The Duopoly in Native Advertising. THE MAD MEN SERIES - part 4

Meet the ugly duckling of the advertising space

The Mad Man Series is a attempt to look at the Advertising Industry and seperate facts from myth. What will this space look like? Who can be the winners? And: are there any companies in this industry that can be part of the 1% best performing stocks in the coming 5 years?

“Every assumption on why people buy things, is wrong” - Rory Sutherland

Mr Mimetic has been brooding about this article (and the Mad Men series as a whole) since it touching on so many fundamental aspects on how the world chooses to communicate.

Facebook, Snap, TikTok, Google Search, etc are free. As more and more advertising money goes towards those platforms, companies are choosing to communicate with their customers in the lowest cost environment.

Is that really where you want to be? Is that the kind of relationship you want with your customer?

When you calculate it, you are seeing well over 100.000 ads a year. Online, in the supermarket, on the road,… Well, you don’t see them, actually. You hardly notice them. They are delivered to you, in the hope you will notice them.

So, the reality is: the % of the ads you actually notice is quite small. And the ads you engage with is an even smaller percentage. The ads you act upon is tremendously small.

Why even bother?

The only reason companies would even advertise on social platforms is because it is so damn cheap and easy to do. It is a volume play. Plus: you can experiment all you want.

Each year Mr Mimetic lets his students conduct an ad campaign for a local Mom&Pop shop, with a total budget of 100,- in our local currency.

It’s amazing how enthusiastic both the Moms&Pops are and how blown away the students are with how many people you can reach with “just” a hundred bucks.

But is it effective?

Ads are only effective when we don’t need them, so to speak. When I really want to have a local bakery in the village and someone decides to open one up, then it is effective for that bakery just to tell me: “Hi, there - we exist.”

When we want something already, it is fruitful to advertise your existence.

We know by now that the only way to really engage with people - to maybe persuade them that they might want something they don’t already want is through “content”.

Content that is valuable in and of itself.

When Mr Mimetic reads in the newspaper that people who don’t drink coffee in the afternoon have 16% less chance of dying during the 10 year period span a group was monitored? Well, Mr Mimetic stops drinking coffee in the afternoon. (Especially since the message was also: drink all you want before 12 o’clock, since that has no effect whatsover)

When Mr Mimetic reads that some type of motors can easily handle 500.000 kms without costly maintenance, then suddenly it becomes “cheaper” to buy a topline luxury second hand car than buy a middle range new car.

That kind of stuff.

That’s how you learn you want something, you didn’t want before.

As said, the key to that is not ads, it is content.

Content. Content. Content.

That’s why we wrote about “affiliate marketing” before. It is effective. Especially in terms of ROIC since the model is such that you only pay, when a sale is made.

It ensures that the content creater makes content that is as effective as possible, to earn his dime.

You can read about that here:

The Open Web

The company we will be talking about today is in the business of bringing the content to people who didn’t know they wanted that content. But they do.

That is what should set this company apart: that they will know better than anybody out there how to show you content you actually WANT, in the open web.

What is the Open Web?

Well, it’s called the Open Web, because there is a gated web.

They call it the Walled Garden.

The Open Web is available for everybody and not restricted by paywalls or subscription or even registration.

The Walled Garden is where advertising and content is controlled, through Meta, Alphabet, Amazon and the likes.

The philosophy behind the company is simple:

Content should be looking for you.

Not the other way around. Content shouldn’t just sit there and hoping you will find it, through search or haphazardness or whatever.

It should actively try to reach you.

In the movie Minority Report, they had the same idea:

With this caveat: you should only try, when there is a reasonable chance the customer will want what you are selling.

Otherwise, there is no use.

So, this is what this company does: it delivers content to your eyeballs, and gets payed when you act upon that message.

As the founder of this company explains:

“I realized that there are three ways people got to consume content: (1) Search: if they knew what they were looking for and could type it (2) Social: if a friend of theirs shared it (3) Opportunistic: they just happened to be on a page, or they happened to open their TV - What’s next? I was very passionate about solving and connecting people worldwide with content they may like.”

