfolio).

No panic, however, we did find a nice niche roll-up player in the fine city of Empoli, Italy.

In terms of stock market action, Mr Mimetic found that this proud jewel on the Empolian business crown compares very well head to head with Judges Scientific, although (as you will find out later) it is much cheaper. We are talking magnitudes, multitudes cheaper.

As an exercise, Mr Mimetic will compare “Empoli” with Judges Scientific, Constellation, and Lifco on every aspect of our investing criteria.

Let’s see how it holds up?

PAINTING BY NUMBERS

When we compare Constellation Software, Lifco, Judges Scientific, and our “Empoli” company according to some of our mathematical criteria, we get this:

Apart from the market cap limit of 2 billion US$, CONSTELLATION SOFTWARE would not meet our criteria in terms of Margin Expansion, EBITDA growth (minimum CAGR of 15%), and the fact that we expect EBITDA to grow faster than revenue.

Insider ownership is debatable: do you want the founder-operator to control the company or do you want to have most of his personal wealth tied to the fortunes of the company?

Where Lifco, Judges, and our “Empoli” company fail is in revenue growth. They do make up for it in terms of EBITDA growth, so Mr Mimetic is leaning towards clemency there.

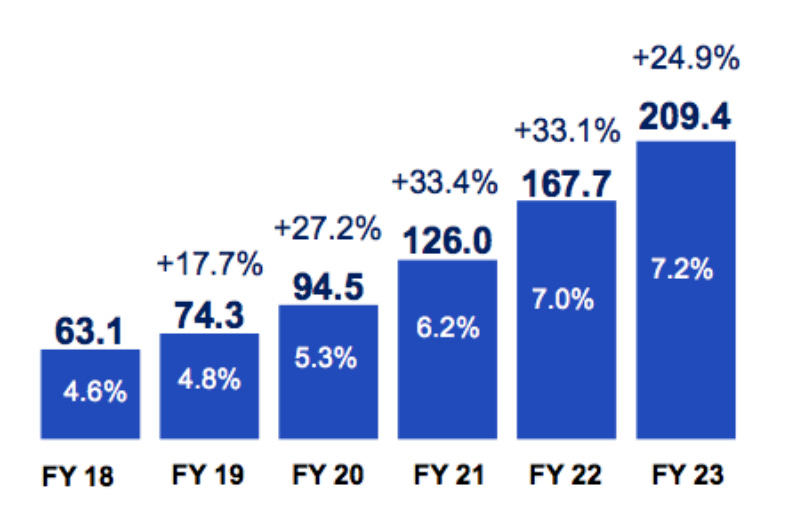

Besides, the table goes from 2018 to 2022. When you look at the CAGR for the last 3 years until 2023 you get a nicer picture for “Empoli”:

Moreover, we can see that “Empoli” is growing EBITDA faster compared to revenue than any of the others, but we also see that the Margins are really really low compared to the Roll Up All-Stars.

The good news there is that these margins are bound to go up, due to the nature of the latest acquisitions. Since 2015 “Empoli” has done over 60 acquisitions, with increasingly better structural margins.

This is a list of acquisitions since 2022:

You can see that the higher margin acquisitions bring in less revenue and vice versa but still, there is a nice historic uptrend that is bound to continue in the years to come:

The acquisitions done in 2022 and 2023 carry a combined margin of 17% for 200 million in revenue:

This will bring them to 8% margin in no time…

You can also see, more often than not, they buy only 51% of the companies they acquire, which suggests the founder-operators of the original companies (or their families) stay involved with the business.

“Deal structure focused on the long-term commitment of skills and key people of the target companies”

- Empoli Shareholder Presentation

Mr Mimetic sees that as a plus.

So far, 5 of the 9 criteria on the list have been checked:

HEALTHY AND CHEAP

Meanwhile, updates by professor Aswath Damodaran of NYU show us that the average Return-on-Invested-Capital is 15.79% (excluding financials). The average cost of capital is 10.01%.