This is important, because of a trend that will emerge in the coming decade or so:

The internet will be read by bots, not humans.

So, in the days when you still used Google Search, you would’ve been as specific as possible in your search description, to maximize the chance that the first link Google came up with was valuable to you.

In reality, you had to wander through 10 or more different websites - get lost in a rabbithole on each of those websites and there you go: another day of your life, poofff, gone like snow in the sun.

Google started to display the answers of the query on their own feed, already.

So if you go out and say, who are the Yankees playing tonight, you used to have to click on the first result feed and go to ESPN and you'd get the answer there. Now Google just tells you.

Generative AI combined with web search is a continuation of that. With Perplexity, Co-Pilot and the paid Chat-gpt functions…you let bots read those first 10 websites or so, and then the AI-platform summarizes that content for you.

There is no need for you to search through those 10 websites. Only the ones you really, really like and you deem highly valuable will earn your visit. Maybe.

You don’t care about some website. Nor do you care about the article. You care about the content.

As of today, traditional digital publishers already have a really hard time, converting traffic to their websites.

Mr Mimetic goes dailly to 6 news sites or so to discover valuable content. Yet, almost everybody Mr Mimetic knows uses 2 news sources at most.

And apart from those 5 or 6 websites, there is no loyalty. There is no routine. It’s all context-based.

For example, every day Mr Mimetic shares all the sports articles of our favourite football team with his OG friends in a Whatsapp-group. (We still go to the games together).

After each game, Mr Mimetic shares detailled match statistics in the same Whatsapp-group.

None of those friends pay for the content. Mr Mimetic shares it. In a pdf-format. Or as a screengrab.

That is as of today.

But in the near future Mr Mimetic will set up a bot, that will scan trusted sources and summarize them, or even quote them as a whole: for example when Mr Mimetic indicates he likes to read interviews with people from his footbal club, they will be able to provide me those, word-for-word. Just will have to included “ad verbum” or “verbatim” in the prompt, or something similar.

This means that all the adds on the actual websites will not be read by actual humans, at all.

Mostly by bots.

This is hugely problematic for the today’s model of the Open Web.

The two-sided Problem for the Open Web

Say you have a website with dailly content.

It’s mostly for free, with some premium articles behind the paywall.

There is a certain conversion rate from “free readers” to “subscriptions” so you have every incentive to attrack more readers with the free stuff.

You have 2 problems:

how do I attrack more readers?

how do I earn money on my traffic?

You can optomize for Google Search etc, but this only brings you so far. And the effect is in decline.

What you need is:

others talking about you

others paying you for your traffic

So, you want to “exist” outside of your own website. And you want effective ads on your website, without spooking your readers.

That’s where Native Advertising comes in.

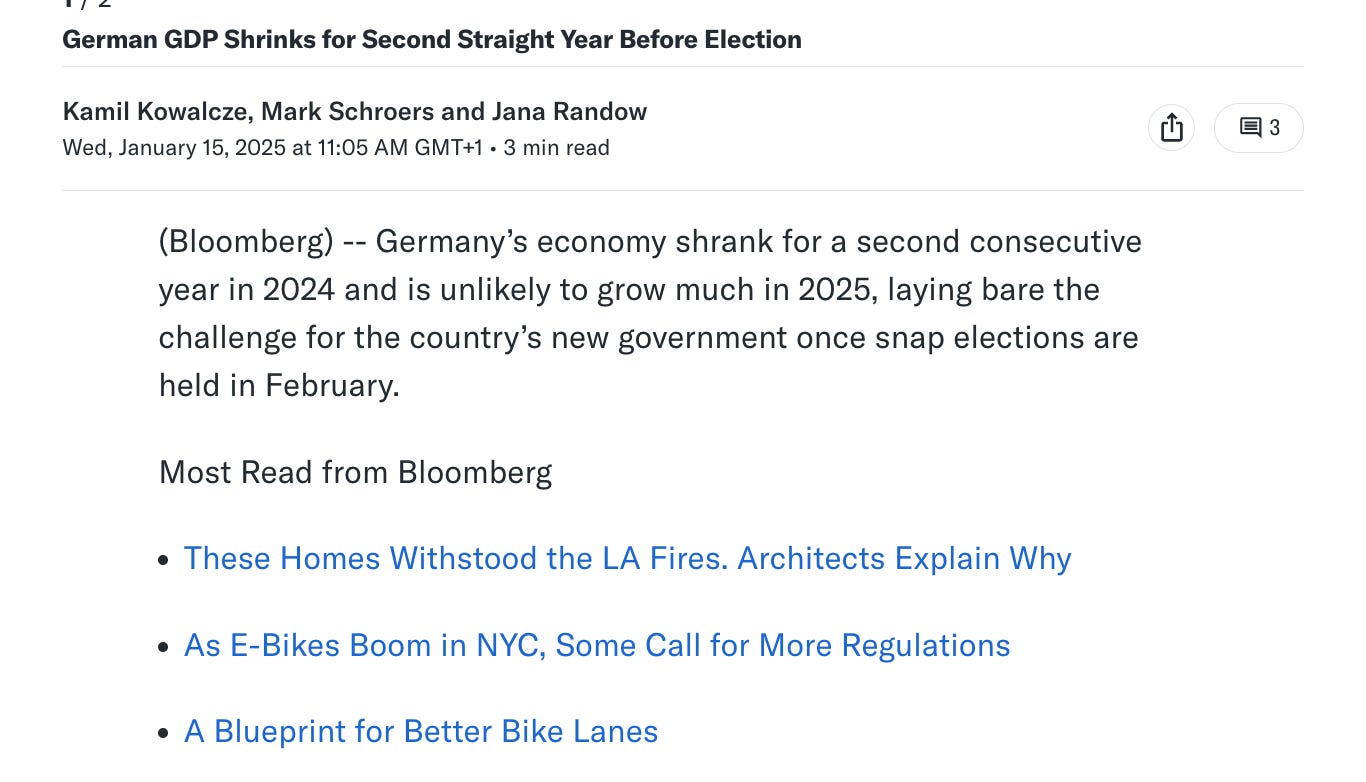

Suppose you go to finance.yahoo.com. You might see this

When I click on the Bloomberg link in the right column, you will see this:

Still, on the Yahoo domain.

But now click on one of the links in the article? Where will you go? Hereto:

Bloomberg pays Yahoo when you click on that link.

Actually, Bloomberg pays today’s company to do so. And they split the difference with Yahoo. (66% for Yahoo, 33% for the company)

As of today, this kind of “ads” by the company of today reaches 600 million pair of eyeballs dailly.

That is huge.

Now the challenge is: make sure the content you advertise is good enough for readers to click through.

So this company does 2 things:

It provides content platforms with the possibility to advertise content links on other platforms. Yahoo, TheGuardian, NBC News, CNBC, USA Today… To grow the traffic to your site.

But it also allows platforms to host those links, for revenue recognition. To monetize their traffic.

That is context. And it used to be very difficult. So there were cookies and such. But now with AI, it is a lot easier to do.

Still hard, but a lot easier.

The thesis is thus, that the more AI-bots are out there reading websites, the more valuable Native Advertising will become.

The reality is also: more and more content websites will strugle and go out of business.

Buzzfeed, Gawker, Vice… Once they ware household names, now they are defunct.

we work with the types of publishers that are going to be here in one form or another for many years, and it's really just a matter of how they keep their audience. And frankly, that's where it's an opportunity for us.

They have an advantage that Google and Facebook don’t have: they are placed directly on the publisher’s page. The publishers can monetize advertising dollars from readers on their site.

The Ugly Duckling

Now, Mr Mimetic has been following this company for a while now. And it has come a long way.