(Mind you, this is a calculation by sector worldwide and then averaged out)

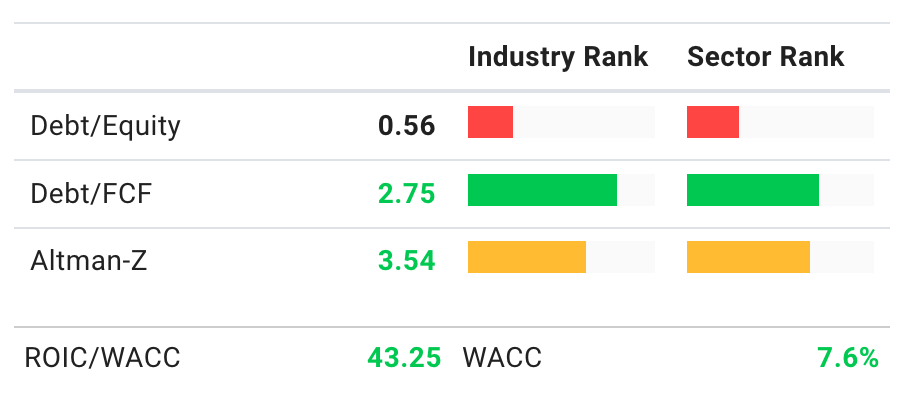

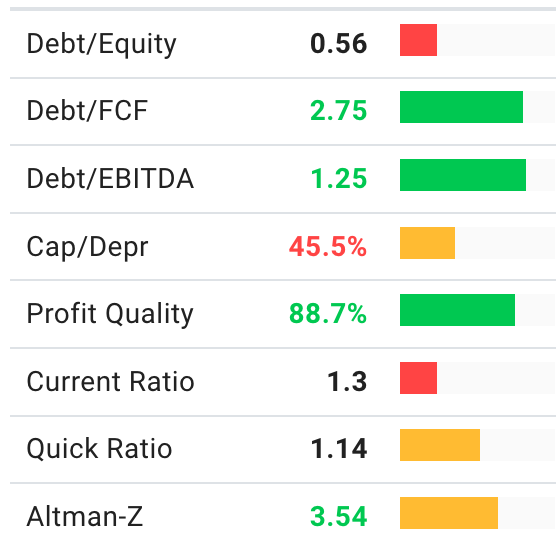

For a WACC of 7,6% “Empoli” has a ROIC of 17,69% and even a ROIC of 40,42% when excluding cash. Strip out Goodwill and we get to a massive ROIC of 328,7%.

Debt is low, compared to FCF and EBITDA.

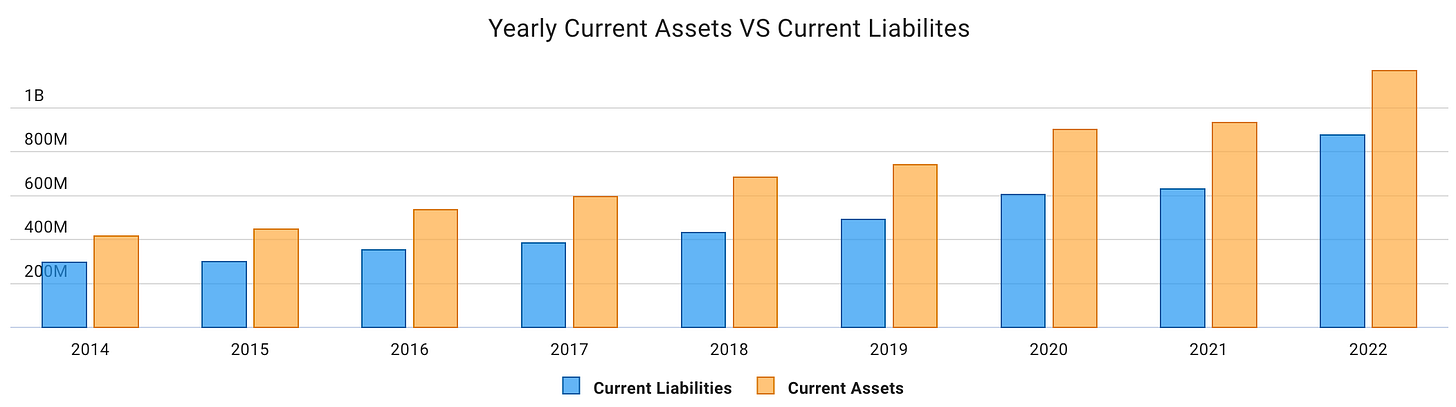

Liquidity is not an issue:

All in all, “Empoli” will likely have no problem covering liabilities and has room to take on more debt to boost the acquisition rate when necessary.