What you see on the Yahoo-website and elsewhere are called “Discovery Ads”. And they are at best relevant, and useful, and valuable for all parties involved.

But in the old days, they were not.

They were called “Chumboxes”. And all they did was click bait you to dubious sites, full of banner advertising and hardly any content, the so-called Made-For-Advertising websites.

It was awful.

Next to the company we are talking about today, there is only one serious competitor (the others are all local players, or self-managed by websites), so they are de facto a Duopoly.

Well, an article as recent as 2019 called the Duopoly of Native Advertising “the two worst companies in the world”

Others go philosopical about it in their disdain:

Since then, the company has worked hard on upping its game and delivering quality instead of quantity:

“We established partnerships with IAB, Moat, TAG, Integral Ad Science, and Double Verify to address the issue” - the founder-CEO

Now they are so realiable, Tier1 advertisers are lining up. They signed Yahoo, who switched from an internal advertising departement to theirs:

We started our journey as basically a company that worked on the bottom of the article (….) we're kind of expanding out of that.

The contract with Yahoo is a 30-year long exclusive agreement.

Yahoo acquired 25% of the stock in this company (and a board seat) to “celeberate” the signing of the contract.

They now also signed contracts for Apple News and Apple Stocks.

if you swipe right on your iPhone, you'll get an Apple News feed. If you click on one of the articles and look in the article, we'll actually be mid-article there with advertising.

The reason why might be very simple:

“It's basically it was a best-of-breed choice. (…) They expect to make more with us than they will with someone else. They also pick us for all the other tools we bring, which most of our competitors don't.” - the founder-CEO

Mr Mimetic thinks now is about the time the Ugly Duckling will start to grow into a Swan, after all.

Why? Because the flywheel is about to start spinning…

Distance Analysis

The Open Web Ad market is about 80 billion US$ a year, and growing.

Revenue has not dramaticly improved in the last couple of years. Just, you know, steady as she goes. No real hyper growth story. They are not exactly stealing market share head over heels:

But now, with the acquisition of the Yahoo and Apple account, they are at the beginning of what might be a flywheel effect.

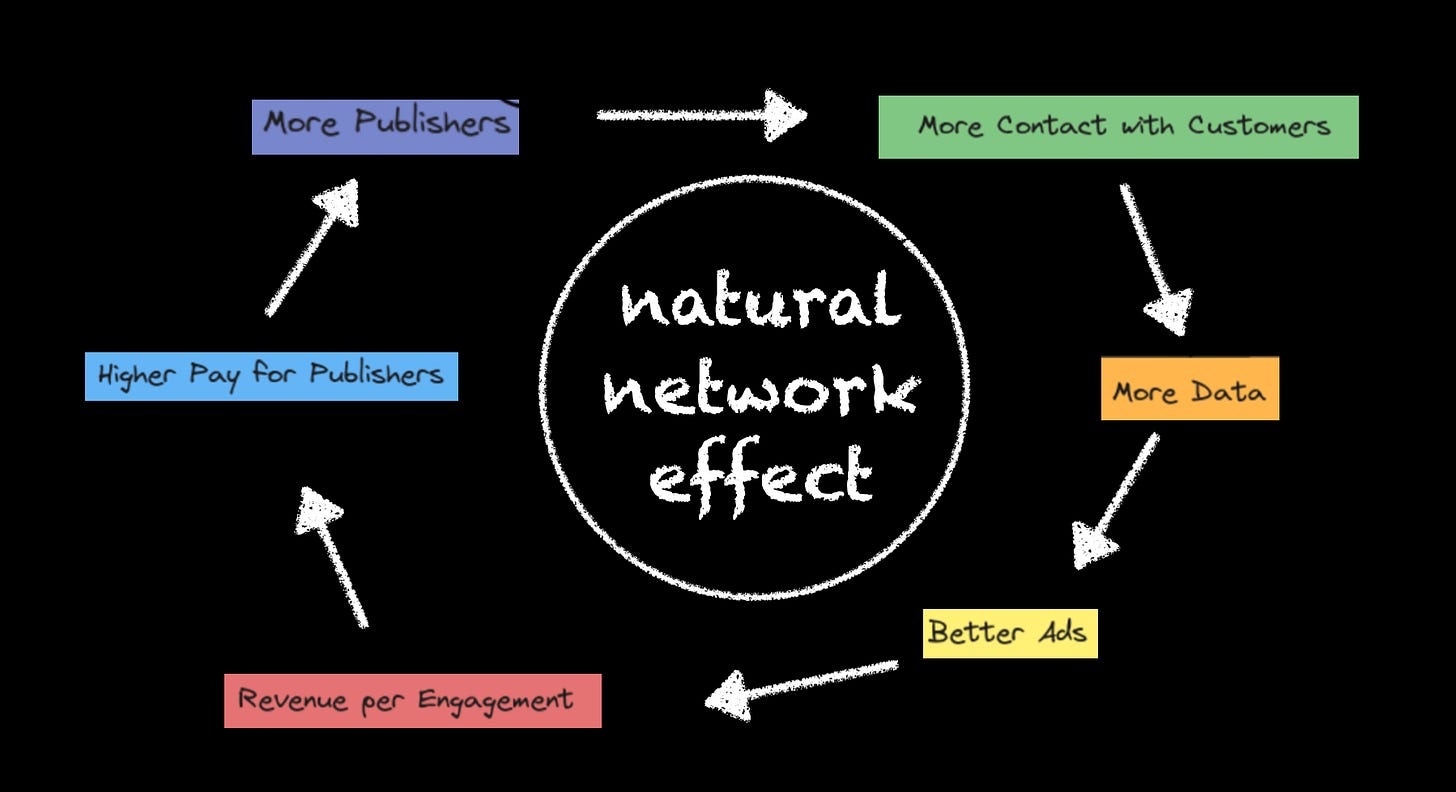

there is kind of a natural network effect in our business. The way it works is the bigger you get, the more often you see consumers, the more often you see consumers, the more data you get about what they do in particular context, what -- in a particular context, what are they likely to click on, what are they likely to read? And based on that, you can do a better job of targeting ads. The better job you can do of targeting ads, the more revenue per engagement with that user you get, the more you can pay the publisher. The more you can pay the publisher, the more likely you are to win the next one and then it's a self-reinforcing kind of network effect.

It is the last 6 à 7 quarters that we are starting to see how Revenue is starting to stick to the bottom line, in the form of Cash Flows.

So, with every intention to share the benefits of better performance with their clients (Scale Economies Shared) in combination with a Flywheel Effect…

…you have possibly a combination of 2 of the best Business Models in history working together

We measure our success by looking at new advertiser retention rates going up (so essentially lower churn rates), and Net Dollar Retention going up (NDRs), which means advertisers are able to spend more with us over time

In the eyes of Mr Mimetic, Revenue per Engagement is the key thing to look for.

Obviously, you want them to engage with more websites (16.000 to 20.000 are signed on their platform right now - Google and Meta have over 10 million), you want them to reach more eyeballs, as well - but you really want them to improve on the “Average Revenue per User” (ARPU).

“we estimate Meta makes ~$200 revenue per user a year in the US, Snap makes ~$33, and we make about $3-4 per user per year. There is tremendous upside in driving yield higher and it represents our single largest opportunity to accelerate top line growth.”

With less than 2 billion of revenue in a 80 billion dollar market… Mr Mimetic can see a future where they have 200.000 Open Web clients signed up (10x from now), or maybe a future where they have a revenue earn of more than $8 per user (a double from now), or maybe a future where they dramatically gain market share in terms of eyeballs (end-users).

They have expressed they are expecting to earn 1 billion a year from the Yahoo-deal once ramped up (yearly revenue from Yahoo is now about 100 million).

The good news is: there’s multiple ways to grow.