Despite all these great numbers, somehow the stock price started a steady decline since November 2021, losing over 40% in valuation.

Notwithstanding this down-trend, the yearly return for the last 5 years is still 30%, from 28€ in July 2018 to 106€ as of today:

This makes “Empoli” super cheap when compared to its niche roll-up peers and when you account for growth and expanding margins:

Is this stock price decline due to pessimism in the national Italian economy? Is it due to inflation? The end of cheap capital? Is it because they upgraded from the small cap to mid cap market? Mr Mimetic couldn’t find a clear-cut answer in the Annual Reports, press releases, nor in the Earning Calls.

The market they operate in was flat and this might have spooked some investors.

Meanwhile, the FY 2023 numbers have shown no sign of weakness in the business lines or Empoli’s capacity to grow.

All in all, this gives us a stellar 7 out of 9:

THE LAST HURDLE

Is “Empoli” active in an industry with high barriers to enter + does it have a competitive advantage, that makes it stand out from its peers?

We know Constellation Software, Lifco, and Judges Scientific have (mostly) high-quality companies in their portfolio. Actually, we don’t really know. It is by the sheer reputation of the holding company, and the consistency of bringing home the numbers, year after year, that we presume their holdings are all quality companies. Management says so, and we don’t have reasons to doubt.

“Empoli” has lower-margin businesses in the fold. This makes one suspect there is a more commodity-kinda situation going on right here.

Things like cloud services and data centers.

Some suspect the decline in share price is because of just that: some of their business lines are seen as non-defensible in a tight market.

However, the businesses of “Empoli” are market leaders with a strong market share. This might give them a better chance to be the low-cost producer when competition heats up.

Also, “Empoli” is in the business of digitizing the Italian Economy. Italy is far behind the rest of (Northern) Europe. A 26 billion € funding program will be spent to help Italian businesses rapidly catch up.

This is a huge tailwind for “Empoli” - despite the danger of stronger competition, tighter markets, etc.

Even in the event that they lose market share, they might win in absolute terms.

To sum it up, Mr Mimetic suspects at least some of the business of “Empoli” has no high barrier to enter. Some of it has (vertical software), some of it might not. It’s a mixed bag.

However, Mr Mimetic thinks “Empoli” is best positioned to grab market share of weaker companies and exploit the coming digitalization wave in Italy’s Small and Mid-sized enterprises due to its ability to invest in R&D, bolt-on acquisitions, and acquisitions outright.

If Lifco or Judges Scientific was trading at this price, there would be no doubt.

Now, Mr Mimetic is doubtful about some of the commodity-like nature of the business units under the “Empoli” umbrella.

Because of some characteristics -the founder still at the helm, quality of management, keeping legacy key players in charge of the acquisitions, acquisitions bought at 5 EV/EBITDA, their focus on SME’s, growth trajectory not disturbed despite a decline in sector growth, growing margins, political tailwinds - Mr Mimetic thinks the probability that “Empoli” will come out as the winner in the spaces it operates is higher than the probability you are overpaying right now.

Therefore Mr Mimetic likes to add “Empoli” to the Mr Mimetic Fox Fund.

THE REVEAL: WHO IS “EMPOLI”?

Kind regards,

Mr Mimetic

A FEW SOURCES

Some research by The Word Federation of Exchanges.

A professional investor in Sesa Group.

How many stocks create the market cap?

This report by Alta Fox Capital started this experiment.

Some great data by Professor Aswath Damodaran

A look at value creation in the Swedish stock market.

The investor relations page of Sesa Group.

The investor relations page of Constellation Software.

The investor relations page of Lifco.

The investor relations page of Judges Scientific.

Mr Mimetic used Tikr Terminal, Chartmill, Yahoo Finance, Gurufocus, and Financial Modeling Prep.

Chris Mayer of Woodlock House (and 1OO-baggers fame) on serial acquirers.

Hey Peter,

Indeed, in the end it is performance per share that counts. Since Sesa doens't dillute its share count, the per share calculation doesn't change anything material, in this case. Also, share count is a financial/accounting measure. Our first, dirty look is motivated by finding out if a company is economically able to grow (double) revenue and earnings. (In reality we look at bit deeper: incremental EBIT, Operating Income after Tax, Residual Earnings, etc...) But you are correct: a per share count is the right reflex.

How do you not talk about the share count when you talk about earnings (or EBITDA) growth? Clearly share count is critical.