“the only reason the Open Web is only a $80B market is because it uses low yield monetization capabilities such as display, as well as asking advertisers to “bid” using CPCs and CPMs which companies like Google or Meta don’t do. The Open Web is using monetization capabilities that were invented 30 years ago, and (we) has the opportunity to re-invent that.” - 2023 shareholder letter

The other good news is: the growth can potentially become dramatic. Epic, even.

All this should allow them to be able to pay more to their publishers (now the cost of advertising is about 66% of what they receive for each pay-per-click).

Mr Mimetic would be a big fan of them not growing gross income (after traffic acquisition cost), but transfering the growth in revenue to the publishers and/or advertisers. In other words:

They should systematically lower their margins in an effort to gain market share and building moat.

Suppose after all is said and done, they can earn a few hundred million in Free Cash Flow? At this point (or even sooner, or even now) the better strategy would be to keep the Free Cash Flow lowish, and donate a bigger amount of what you normally take from the Average Revenue per User back to the Publisher and/or the Advertiser.

In this scenario, it would be quasi impossible to compete with them.

Mr Mimetic has to admit this is speculation at this point, but is pleased to learn that they are talking about “the more you can pay the publisher” - and thus build Moat through Scale Economies (or Efficiencies) Shared.

Another aspect Mr Mimetic is pleased about is the long-term nature of the contracts they sign. The Yahoo contract is for 30 years. Other contracts are for 5 years or longer.

That’s highly recurring revenue.

So, in conclussion, is a patht towards 10x possible? Mr Mimetic thinks so.

Not overnight, not assured, but Mr Mimetic thinks the odds are in our favour.

The Competition

In a Duopoly there is a second player. The Pepsico. The AMD. The xBox. The Airbus. The Lyft. The Adidas.

In Market Cap, the COMPETITOR company is 3 à 4 times smaller than today’s company. In terms of revenue, the COMPETITOR is about 50% smaller. The cash flow is 3 times less ; and the Balance Sheet is in a less prestine condition that the company Mr Mimetic has his eye on.

The COMPETITOR pride themselves in saying they have the more “premium” clients (wiht higher ARPU?), but Mr Mimetic doubts if that is still the case today.

Overall, when reading interviews, transfer call transcripts, letters and such… the vision of “our” company is much clearer than that of its COMPETITOR.

It is obvious the founder-CEO is willing to skate wherever the puck is going. There is a possible future where he is willing to utilize the expertise of the company to reach users, wherever they are. In the Open Web? Yes. On Mobile? Yes. In the Real World? Yes.

What if they become so good in delivering valuable content to costumers, that they will be used to decide which personalised messages to publish on billboards, other digital ad-screens, maybe on your tv?

Mind you, we are not talking about brand-ads. We are talking about performance-based advertising for content.

Both can exist ; the space is big enough…

The ambition of the CEO is clear, though: from…

to…

“A brilliant business model. Not because it’s algorithmically complex but because it’s so darn simple.“ - Ben Thompson

Technology is a big part in this:

We call our recent AI investment in that area “Maximize Conversions,” which now represents 50% of our revenue in only six months. It allows advertisers to stop “guessing” CPC or CPM (representing how much they’re willing to pay per click/view) and just tell us their business objective, give us a budget, and that’s it. It feels like magic. Imagine a flower store opening a campaign with Taboola, saying, “I have $5,000. Go get me people who want to buy flowers.”

CPC stands for Cost Per Click

CPM stands for Cost Per Mille, which translates to Cost Per Thousand Impressions.

So, while they are positioned really well to become the dominant force in the Open Web, we still have to acknowledge that this corner of advertising space is highly commoditized. It is those who can survive with the lowest margins, that will trive.

In the long term. (There might be hick-ups along the way).

To summarize: we have a good view of the dynamics of the market, we can see the path forward, we can assess the moat,… Time to spill the beans and tell who the hell we are talking about?

Who are the members of the Duopoly?

And this is what you get to see when you go on their platform:

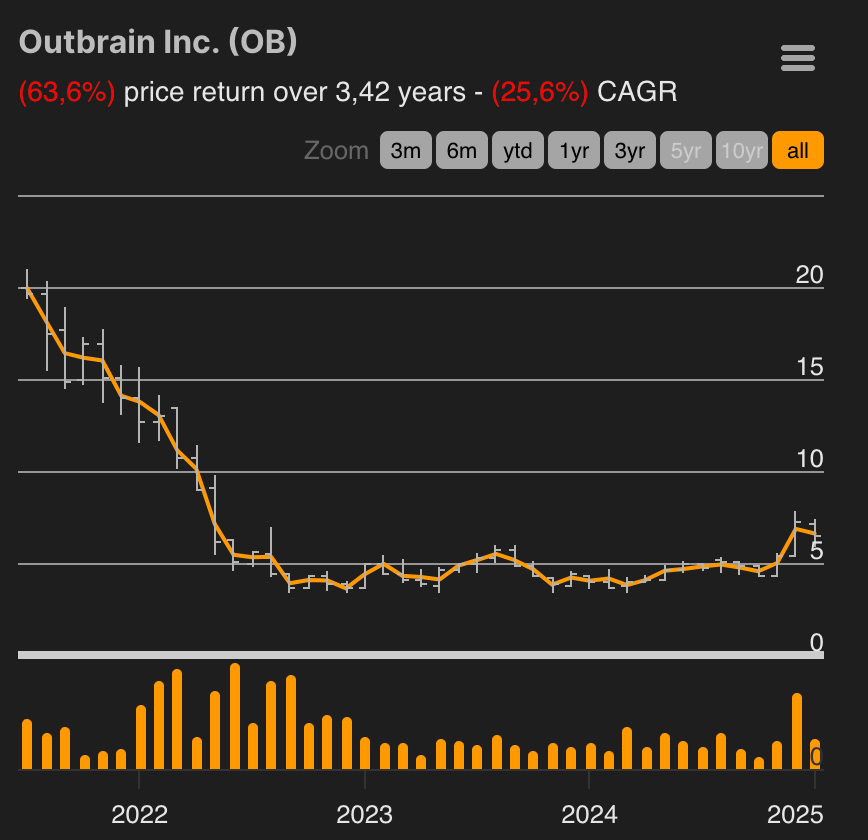

The smaller player, who might have a hard time fighting off the flywheel effect is:

Both have been a dramatic investment:

The difference is: Outbrain’s revenue has been shrinking , while Taboola’s has been growing - and is about to dramaticaly increase.

The key question to answer is: can they 10x their revenue in the coming decade or so? More clients, more campaigns, better conversion?

Free Cash flow should double YoY for Taboola in the accounting year 2024:

doubling EBITDA this year, doubling free cash flow. So that's driving great performance, but we actually think there's a lot more potential here.

As said before, Mr Mimetic is not to keen on Free Cash Flow. Rather donate those margins to your customers, and/or invest in growth opportunities…

All in all, with the recent deals in place, Mr Mimetic put his eggs rather in the Taboola basket instead of in the Outbrain leaking bucket.

So, far this writeup has been mostly story-telling.

But is there enough hard truths in the data to become part of the Mr Mimetic Fox Fund?

The Checklist

Longer term readers are aware that this blog and the accompanying Mr Mimetic Fox Fund is an experiment.

The experiment is as follows:

Can we build a portefolio of out-performing stocks, when using a simple list of criteria - inspired by a research-report by Alta Fox Capital from 2020?

Turns out: no.

The performance of the Mr Mimetic Fox Fund has been underwhelming so far.

The biggest reason for that is obviously Mr Mimetic himself. Beyond that, the why and how to remedy will be part of a next post (evaluating our 2-year performance).

As part of that evaluation Mr Mimetic has made the hurdle rate to become part of the Fund quite a bit harder. There are 13 criteria in the Checklist:

Mr Mimetic suspects Taboola is building moat and is about to start a ride on the flywheel. This should improve Revenue Growth, Compounding Rate en Return on Net Operating Assets.

5 years from now, this might be evident.

The market of Performance Marketing and Native Marketing has many local and small players ; it is splintered - but in time these shall naturally weed out. For example: a splintered market is fertile ground for a serial acquirer.

Scale is the name of the game. The more publishers you have on your platform, the more advertisers have the possibility to find the right match, the higher your conversion rate (turning eyeballs into customers), the more publishers, etc.

It’s too early to tell. On the other hand: now is the time to be on the right side of history, and jump in.

Q4 is announced around February 20.

What Mr Mimetic doesn’t like

Why are customer not flocking to the platform? Why are they choosing the Walled Gardens (Meta and Alphabet)? 20.000 vs 10 million.

Shouldn’t they be marketing themselves more?

Why is the revenue per user so low? And how can they guarantee us that this is a number that will trend up?

Is the commodization of the Open Web a race to the bottom? While advertisers are bidding against eachother to appear on Meta/Alphabet, are the Platforms of the Open Web bidding against eachother to attrackt Advertisers and Publishers?

It started out as the scum of the internet, really. It took them a while to shred of the stench of those nasty beginnings ; but how long will it take to become a truelly respectable alternative for the Walled Gardens?

Next year? Or in 5 years time? Never?

When will Taboola become the “must-go” company when you want to survive, trive and grow on the Open Web?

When will it become second nature for Publishers on Substack to open a Taboola-account, to attrackt traffic? (Maybe this is an experiment Mr Mimetic has to try out)

To find out if those objections weigh heavy enough to keep Taboola out of the Fund, you can upgrade your subscription to find out. (only $30/year)

If you like what you’ve read, please consider sharing this post with your investing aficionados

Kind regards,

Mr Mimetic.

* Full discosure: Mr Mimetic owns a tracking position of Taboola shares in his personal account. It is a very small amount. Obviously, this can change in the future.

Next up in the Mad Men Series:

What shovels are to the gold rush are verification and safety companies to the online advertising space.

Who should be keep on eye on for future capital gains?

A Few Sources

https://www.prnewswire.com/news-releases/taboola-announces-collaboration-with-moat-to-offer-100-percent-guaranteed-viewability-or-completion-for-video-advertisers-301032407.html

Taboola.com Ltd. Presents at UBS Global Technology and AI Conference, Dec-03-2024 10:55 AM

https://adalytics.io/blog/ads-observed-on-made-for-advertising-sites-in-january-2024

https://my6sense.com/blog/taboola-review/

https://thenextweb.com/news/taboola-and-outbrain-the-two-worst-companies-in-the-world-are-merging

https://www.axios.com/2024/07/16/taboola-apple-news-deal

https://paleoadtech.com/2024/06/27/65-adam-singolda-the-tabula-rasa-of-taboola/

https://digiday.com/media/confessions-of-an-mfa-publisher/

https://ebiquity.com/news-insights/blog/advertisers-wasting-millions-on-made-for-advertising-sites/

https://heytony.ca/taboola-vs-google-ads-which-is-better/

https://blog.rtbhouse.com/grow-your-brand-in-the-open-web-without-cookies/

https://digiday.com/marketing/caught-between-resignation-and-resistance-ad-industry-grapples-with-the-prevalence-of-made-for-advertising-sites/

https://www.forbes.com/sites/bradadgate/2024/04/24/6-questions-for-adam-singolda-founder--ceo-taboola/

https://onemanandhisblog.com/2024/07/bad-news-apple-loves-taboola/

https://www.lilachbullock.com/taboola-product-review/

https://www.investopedia.com/articles/personal-finance/032515/taboola-how-content-you-may-makes-money.asp

https://seekingalpha.com/article/4682154-taboola-key-inflection-point-right-time-to-buy

https://www.thecurrent.com/open-web-vs-walled-garden-interoperability

https://tapstone.com/what-makes-taboola-a-highly-effective-platform-for-digital-advertising/